News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

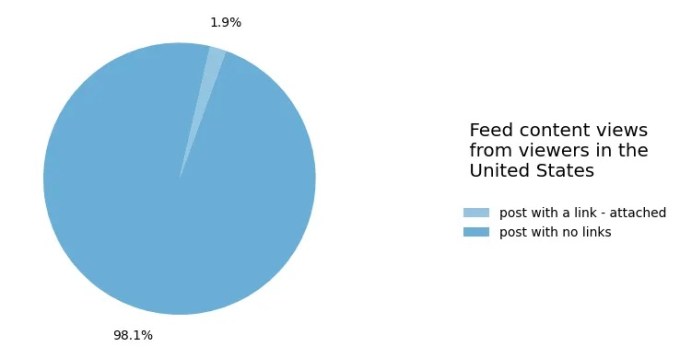

Facebook is testing a link posting limit for professional accounts and pages

TechCrunch·2025/12/17 18:39

This is why Dogecoin whales are now going all in.

币界网·2025/12/17 18:34

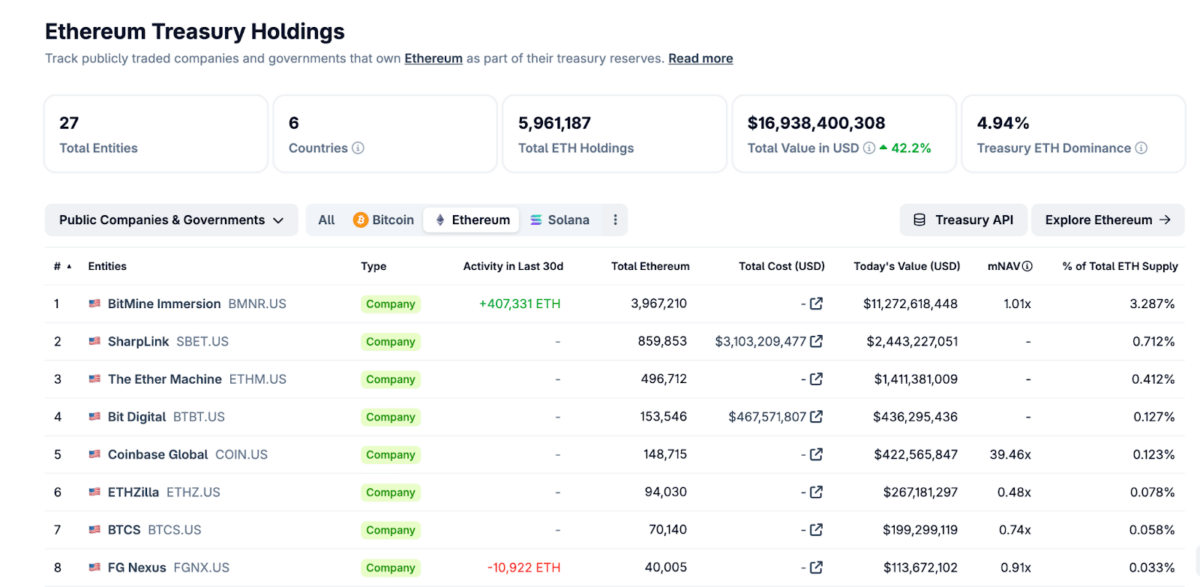

SharpLink Gaming Appoints New CEO as Ethereum Treasury Surpasses 863K ETH

Coinspeaker·2025/12/17 18:18

Critical Challenge for Bitcoin Miners in 2026: The AI Temptation

Bitcoinworld·2025/12/17 18:12

Bhutan says 10,000 bitcoins will be used to build its new administrative city

币界网·2025/12/17 18:08

Analyst to XRP Holders: Hold On to Your Hats. We Wait for a Decision

TimesTabloid·2025/12/17 18:06

XRP Price Stalls at $1.80 Key Support: Freefall Ahead or Fresh Bounce?

