News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 3) | Trump Strongly Hints at Hassett as Next Fed Chair; Elon Musk Predicts a $38.3T “Crisis” Could Trigger a BTC Price Surge2Bitcoin mispricing deepens as BTC trades below $100K, but not for long: Bitwise3BitMine buys $70M ETH while Tom Lee revises Bitcoin prediction

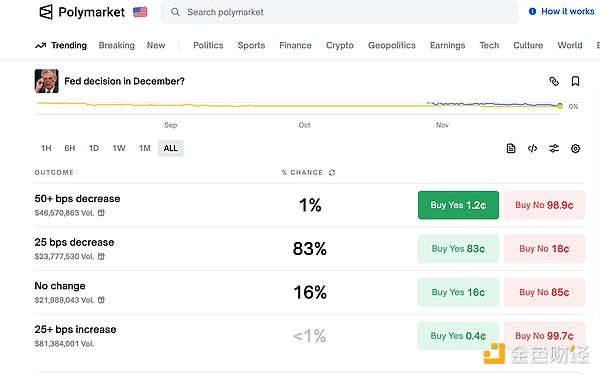

Interest Rate Cut Expectations Shift Dramatically! Has Bitcoin Already Bottomed Out?

Bitpush·2025/11/27 07:11

Wall Street's "most optimistic bull" JPMorgan: Driven by the AI supercycle, the S&P 500 Index is expected to break through 8,000 points by 2026

The core driving force behind this optimistic outlook is the AI supercycle and the resilient US economy.

ForesightNews·2025/11/27 06:22

The most profitable application in the crypto world starts to slack off

Why is pump.fun being questioned for "rug pulling"?

BlockBeats·2025/11/27 05:42

Interpretation of the Five Winning Projects from Solana's Latest x402 Hackathon

The Solana x402 hackathon showcased cutting-edge applications such as AI autonomous payments, model trading, and the Internet of Things economy, indicating a new direction for on-chain business models.

BlockBeats·2025/11/27 05:42

The crypto market takes a breather as Bitcoin rebounds to $91,000—can it continue?

金色财经·2025/11/27 05:33

With three major positive factors, can the crypto market shake off its slump in December?

Ethereum upgrade, Federal Reserve rate cuts, and the confirmation of a dovish Federal Reserve candidate.

ForesightNews 速递·2025/11/27 05:33

70% of traders suffer from insomnia? Bitcoin's nighttime volatility is to blame

70% of traders believe that lack of sleep is the main cause of mistakes in trading decisions.

ForesightNews 速递·2025/11/27 05:32

Bitcoin’s path back to $112K and higher depends on four key factors

Cointelegraph·2025/11/27 05:21

Bearish Bitcoin mining data may be counter signal that encourages spot-driven BTC rally

Cointelegraph·2025/11/27 05:21

Flash

- 17:33USDC and CCTP are now live on StarknetForesight News reported that Circle announced USDC and CCTP are now live on Starknet. Developers, DeFi users, and market makers can now utilize them for a variety of applications: including spot and perpetual contract trading based on DeFi transactions, as well as 24/7 settlement on decentralized exchanges; they can also be used for gaming economies and global payments, supporting fully reserved digital dollars; and through CCTP, seamless transfers of USDC between Starknet and supported blockchains are enabled.

- 17:33YZi Labs accuses BNB treasury company CEA Industries and asset manager 10X Capital of "mismanagement and threatening to abandon the BNB strategy"Foresight News reported, according to an official announcement, that BNB Treasury company CEA Industries, Inc. (NASDAQ: BNC) major shareholder YZi Labs Management Ltd. has issued a formal notice and correction request to the company’s asset manager, 10X Capital Asset Management LLC. YZi Labs accuses 10X Capital of mismanagement and lack of transparency, threatening a breach of the strategic services agreement with YZi Labs. The core dispute centers on 10X Capital’s threat to abandon the BNB treasury strategy in favor of investing in other cryptocurrencies such as Solana, which contradicts the company’s previous commitment to PIPE investors to use $500 million to “establish the company’s BNB treasury operations.” YZi Labs requires 10X Capital to provide written confirmation by December 5 that it will adhere to the BNB treasury strategy and has not improperly disposed of BNB assets. It also pointed out that under 10X Capital’s management, BNC’s stock price has significantly underperformed its peers, dropping about 19% from pre-PIPE announcement levels and 87% from post-announcement levels. YZi Labs has submitted a preliminary consent solicitation to the U.S. Securities and Exchange Commission, seeking to expand the board of directors and appoint independent directors.

- 17:33Qivalis, a stablecoin issuer launched by 9 European banks, plans to issue a euro stablecoin in the second half of 2026.Foresight News reported that nine major European banks—Banca Sella, CaixaBank, Danske Bank, DekaBank, ING, KBC, Raiffeisen Bank International, SEB, and UniCredit—have announced the launch of Qivalis, a stablecoin issuer compliant with MiCAR standards. Qivalis will issue a euro stablecoin under the supervision of the Dutch Central Bank (DNB), with plans to launch the euro stablecoin in the second half of 2026. BNP Paribas SA has also recently joined the alliance, further expanding the number of financial institutions participating in this MiCAR-compliant euro stablecoin initiative.

News

![[Bitpush Daily News Highlights] JPMorgan expects the Federal Reserve to cut rates in December, overturning last week's forecast; Bloomberg analyst: Nasdaq ISE proposes to raise IBIT options position limit to 1 million contracts; the US extends some China tariff exemptions until November 10, 2026; Opinion: Gold price to approach $5,000 in 2026, will break another historic milestone in 2027](https://img.bgstatic.com/multiLang/image/social/36cf6fca0c010535f81683c20d2ea6141764227343223.png)