News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- ICP's 30% price surge to $4.71 (Nov 2025) stems from tech upgrades, institutional adoption, and AI integration via Caffeine platform. - On-chain metrics show mixed momentum: 3.9% higher trading volume but 91% drop in token transfers during price dips, highlighting engagement volatility. - 2025 upgrades like Fission (subnet scalability) and Chain Fusion (cross-chain interoperability) boosted TVL to $237B, aligning with multichain trends. - Tokenomics balance 4-5% inflation with burning mechanisms, while M

- Bitcoin Cash (BCH) fell 0.1% in 24 hours but rose 35.79% year-to-date, outperforming peers. - Sustained 7-day (7.55%) and 1-month (9.1%) gains highlight growing institutional and retail confidence. - Market adoption in DeFi and low-cost transactions, plus macroeconomic optimism, drive BCH's long-term appeal. - Analysts predict continued growth as BCH's ecosystem matures and on-chain activity rises.

- Solana's 30% price drop in late 2025 contrasts with strong on-chain metrics like 400ms finality and $35.9B DEX volume, but declining user engagement and rising NVT ratios signaled overvaluation. - Macroeconomic factors including high interest rates and institutional caution reduced speculative demand, with ETF inflows favoring staking products over direct price support. - Whale accumulation and RWA growth (up 350% YoY) suggest strategic buying during dips, though active address recovery and NVT normaliza

- 03:02Columbus Circle Capital Corp I shareholders approve merger with ProCap BTC businessJinse Finance reported that shareholders of Columbus Circle Capital Corp I (NASDAQ: BRR) approved the business combination with bitcoin financial services company ProCap BTC on December 3, 2025. The transaction is expected to be completed on December 5, and the merged company will be renamed ProCap Financial, Inc., continuing to trade on the Nasdaq Global Market under the ticker "BRR". ProCap BTC has raised over $750 million from traditional finance and bitcoin industry investors.

- 02:59The former product director of a certain exchange will join Y Combinator as a visiting partner.ChainCatcher reported that former Product Director of a certain exchange, Nemil Dalal, will join Y Combinator as a Visiting Partner, focusing on the crypto sector. "Personally, YC had a transformative impact on me in 2012. It allowed me to gain invaluable lessons that enabled me to build early-stage startups. This greatly benefited me later in incubating products such as USDC, the exchange's Developer Platform, and x402. I am glad to give back to the YC community, which has given me so much." Nemil Dalal worked at the exchange for 7 years, driving the development of USDC, DeFi, and developer tools.

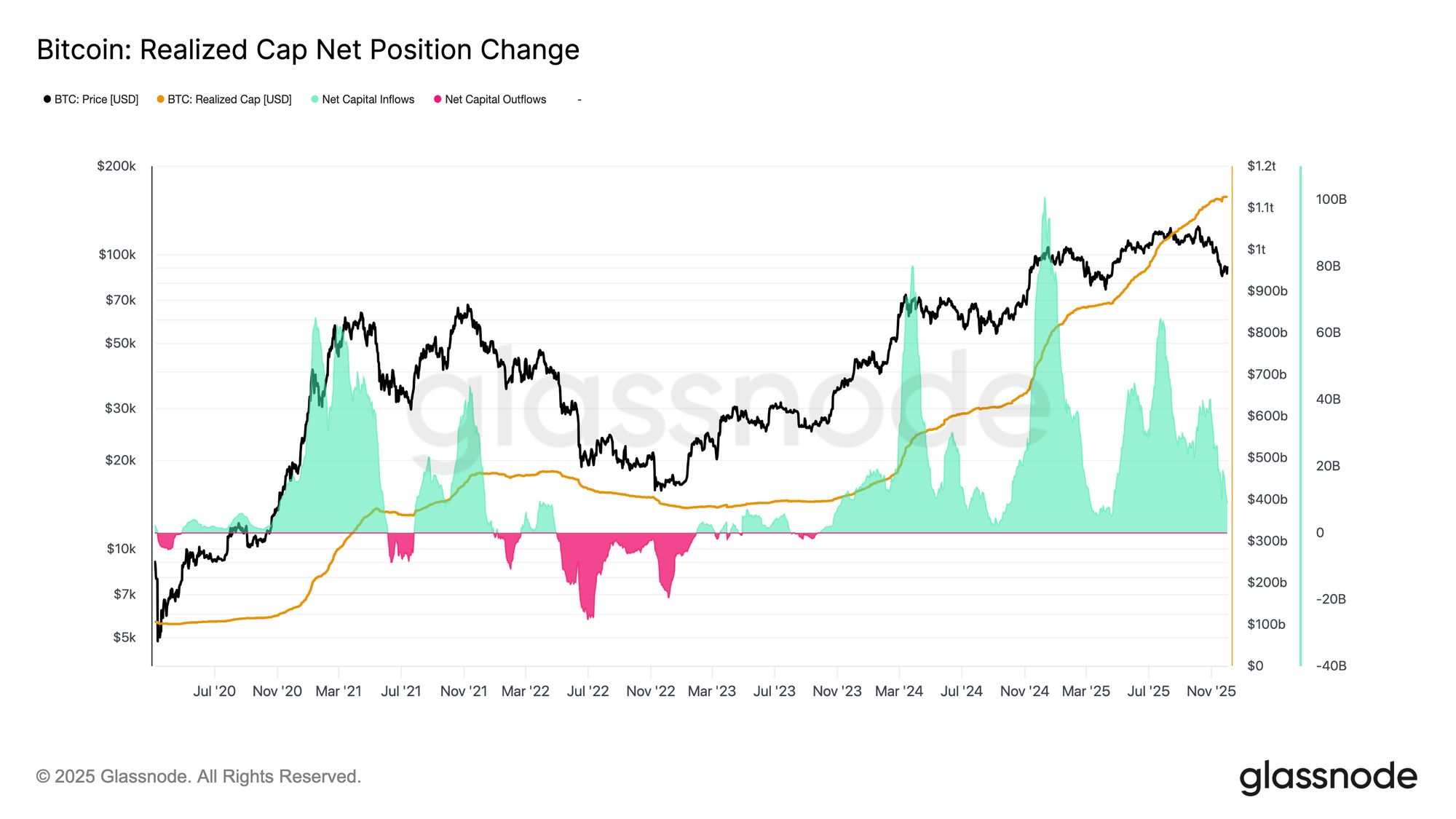

- 02:45Analysis: Bitcoin selling pressure is gradually weakening but demand remains lacking; the reasonable expectation for December is stabilization rather than an immediate rebound.According to ChainCatcher, trader Murphy posted that the main sources of selling pressure currently come from the profitable chips of long-term holders (LTH) and the underwater chips of short-term holders (STH) of bitcoin. For STH, after panic sentiment is released in a concentrated manner, if the price stabilizes or shifts from a sharp drop to a slow decline, the selling pressure will gradually decrease; for LTH, if their realized profit and loss ratio declines, their motivation to sell will also decrease. Currently, the number of new BTC addresses has temporarily stabilized after a round of decline, but the amount of BTC held by these addresses is still decreasing. This indicates that the overall risk appetite of BTC investors has not significantly improved, resulting in a lack of new demand. He believes that before seeing a clear recovery on the demand side, a reasonable expectation for BTC in December should not be an immediate reversal, but rather no further sharp or deep declines, and a corresponding rebound after an oversold situation.