News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Japan's era of extremely loose monetary policy over the past decade is now being permanently consigned to history.

EIP-7951 may not make mnemonic phrases disappear overnight, but it has finally removed the biggest stumbling block to the mass adoption of Ethereum.

In Brief Cryptocurrency market experiences a significant drop, affecting XRP and Dogecoin. XRP's support level break indicates a new trend under professional sell-off confirmation. Dogecoin sees low institutional demand, high volatility, and trading volume drastically increases.

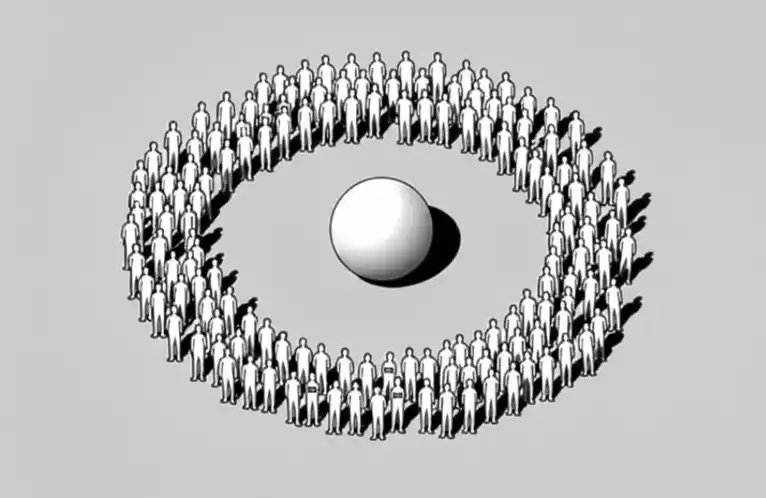

Former Greek Finance Minister Varoufakis revealed that the true holders of government debt are ourselves—pension accounts, savings, and even central banks—meaning everyone is effectively a "lender."

Crypto Twitter is no longer the main driver of consensus narratives and capital flows; the era of a "single culture" has ended, and the market has entered a new stage characterized by decentralization and fragmented contexts.

- 04:56Kazuo Ueda: The Bank of Japan can currently only estimate the neutral interest rate within a relatively wide range.Jinse Finance reported that Bank of Japan Governor Kazuo Ueda stated that currently, the neutral interest rate level can only be estimated within a relatively wide range. The market generally expects the central bank to raise interest rates again this month, bringing rates closer to the neutral level. "Regarding the neutral interest rate, unfortunately, at present we can only estimate it within a fairly broad range," Ueda said in parliament on Thursday. "We do not know its precise level, but how much the nominal interest rate will eventually rise and what level is appropriate will depend on this. I want to emphasize that there is a certain degree of uncertainty involved." Ueda added that the Bank of Japan is trying to narrow the estimated range of the neutral interest rate, and if successful, will announce it to the public. The Bank of Japan previously released a research report stating that the neutral interest rate is roughly between 1% and 2.5%.

- 04:38Data: The current Crypto Fear & Greed Index is 27, indicating a state of fear.ChainCatcher news, according to Coinglass data, the current cryptocurrency Fear & Greed Index is 27, up 0 points from yesterday. The 7-day average is 25, and the 30-day average is 19.

- 04:30Putin's economic advisor calls for inclusion of cryptocurrencies in Russia's national trade ledgerChainCatcher news, according to reports from Vedomosti and RBC, Maxim Oreshkin, economic adviser to the Russian president, stated that cryptocurrencies should be included in the country's balance of payments, and described bitcoin mining as an "undervalued export project." He pointed out that Russian companies have already invested over $1.3 billion in mining infrastructure and are conducting import and export settlements through cryptocurrencies, which has a real impact on the foreign exchange market. The Russian government is gradually promoting the inclusion of crypto trading within a regulatory framework to address foreign trade needs under the context of sanctions.