Here’s How Much Your 1,000 to 5,000 XRP Could Be Worth if JPMorgan’s XRP ETF Forecast Plays Out

The debut of XRP ETFs has revived optimism in the market, especially as these products continue to attract large amounts of capital.

For context, since their launch, the funds have pulled in roughly $666 million across 11 trading sessions. This figure represents more than 300 million XRP tokens acquired in less than two weeks.

Amid the acceleration of inflows, analysts and market commentators have started revisiting an earlier outlook from JPMorgan that could have implications for XRP’s value if the projection proves correct.

JPMorgan Expects XRP ETFs to Hit $8B Inflow in a Year

Notably, in January 2025, four JPMorgan analysts, Madeline Daleiden, Alexander Bernstein, Kenneth B. Worthington, and Michael Cho, released a research report evaluating potential asset flows for forthcoming altcoin ETPs.

In the report, the team estimated that the Solana ETFs could gather between $3 billion and $6 billion in their first six to twelve months of trading. The same document argued that XRP products could attract even more capital, projecting between $4 billion and $8 billion in net new inflows over the same timeframe.

They based their assessment on adoption patterns observed in earlier Ethereum and Bitcoin ETFs. The analysts noted that Bitcoin ETFs absorbed the equivalent of 6% of the Bitcoin market cap during their first year, collecting around $108 billion.

Speaking further, they added that Ethereum ETFs gathered roughly 3% of their market cap within six months, a figure that translated to approximately $12 billion.

The analysts applied these same adoption ratios to the considerably smaller market valuations of Solana and XRP and concluded that both assets could jointly see as much as $14 billion in total ETF inflows despite expectations of lighter overall demand compared to Bitcoin and Ethereum.

XRP Price if JPMorgan’s Forecast Plays Out

If this projected inflow to XRP ETFs plays out as forecasted, the market could experience a dramatic price reaction. However, determining the exact scale of that reaction remains difficult, so we sought insights from Google Gemini.

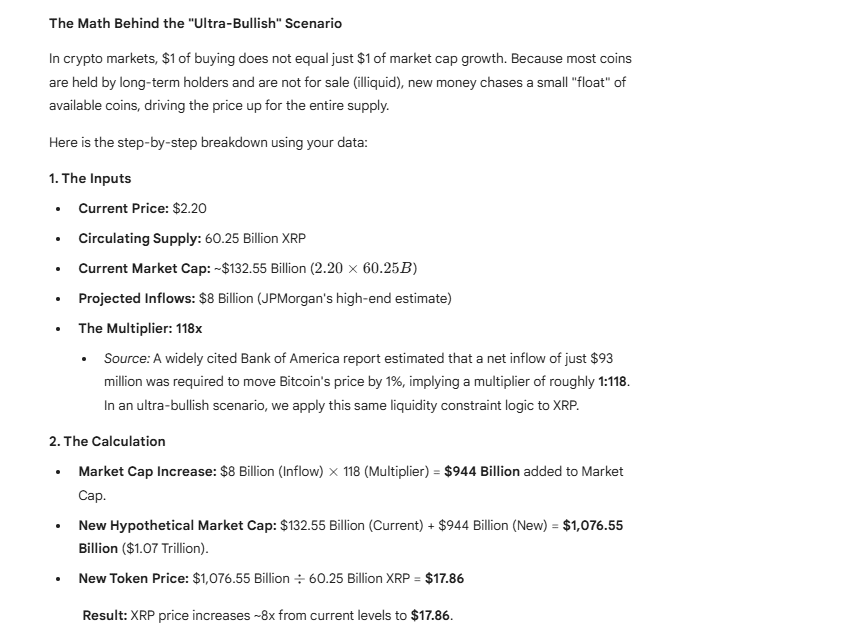

Responding, Gemini explained that its projection relied on JPMorgan’s upper estimate of $8 billion in new ETF inflows. It also incorporated a liquidity-based model called the Bank of America multiplier, which suggests that limited asset availability can cause market cap to rise far more sharply than the amount of money entering the market.

Gemini noted that a widely cited Bank of America analysis once indicated that about $93 million of net inflows could move Bitcoin by roughly 1%, implying a multiplier of about 118. It applied this same ratio to XRP for a bullish theoretical scenario.

Based on those assumptions, Gemini applied the $8 billion inflow and multiplied it by 118 to reach an estimated $944 billion increase in market capitalization. Adding this amount to the current valuation produced a theoretical new market cap of roughly $1.07 trillion.

The AI chatbot then divided this figure by the circulating supply to generate a hypothetical price of $17.86 for each XRP token. According to the chatbot, this scenario would represent an 8x price jump from current levels.

How Much Would 1,000 to 5,000 XRP Make

Such a move would create meaningful gains for everyday investors, many of whom have held XRP through years of slow price action and uncertainty.

The current XRP Rich List shows that more than 596,000 wallets hold between 1,000 and 5,000 XRP. At today’s prices, those amounts range from roughly $2,200 to about $11,000, which places most of these holders in the category of everyday retail investors.

If XRP rises to the $17.86 level suggested in Gemini’s hypothetical scenario, these holdings would rise dramatically. Specifically, a wallet with 1,000 XRP, currently worth around $2,200, would rise to about $17,860, representing a profit of $15,660.

Meanwhile, investors who hold 5,000 XRP would see their stake grow from about $11,000 today to about $89,300. This would mark a profit of over $78,000. However, it is important to note that both JPMorgan’s inflow forecast and Gemini’s projection are not guaranteed.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After viewing your Spotify Wrapped 2025, take a look at these similar alternatives

Privacy Coins and Market Fluctuations: Uncovering the Factors Behind ZEC's Latest Price Jump

- Zcash (ZEC) surged 700% in late 2025 driven by institutional backing and network upgrades like the Zashi wallet. - Regulatory pressures and market fragmentation intensified as exchanges delisted privacy coins and liquidity shifted to decentralized platforms. - ZEC's volatility reflects macroeconomic tailwinds and speculative demand, but its long-term viability hinges on balancing privacy with regulatory compliance. - Institutional adoption of privacy coins accelerated in 2025, yet fragmented markets and

Why Dash (DASH) Is Soaring as Institutions Embrace It and Privacy Concerns Fuel Demand

- Dash (DASH) surged 150% in June 2025, driven by institutional adoption and privacy-focused demand. - Institutional ownership reached 90.64% after AGF Management's $7.79M investment and DoorDash's $450M partnership. - Dash Platform 2.0 enhanced scalability while PrivateSend usage grew 25% YoY amid rising privacy needs. - Regulatory challenges persist under EU MiCA and SEC scrutiny, prompting multi-jurisdictional compliance strategies. - DeFi integration and Latin American adoption expanded DASH's utility

ZK Atlas Upgrade: Pioneering the Future of Blockchain Infrastructure for Enhanced DeFi Scalability

- ZKsync's 2025 Atlas Upgrade revolutionizes DeFi scalability via zero-knowledge rollups, boosting transaction throughput to 43,000 TPS and slashing costs to $0.0001 per transfer. - Modular architecture with Atlas Sequencer and Airbender Prover enables real-time execution, while zkSync OS supports EVM/WASM compatibility and cross-chain liquidity unification. - Post-upgrade DeFi metrics show 300% transaction volume growth and $0.28–$1.32 ZK token price projections, positioning ZKsync as a key Layer 2 infras