News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Tech advocates vs price advocates: Monad's founder and Arthur Hayes have engaged in a remote debate.

Arthur Hayes questioned whether Tether's exposure to gold and bitcoin could pose insolvency risks, while Tether countered by highlighting its substantial equity. The debate between the two parties has reignited on X.

Monad’s FDV exceeded 4 billions the day after its launch?

ETF determines the foundation of institutional support, while funding rates can amplify or weaken momentum. Stablecoins supplement native capital, and the structure of holders determines risk resilience. Macroeconomic liquidity controls the cost of capital.

Arthur Hayes has raised concerns about Tether's gold and Bitcoin exposure and the potential risk of insolvency. Tether has countered with significant proprietary equity, reigniting the debate between the two parties.

The darkest moments in human history often occur when the "offensive advantage" of technology outweighs its "defensive advantage." d/acc aims to reverse this imbalance.

Weekly highlights from December 1st to December 7th.

- 21:23The US Dollar Index rose by 0.1% on the 8th.Jinse Finance reported that the US Dollar Index rose by 0.1% on the 8th, closing at 99.087 in the late foreign exchange market.

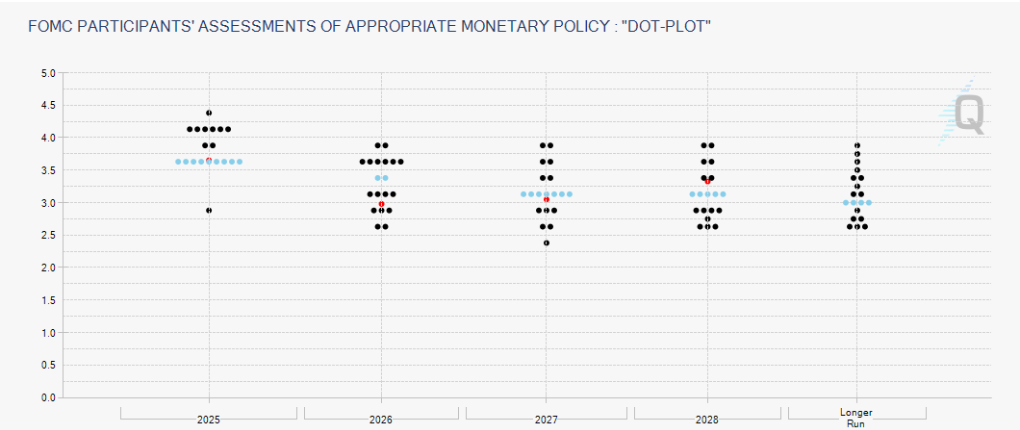

- 21:22U.S. Treasury yields reach multi-month highs as market lowers expectations for Fed rate cuts next yearJinse Finance reported that U.S. Treasury yields have risen to their highest levels in more than two months, following declines in most global government bond markets as investors prepare for three U.S. bond auctions and this week's Federal Reserve interest rate decision. Treasury yields rose overall by 3 to 6 basis points, with mid-term bonds performing the weakest. The Treasury will issue $58 billion in 3-year bonds at 1 p.m. New York time, and will issue $39 billion in 10-year bonds on Tuesday and $22 billion in 30-year bonds on Thursday. The Treasury has adjusted this week's auction schedule to align with the Federal Reserve's two-day policy meeting. Traders believe there is about a 90% probability that the central bank will cut rates by 25 basis points for the third consecutive time. With inflation remaining stubbornly high, market participants will interpret the officials' outlook for 2026 through the "dot plot."

- 21:11The Dow Jones Index closed down 215.67 points, with the S&P 500 and Nasdaq also declining.ChainCatcher news, according to Golden Ten Data, the Dow Jones Index closed down 215.67 points, or 0.45%, at 47,739.32 points on Monday, December 8; the S&P 500 Index closed down 23.89 points, or 0.35%, at 6,846.51 points; and the Nasdaq Composite Index closed down 32.22 points, or 0.14%, at 23,545.9 points.