Bitcoin price is consolidating near $115,000–$116,000, trading sideways between short-term support at $114,990 and resistance at $115,977; market breadth is mixed, and short-term volatility is low, suggesting continued range-bound action over the next 24–48 hours.

-

BTC consolidating in a narrow $115K–$116K range

-

Short-term support at $114,990 and resistance at $115,977; low probability of sharp moves today.

-

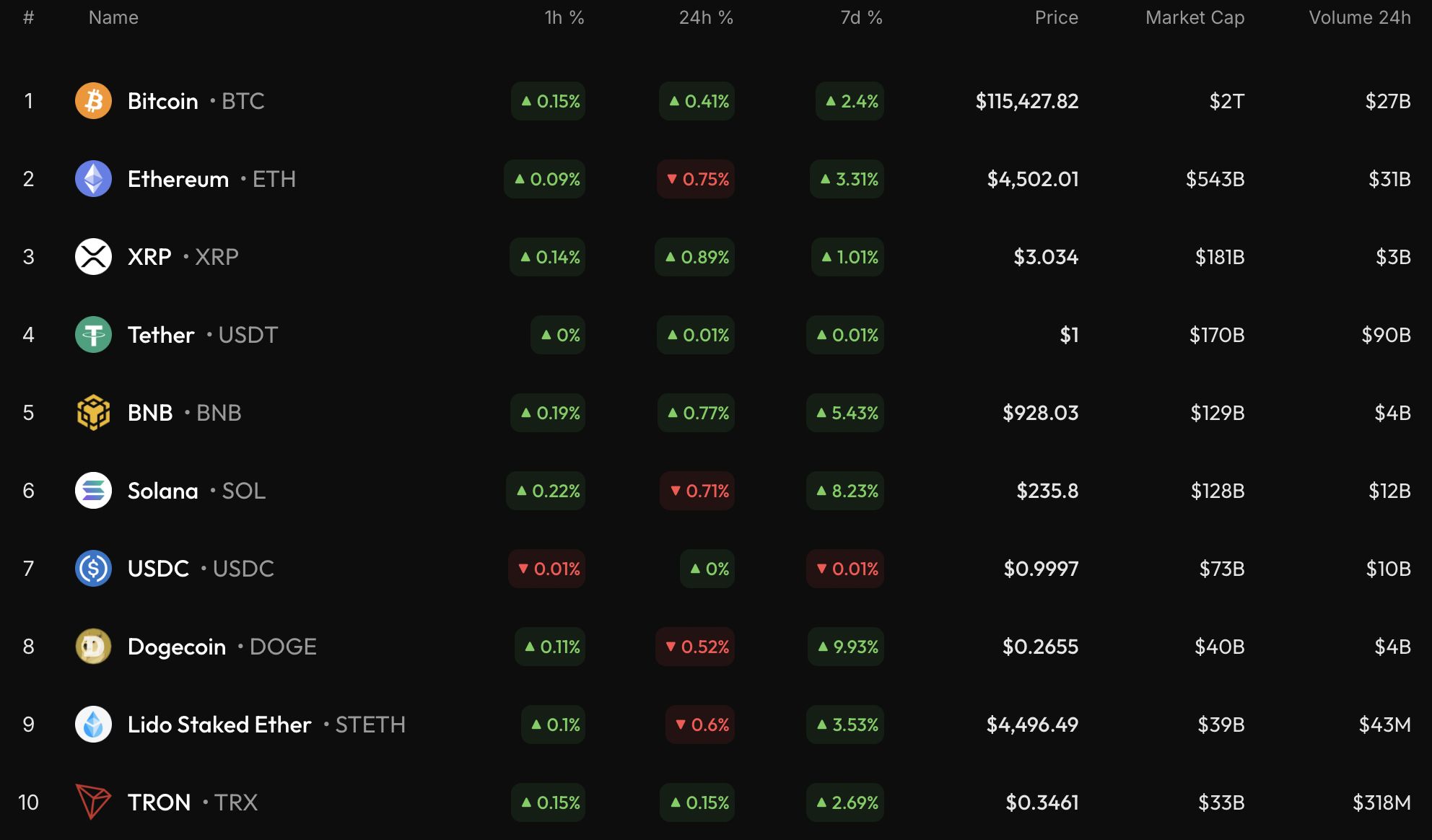

CoinStats shows mixed market breadth; TradingView hourly and daily charts both indicate neutral momentum.

Bitcoin price consolidates near $115,000 with neutral bias; read COINOTAG’s latest BTC price analysis and support/resistance levels for actionable context.

The market is trying to stay bullish even though some coins are in the red zone, according to CoinStats.

Top coins by CoinStats

What is the current Bitcoin price outlook?

Bitcoin price is neutral in the short term, consolidating between $114,990 support and $115,977 resistance. Price action shows low momentum on hourly and daily charts, indicating a high probability of continued sideways trading near $115,000 for the next 24–48 hours.

How is BTC/USD trading on intraday and longer-term charts?

On the hourly chart, BTC/USD sits in the middle of a local channel with both sides balanced, reducing the chance of immediate directional breakouts. TradingView analysis of intraday candles shows limited volume and range contraction.

Image by TradingView

On longer time frames the structure remains neutral. The chief crypto is far from critical trend lines or psychological levels, which suggests neither buyers nor sellers have clear control. Consolidation around current levels is the most likely midterm scenario absent new macro catalysts.

Image by TradingView

Key technical context:

- Immediate support: $114,990 — break below increases downside risk to wider channel lower bound.

- Immediate resistance: $115,977 — sustained move above would reopen short-term upside.

- Momentum: Low on hourly and daily charts; volume contracted over the past sessions.

From the midterm perspective, the price is positioned in the center of a broad channel and is not at decisive support or resistance. Given the neutral technical picture and mixed market breadth reported by CoinStats, the highest-probability outcome is continued range-bound trading and consolidation.

Image by TradingView

Bitcoin is trading at $115,461 at press time.

Frequently Asked Questions

Will Bitcoin drop below $114,990 soon?

Current indicators show low downside momentum; a break below $114,990 would require increased selling volume. Without such volume, the probability of a sharp drop is limited and consolidation remains more likely.

How should traders approach BTC during consolidation?

Traders should favor range strategies or remain sidelined until a clear breakout with volume occurs. Use tight risk management and monitor support/resistance levels for confirmation.

Key Takeaways

- Range-bound action: Bitcoin is trading in a narrow $115K–$116K range with neutral bias.

- Low volatility: Hourly and daily charts show contracting ranges and lower volume, reducing breakout odds.

- Watch levels: Immediate support $114,990 and resistance $115,977 — use these for trade triggers and risk control.

Conclusion

This COINOTAG price update shows that the Bitcoin price is consolidating with neutral momentum and limited near-term directional risk. Traders and observers should watch $114,990 and $115,977 for breakout confirmation and manage positions accordingly. Check updated market data and official exchange feeds for live pricing and orderbook context.