News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Japan's era of extremely loose monetary policy over the past decade is now being permanently consigned to history.

EIP-7951 may not make mnemonic phrases disappear overnight, but it has finally removed the biggest stumbling block to the mass adoption of Ethereum.

In Brief Cryptocurrency market experiences a significant drop, affecting XRP and Dogecoin. XRP's support level break indicates a new trend under professional sell-off confirmation. Dogecoin sees low institutional demand, high volatility, and trading volume drastically increases.

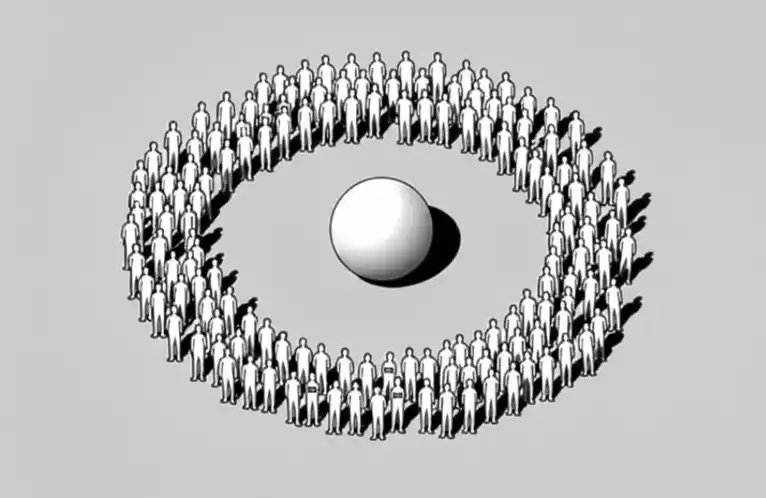

Former Greek Finance Minister Varoufakis revealed that the true holders of government debt are ourselves—pension accounts, savings, and even central banks—meaning everyone is effectively a "lender."

Crypto Twitter is no longer the main driver of consensus narratives and capital flows; the era of a "single culture" has ended, and the market has entered a new stage characterized by decentralization and fragmented contexts.

- 03:31Data: In the past 7 days, CEXs have seen a cumulative net outflow of 8,915 BTCChainCatcher news, according to Coinglass data, in the past 7 days, CEXs have seen a cumulative net outflow of 8,915 BTC. The top three CEXs by outflow are as follows: · One exchange, with an outflow of 6,335.56 BTC; · One exchange, with an outflow of 1,193.43 BTC; · One exchange, with an outflow of 1,163.66 BTC. In addition, one exchange saw an inflow of 1,097.26 BTC, ranking first in terms of inflow.

- 03:21Analysis: Rising Bitcoin "vitality" indicator suggests the bull market may continueJinse Finance reported that crypto analyst "TXMC" posted on X, pointing out that although the recent bitcoin price has declined, the liveliness of this cycle continues to rise. This indicates that there is underlying demand for spot bitcoin, which is not reflected in the price trend and may suggest that the bull market cycle is not yet over. The analyst stated that this indicator reflects the long-term moving average of on-chain bitcoin activity, representing the sum of all lifecycle spending and on-chain holding activity. During bull markets, as supply changes hands at higher prices, market "liveliness" usually increases, indicating the inflow of new investment capital.

- 03:12Bankruptcy sector concept tokens continue to surge, USTC up over 78% in 24 hoursBlockBeats News, December 7, according to data from a certain exchange, the bankruptcy sector concept tokens continue to surge, among which: · USTC has risen over 78% in 24 hours, with a market cap rising to $69.35 million; · LUNA has risen over 39% in 24 hours, with a market cap rising to $160 million; · LUNC has risen over 19% in 24 hours, with a market cap rising to $363 million; · FTT has risen over 18% in 24 hours, with a market cap rising to $234 million. BlockBeats reported yesterday that recently, after SBF’s fellow inmate was pardoned, SBF has been making frequent statements, indicating a potential possibility of receiving a pardon. However, on the prediction market Polymarket, the probability of "Will Trump pardon SBF in 2025?" remains at a very low level of about 2%.