News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Tom Lee's BitMine may have scooped up another 41,946 ETH

Cryptobriefing·2025/12/05 19:45

The Rise of Astar 2.0 and Its Impact on AI-Powered Learning and Marketing

- Astar 2.0, a blockchain platform, introduces Burndrop PoC and Tokenomics 3.0 to enhance AI integration in education and advertising . - It partners with Google, IBM , and Animoca Brands to deploy AI tools like Smart Scheduling™ and AdCreative.ai, addressing efficiency and personalization challenges. - While AI-driven solutions optimize education and advertising, critics warn of risks like reduced critical thinking and ethical concerns in AI adoption. - Astar 2.0's interoperability and deflationary tokeno

Bitget-RWA·2025/12/05 19:38

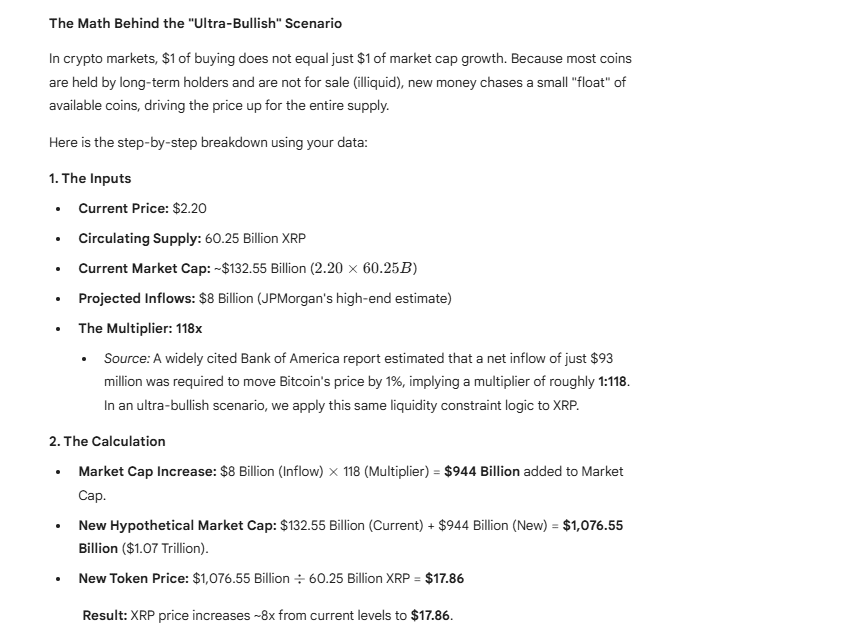

Expert Says Sell Your XRP and Walk Away If You Don’t Understand This

CryptoNewsNet·2025/12/05 19:33

Here’s How Much Your 1,000 to 5,000 XRP Could Be Worth if JPMorgan’s XRP ETF Forecast Plays Out

