News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The Hong Kong Monetary Authority has released a consultation paper, CRP-1 "Crypto Asset Classification," aiming to establish a regulatory framework that balances innovation and risk control. The paper clarifies the definition and classification of crypto assets, as well as regulatory requirements for financial institutions, aligning with international standards set by the BCBS. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still in the process of iterative improvement.

Could Ethereum become one of the most strategic assets of the next decade? Why do DATs offer a smarter, higher-yield, and more transparent way to invest in Ethereum?

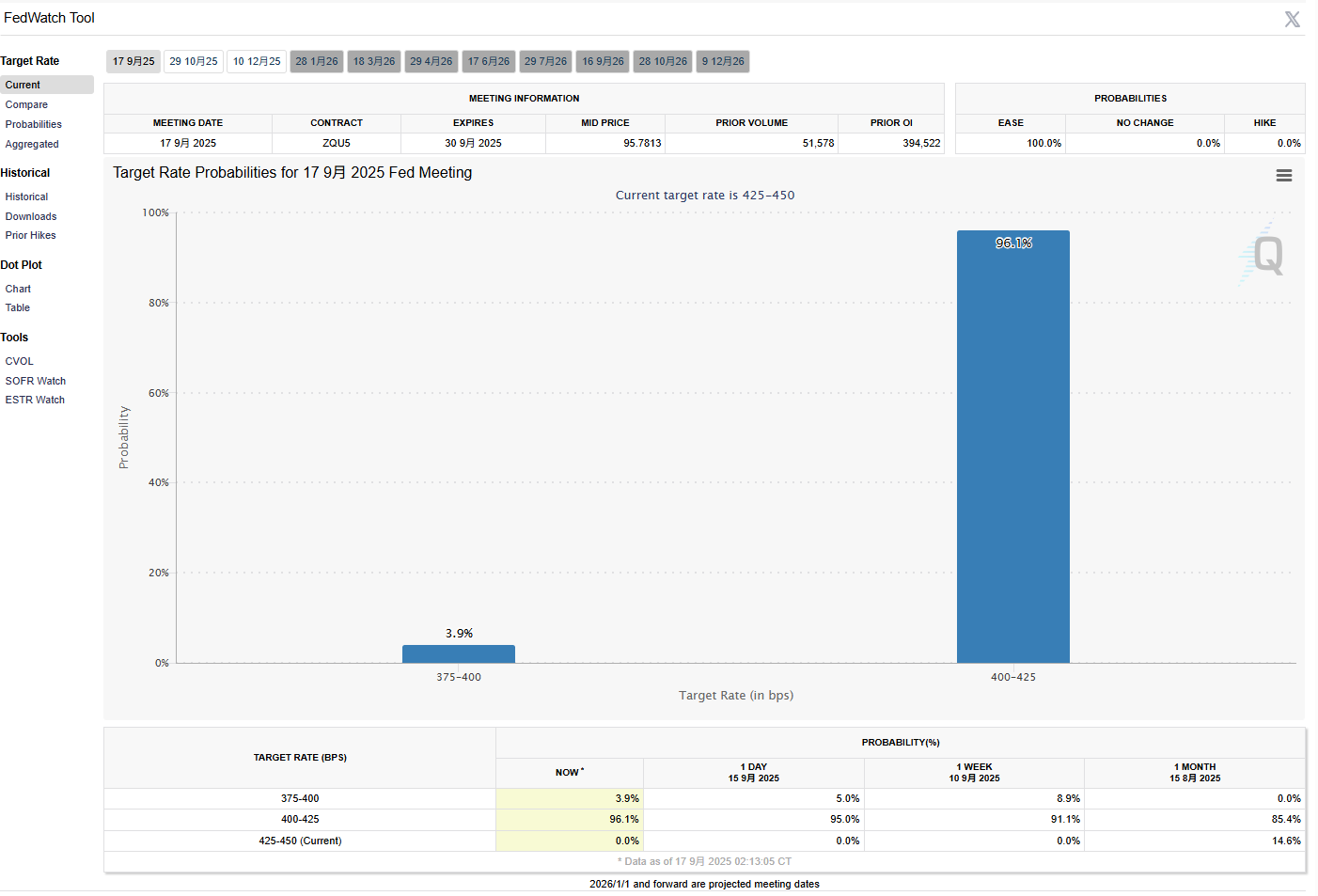

Any indication the FOMC is less dovish than anticipated could weigh on crypto, industry watcher says

Camp is unlocking new use cases for intellectual property (IP), laying the foundation for a future where rights, authorization, and commercial monetization are embedded within the creative process.

In a harsh market environment where most people believe "VC tokens are dead," "the tech narrative has disappeared," "listing certainty has plummeted," and "everything traded is a MEME," I actually think the time has come to buy the dip in technology-focused projects.

- 16:02USDC Treasury minted an additional 250 million USDC on the Solana chain.BlockBeats News, on September 17, according to monitoring by Whale Alert, USDC Treasury has just minted 250 million USDC on the Solana chain.

- 16:00USDC Treasury minted 250 million USDC on SolanaAccording to Jinse Finance, monitored by Whale Alert, about 5 minutes ago, USDC Treasury minted 250 millions USDC on Solana.

- 15:59U.S. consumer credit scores see largest drop since the 2008 financial crisisJinse Finance reported that U.S. consumer credit scores have experienced the largest decline since the aftermath of the 2008 global financial crisis. According to a report released by FICO on Tuesday, the average FICO credit score in the United States dropped from 717 a year ago to 715 in April, marking the second consecutive year of year-over-year decline. The credit rating agency attributed the drop in scores to rising credit utilization and delinquency rates, including the resumption of reporting on student loan delinquencies. The student loan delinquency rate has reached a record high.