News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Tech advocates vs price advocates: Monad's founder and Arthur Hayes have engaged in a remote debate.

Arthur Hayes questioned whether Tether's exposure to gold and bitcoin could pose insolvency risks, while Tether countered by highlighting its substantial equity. The debate between the two parties has reignited on X.

Monad’s FDV exceeded 4 billions the day after its launch?

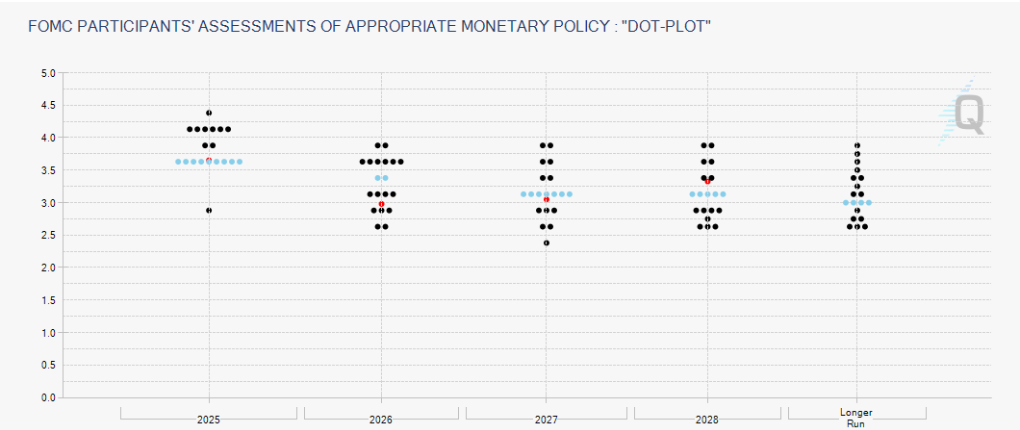

ETF determines the foundation of institutional support, while funding rates can amplify or weaken momentum. Stablecoins supplement native capital, and the structure of holders determines risk resilience. Macroeconomic liquidity controls the cost of capital.

Arthur Hayes has raised concerns about Tether's gold and Bitcoin exposure and the potential risk of insolvency. Tether has countered with significant proprietary equity, reigniting the debate between the two parties.

The darkest moments in human history often occur when the "offensive advantage" of technology outweighs its "defensive advantage." d/acc aims to reverse this imbalance.

Weekly highlights from December 1st to December 7th.

- 05:05US SEC Chairman: Tokenization is the future trend, and it is expected that all US markets will migrate on-chain within the next two yearsJinse Finance reported that Paul Atkins, Chairman of the U.S. Securities and Exchange Commission (SEC), stated: Tokenization is the direction of future development, and putting securities assets on-chain can achieve clear ownership confirmation. He expects that within the next two years, all markets in the United States will migrate to operate on-chain.

- 04:45Data: The current supply of USDC on Ethereum V3 has reached $5 billionJinse Finance reported that Circle posted on X stating that the current supply of USDC on Ethereum V3 has reached $5 billion. USDC on the Ethereum network has grown by 138% year-to-date (YTD), and USYC has been launched on the Aave real-world asset (RWA) market Horizon. All data is for the period from January to December 2025.

- 04:41Data: The current Crypto Fear & Greed Index is 22, indicating a state of extreme fear.ChainCatcher News, according to Coinglass data, the current cryptocurrency Fear and Greed Index is 22, down 5 points from yesterday. The 7-day average is 25, and the 30-day average is 19.