Cryptotale·2025/12/17 18:00

SentismAI Collaborates With Ultiland to Expand DeFi Into Art and Culture

BlockchainReporter·2025/12/17 18:00

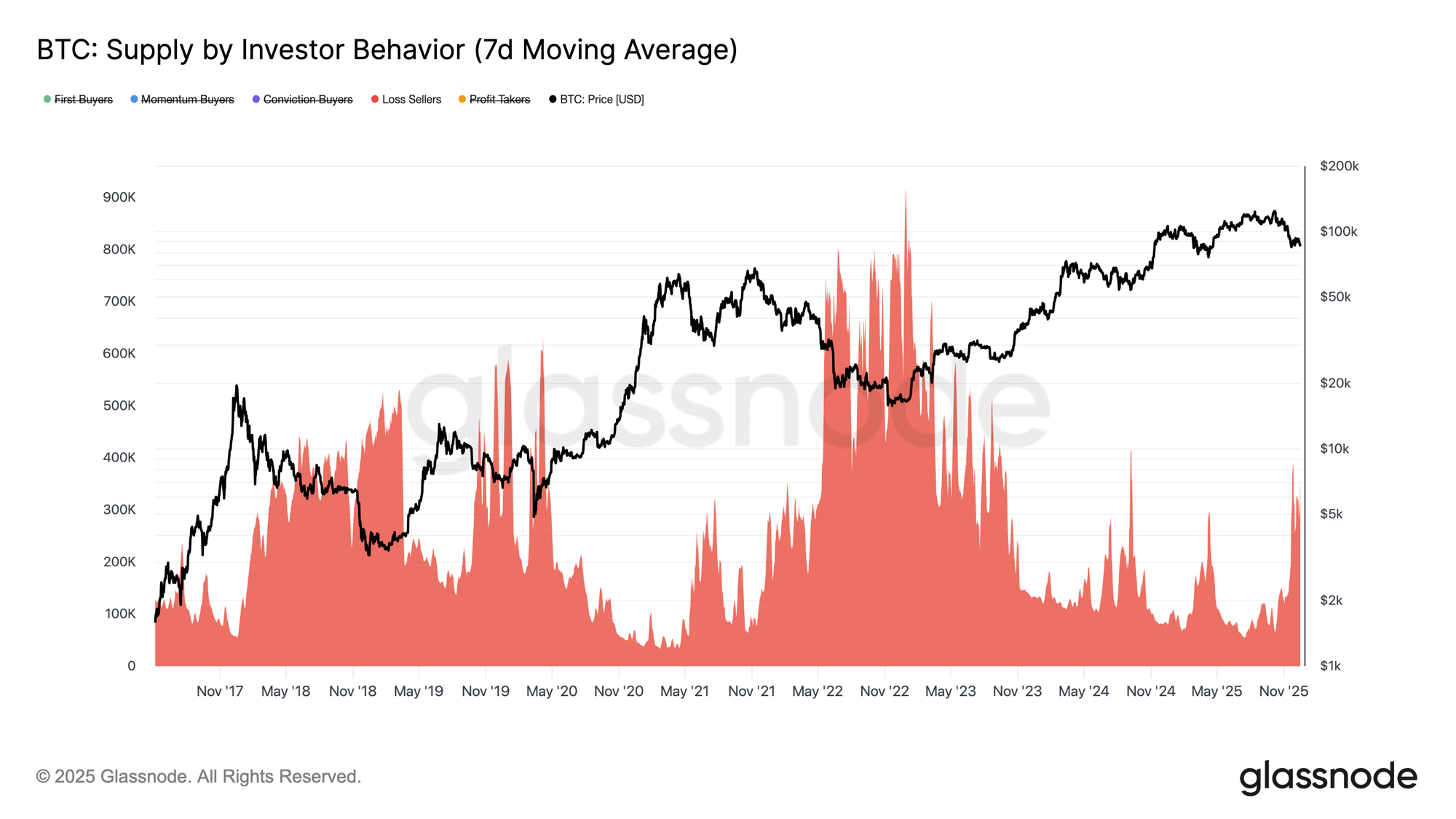

Trapped Under Overhead Supply

Glassnode·2025/12/17 17:57

Flash

23:30

U.S. House Representatives draft bill to exempt stablecoin transactions under $200 from taxesMembers of the U.S. House of Representatives have drafted a bill aimed at exempting capital gains tax on crypto stablecoin transactions under $200. (Watcher.Guru)

23:06

After Japan's rate hike, BTC surges to $88,000 and Arthur Hayes sees this as bullishAfter Japan raised interest rates, the price of BTC surged to $88,000. Arthur Hayes called this move a bullish signal and highlighted the significant weakening of the yen. (Cointelegraph)

22:49

Key BTC Support Level Emerges: 88,121 Becomes the Focus of Bull-Bear BattleMember indicators show that the current price is testing the key support level at 88121, where the chip concentration is as high as 4.65. Buying slightly outweighs selling (buy/sell ratio 1.07), indicating strong market support at this price level. Combined with the candlestick pattern, the appearance of a tweezer bottom further confirms the effectiveness of the support. On the 1-hour candlestick chart, EMA24 and EMA52 are in a bullish alignment, and the price is above the moving averages, suggesting an overall strong trend. Although trading volume has declined, the RSI has broken through the upward trendline, hinting that short-term rebound momentum is building up. Subscribe to become a member to access real-time chip distribution and precise support and resistance analysis, helping you seize opportunities ahead of others!Data sourced from PRO members [BTC/USDT perpetual contract on a certain exchange, 1-hour candlestick], for reference only and not to be considered as investment advice.

News