CryptoNewsNet·2025/12/05 19:33

Cwallet Cwallet Partners with Hosico to Boost Trust and Security in Web3 Finance

CryptoNewsNet·2025/12/05 19:33

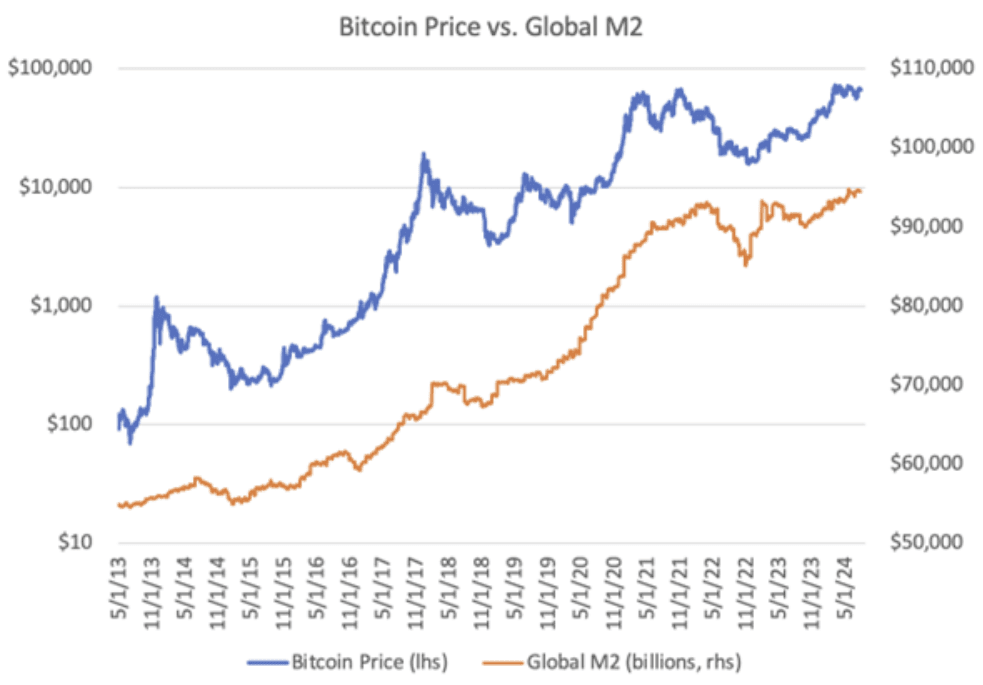

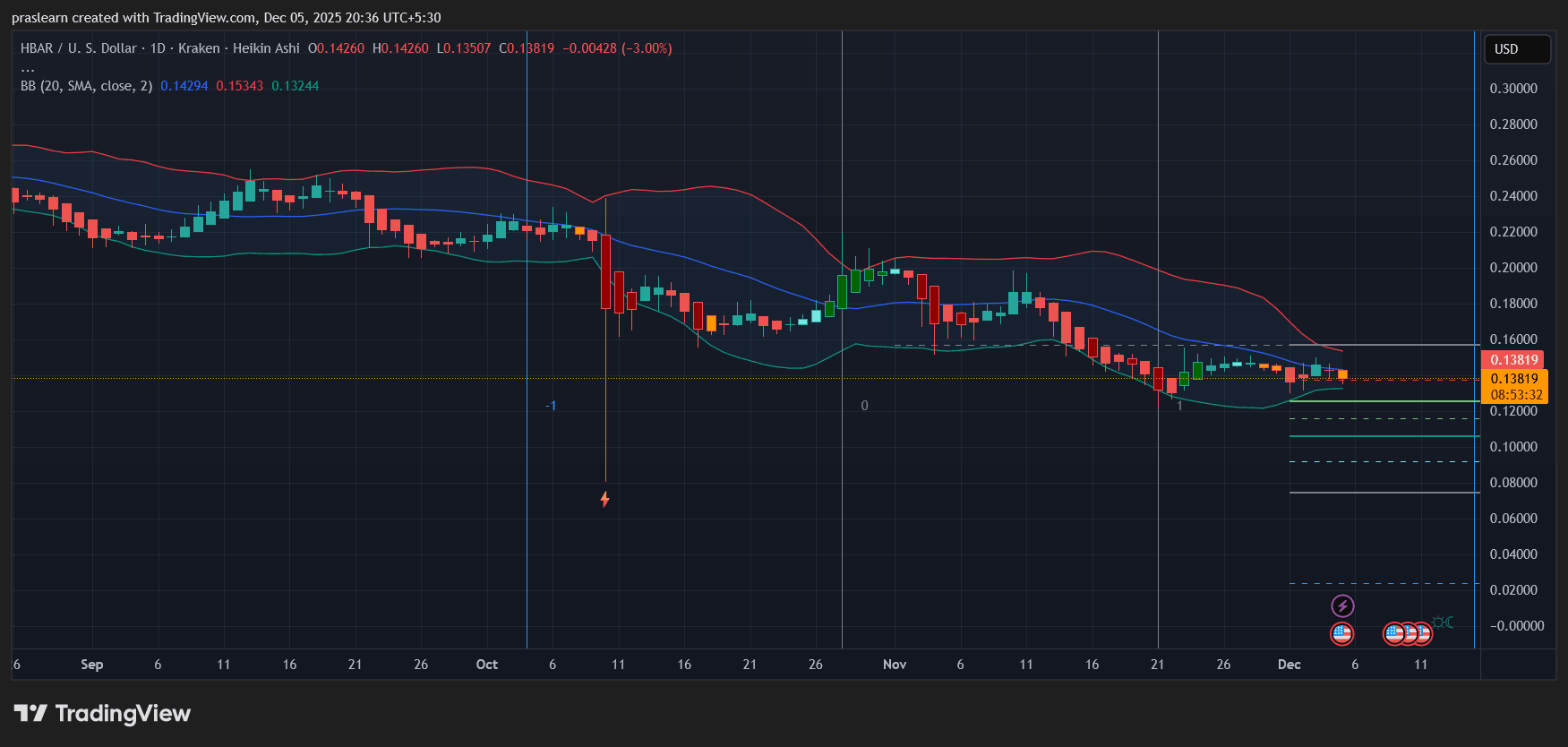

Will HBAR Price Reach $5?

CryptoNewsNet·2025/12/05 19:33

PEPE Website Hack Collides With Rare Rebound Versus DOGE

CryptoNewsNet·2025/12/05 19:33

Cardano Undertakes Quiet Reset Following November Ledger Breakdown

CryptoNewsNet·2025/12/05 19:33

Terra (LUNA) Fraudster Do Kwon’s Proposed Prison Sentence Revealed – A Hard-to-Believe Decision

CryptoNewsNet·2025/12/05 19:33

Flash

- 05:05US SEC Chairman: Tokenization is the future trend, and it is expected that all US markets will migrate on-chain within the next two yearsJinse Finance reported that Paul Atkins, Chairman of the U.S. Securities and Exchange Commission (SEC), stated: Tokenization is the direction of future development, and putting securities assets on-chain can achieve clear ownership confirmation. He expects that within the next two years, all markets in the United States will migrate to operate on-chain.

- 04:45Data: The current supply of USDC on Ethereum V3 has reached $5 billionJinse Finance reported that Circle posted on X stating that the current supply of USDC on Ethereum V3 has reached $5 billion. USDC on the Ethereum network has grown by 138% year-to-date (YTD), and USYC has been launched on the Aave real-world asset (RWA) market Horizon. All data is for the period from January to December 2025.

- 04:41Data: The current Crypto Fear & Greed Index is 22, indicating a state of extreme fear.ChainCatcher News, according to Coinglass data, the current cryptocurrency Fear and Greed Index is 22, down 5 points from yesterday. The 7-day average is 25, and the 30-day average is 19.