Wall Street's "most optimistic bull" JPMorgan: Driven by the AI supercycle, the S&P 500 Index is expected to break through 8,000 points by 2026

The core driving force behind this optimistic outlook is the AI supercycle and the resilient US economy.

The core driving force behind this optimistic outlook is the AI supercycle and the resilient U.S. economy.

Written by: Zhang Yaqi

Source: Wallstreetcn

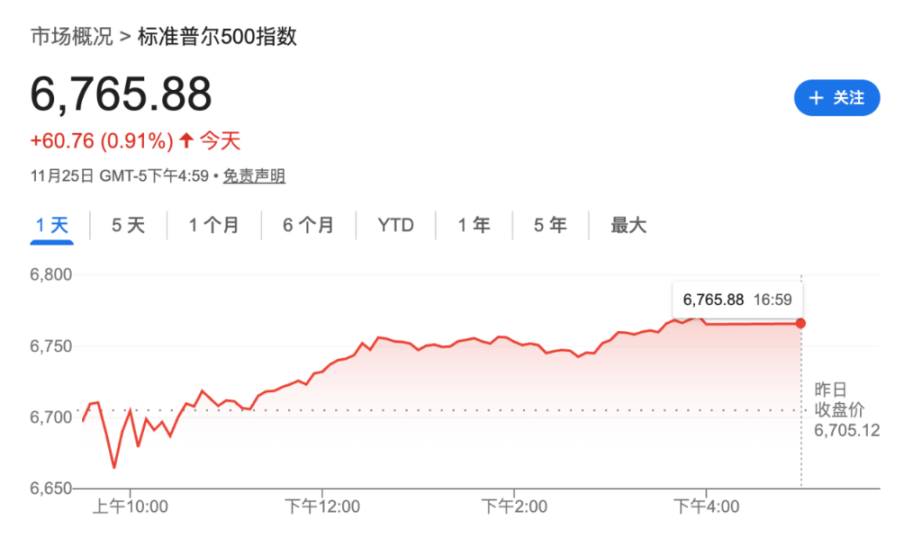

JPMorgan has released its latest outlook for the U.S. stock market in 2026, presenting one of the most optimistic forecasts on Wall Street to date, suggesting that under certain conditions, the S&P 500 Index could break through the 8,000-point mark. The bank firmly believes that, driven by the AI supercycle and a resilient economy, the United States will continue to serve as the engine of global growth.

The strategist team led by Dubravko Lakos-Bujas has set a base target of 7,500 points for the S&P 500 Index by the end of 2026. This forecast is based on the Federal Reserve pausing after two rate cuts at the beginning of the year, and expects corporate earnings to achieve "super-trend growth" of 13% to 15% for "at least the next two years."

However, JPMorgan has painted an even bigger picture for the market. The strategists emphasized in the report: "If the Federal Reserve further eases policy due to improving inflation dynamics, we expect even more upside, with the S&P 500 Index surpassing 8,000 points in 2026." This view makes the bank stand out in Wall Street's forecasting race, surpassing Deutsche Bank's previous 8,000-point target and setting a new high.

This extremely optimistic forecast is based on a firm belief in the "U.S. exceptionalism" thesis. JPMorgan believes that the resilience of the U.S. economy and the ongoing fermentation of the AI supercycle will allow it to continue to be the "engine of global growth" next year, providing strong fundamental support for the stock market.

The AI Supercycle is the Core Engine

JPMorgan believes that the current AI-driven supercycle is at the core of its optimistic outlook.

The strategists pointed out that this cycle has driven record capital expenditures, rapid earnings expansion, and created "unprecedented" market concentration among AI beneficiary stocks and high-quality growth companies. The report defines these high-quality companies as those with strong profit margins, robust cash flow growth, disciplined capital returns, and low credit risk. This technology-driven structural shift is reshaping the market landscape.

Addressing investors' concerns about overvaluation of AI-related stocks, JPMorgan offered a defense. The report acknowledges that the forward price-to-earnings ratio of the 30 major AI stocks has reached 30 times, but emphasizes that these companies, compared to the other S&P 470 constituents with a P/E ratio of 19 times, offer "stronger earnings visibility, higher pricing power, lower balance sheet leverage, and a consistently good track record in shareholder capital returns."

In addition, regarding the issue of capital expenditures that once triggered a market pullback, the bank expects capital expenditures for the 30 major AI stocks to grow by 34% next year. The strategists added that the "Fear of becoming obsolete" (FOBO) mentality is driving companies and governments to invest heavily in this technology. This momentum is spreading from the technology and utilities sectors to industries such as banking, healthcare, and logistics, thereby broadening the scope of AI investment.

