Analyst to XRP Holders: Hold On to Your Hats. We Wait for a Decision

Cryptocurrency markets are unpredictable, and XRP has repeatedly demonstrated that its price movements are shaped by both historical trading patterns and broader economic forces.

As traders brace for the next major shift, understanding the behavior of XRP within established trading ranges provides critical insight into how the asset might respond to upcoming catalysts.

In a recent post on X, crypto analyst ChartNerd highlighted XRP’s 13-month support territory near $1.60. According to ChartNerd, this zone has historically acted as a launchpad, triggering rallies toward trading range resistance.

Over the past year, each time XRP approached this level, the market responded with significant upward movement, reinforcing the support’s reliability even amid heightened volatility.

$XRP: Over the last 13 months, THIS is the support territory when approached, that $XRP typically rallies back into Trading Range Resistance. However, with economic headwinds such as the BOJ rate increase, will this time be different? Hold on to your hats. We wait for a decision.

— 🇬🇧 ChartNerd 📊 (@ChartNerdTA) December 16, 2025

Historical Price Behavior at the $1.60 Support

A closer look at XRP’s price action over the last 13 months reveals a consistent pattern. In early 2024, XRP dipped to roughly $1.60 before rebounding toward $2.20, establishing the support as a critical pivot point.

During the middle of the year, the token again touched this range and rallied to about $2.35, confirming its resilience. Most recently, the price approached the $1.60 level and quickly bounced toward the upper bounds of its trading range near $2.40 to $2.50.

ChartNerd emphasizes that the repeated significance of this zone highlights both technical and psychological factors. Traders consistently perceive $1.60 as a high-probability buying area, where accumulated demand has historically outweighed selling pressure.

Economic Headwinds and Market Uncertainty

Despite this historical reliability, ChartNerd cautions that macroeconomic developments could influence XRP’s next move. Factors such as the Bank of Japan’s recent rate increase introduce additional uncertainty.

While previous rallies from $1.60 were robust, these new economic conditions may test the market’s resilience, requiring traders and holders to prepare for potential deviations from the established pattern.

Technical Significance of the Support Zone

The $1.60 support level is more than a historical data point—it serves as a technical anchor in XRP’s trading structure. Holding above this level preserves the integrity of the 13-month trading range and increases the likelihood of upward rallies toward resistance levels between $2.40 and $2.50.

Conversely, a decisive breach below this support could indicate a deeper correction, potentially resetting market dynamics and investor sentiment.

Preparing for the Next Market Decision

ChartNerd frames the current period as a waiting game, with traders anticipating clarity from both technical signals and macroeconomic developments. XRP holders should monitor the $1.60 support zone and observe how the market reacts while avoiding reactionary trading. This measured approach allows for strategic positioning ahead of potential rallies or corrections.

In conclusion, XRP’s historical price behavior underscores the strength of the $1.60 support zone, while emerging economic factors introduce new variables to monitor.

As the market approaches a critical decision point, informed traders and holders should exercise patience, closely track price action, and be prepared for either continuation within the trading range or an unforeseen deviation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

WLFI Token Buyback: A Stunning $10M Move That’s Reshaping Confidence

Ethereum—Can Bitmine’s $140.6 million ETH purchase offset the liquidity trap?

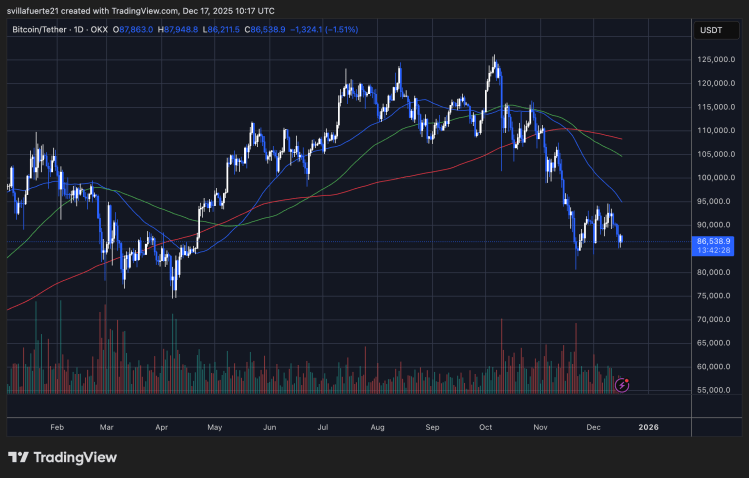

Bitcoin structure turns bearish, structural indicators turn negative