"Winner-Takes-All" Market and Potential Volatility

Despite the bright outlook, JPMorgan also pointed out a downside. The strategists stated that this AI-driven growth is unfolding in a "K-shaped divergent economy," creating a "winner-takes-all" market. This means that some companies achieve great success, while others may fall behind.

The report warns:

"In this environment, as we have seen this year and recently, broad market sentiment indicators may still be prone to sharp fluctuations."

They believe that the market landscape in 2026 will not differ much from 2025, with dominant stocks showing extreme crowding and record concentration.

In addition to the dominant AI theme, JPMorgan also pointed out other investment areas worth watching, including global strategic resource stocks such as rare earths and uranium, which are expected to continue their growth momentum. Deregulation is expected to bring new impetus to the financial, real estate supply chain, and energy industries, while regulatory rollbacks will help promote growth and reduce deficits. At the same time, stocks sensitive to tariffs and trade may also offer some "tactical opportunities."

In terms of sector allocation, JPMorgan maintains an overweight rating on technology, media and telecommunications (TMT), utilities, and defense sectors, and expects the banking and pharmaceutical industries to further outperform the market. The bank holds a neutral view on the broader financial and healthcare sectors. The strategists also added that the earnings growth potential related to deregulation and expanding AI productivity gains is still "underestimated" by investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

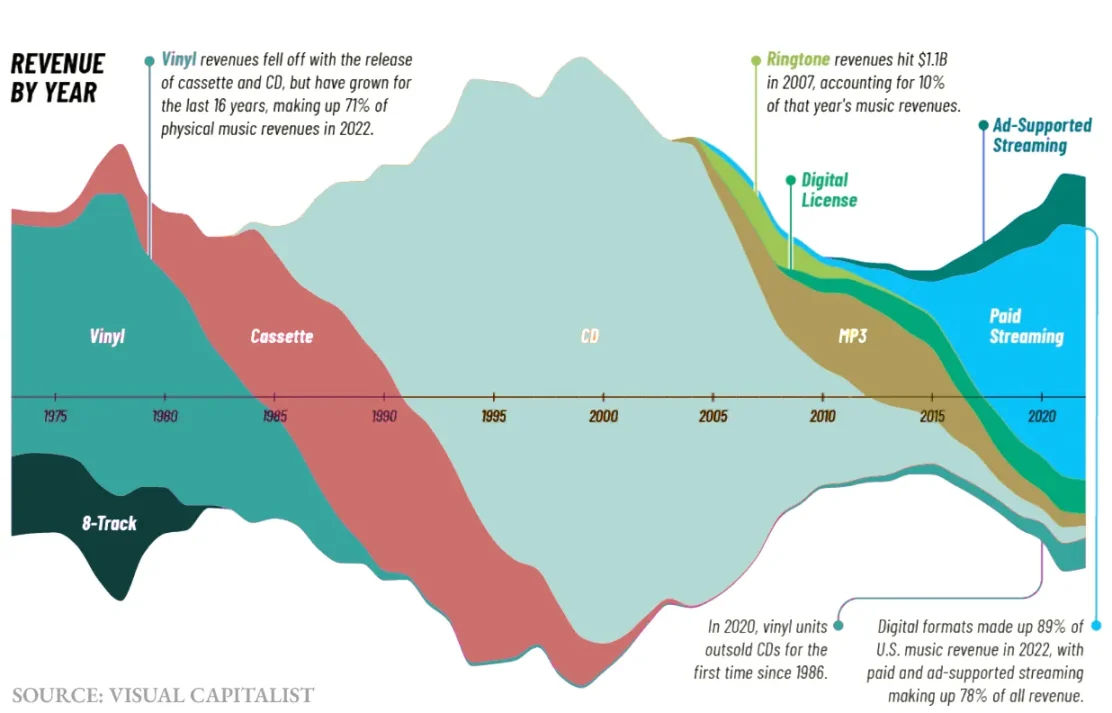

From "Subscription Hell" to Precise Payment: A History of the Evolution of Internet Pricing Models

This will be the topic we will delve into next: how developers can use x402 without worrying about potential failures in the future.

4 Catalysts That Could Boost Bitcoin

Vitalik Buterin Charts ‘Targeted Growth’ as Ethereum Hits 60M Gas Limit Milestone

![Crypto News Today [Live] Updates On November 27,2025 : Bitcoin Price,Grayscale Zcash ETF,Upbit Hack and More……](https://img.bgstatic.com/multiLang/image/social/03300f325ed4211e8f2d9d00885d0bcc1764232946103.webp)