News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Solana (SOL) Forms Key Bearish Pattern — Could a Downside Move Follow?

CoinsProbe·2025/10/14 21:30

Metaplanet’s Market Value Falls Below Bitcoin Holdings as Investor Confidence Wanes

DeFi Planet·2025/10/14 21:27

Solana Partners With Korea’s Wavebridge to Launch KRW Stablecoin and Tokenization Platform

DeFi Planet·2025/10/14 21:27

SOL dips below $200 as US-China trade tension escalates

Coinjournal·2025/10/14 21:21

Sui price outlook as Figure deploys SEC-registered yield-bearing token YLDS

Coinjournal·2025/10/14 21:21

WisdomTree launches physically-backed Stellar Lumens (XLM) ETP across Europe

Coinjournal·2025/10/14 21:21

Tether will launch a fully open-source Wallet Development Kit (WDK) this week

Coinjournal·2025/10/14 21:21

Bittensor price surges 12% as TAO defies market slump

Coinjournal·2025/10/14 21:21

Stripe introduces stablecoin payments for subscription services

Coinjournal·2025/10/14 21:21

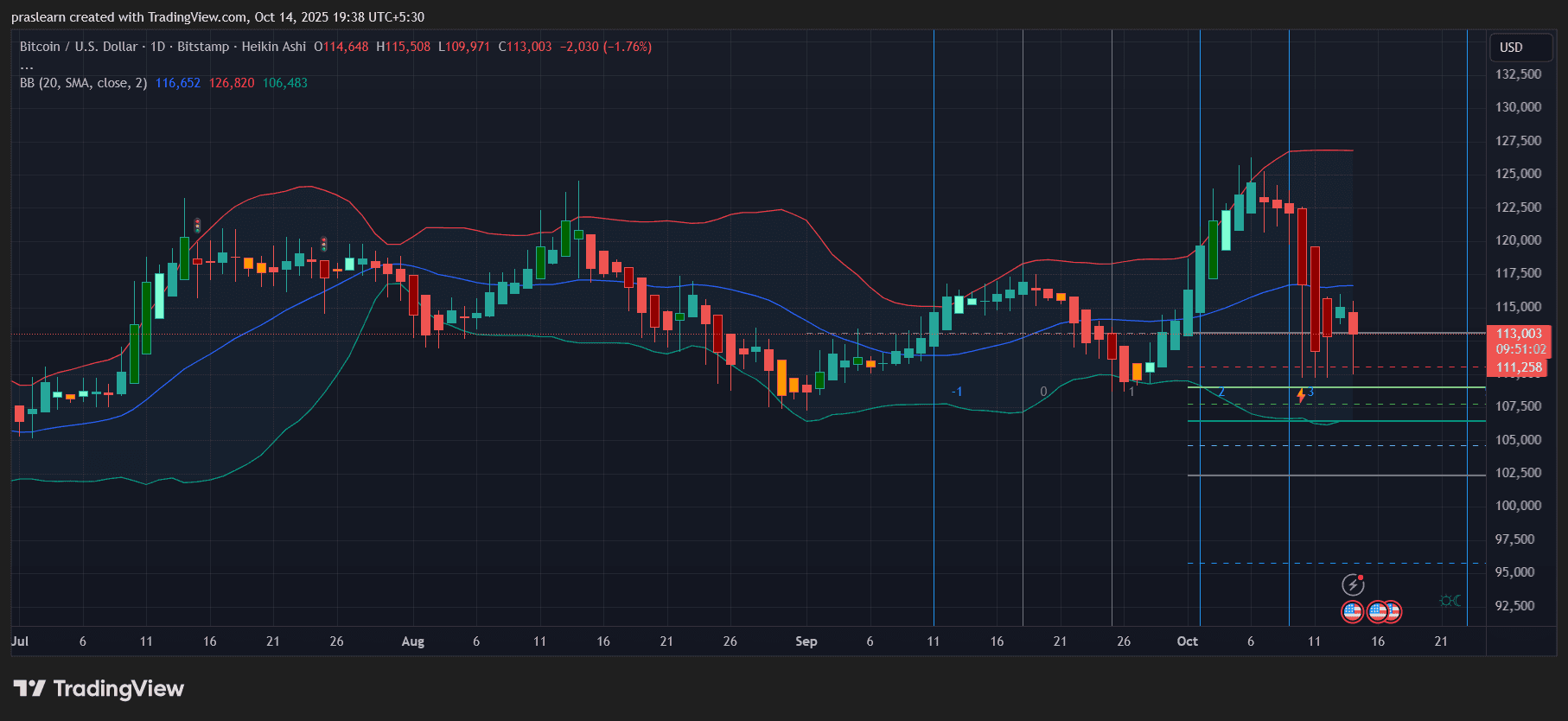

Bitcoin Crash Coming? Could BTC Really Drop From $110K to $65K?

Cryptoticker·2025/10/14 21:12

Flash

02:29

Arthur Hayes: The Federal Reserve's RMP program is essentially equivalent to quantitative easing and will drive Bitcoin to break above $124,000 again.According to TechFlow, on December 20, Arthur Hayes stated in his latest article that the Reserve Management Purchase program (RMP) introduced by the Federal Reserve at its December 10 meeting is essentially equivalent to Quantitative Easing (QE). Hayes analyzed through an accounting T-chart that RMP creates liquidity by purchasing short-term Treasury bonds, ultimately providing funding for government spending and having an inflationary effect. Hayes predicts that although the market currently mistakenly believes that the impact of RMP is less than that of QE, as the market gradually realizes the equivalence of the two, Bitcoin will break through $124,000 again and quickly surge toward $200,000. He pointed out that the RMP's monthly purchase scale of $40 billion will continue to push up the prices of risk assets. The article also mentions that, as major central banks around the world may be forced to follow suit with easing policies to cope with the depreciation of the US dollar, 2026 will witness the Federal Reserve, the People's Bank of China, the European Central Bank, and the Bank of Japan jointly accelerating the process of fiat currency devaluation. Hayes expects Bitcoin to fluctuate in the $80,000–$100,000 range in the short term until the market fully recognizes the impact of RMP.

02:28

Arthur Hayes: The Federal Reserve launches a new round of quantitative easing, bitcoin may return to $124,000BlockBeats News, December 20, Arthur Hayes stated in his latest article "Love Language" published today that the RMP (Reserve Management Purchase) launched by the Federal Reserve is essentially a new version of quantitative easing (QE), which means liquidity will be released again and the long-term risk of fiat currency depreciation will rise, and the crypto market, especially bitcoin, will benefit significantly. He expects that in the short term, BTC may fluctuate in the $80,000–$100,000 range; once the market realizes that "RMP = QE," bitcoin may return to $124,000 and quickly surge to $200,000; he predicts that around March next year, there may be a temporary emotional peak, followed by a pullback, but the overall bottom is still likely to remain above $124,000. It is worth noting that although Arthur Hayes continues to be bullish on the crypto market, he transferred 508.647 ETH (worth $1.5 million) to Galaxy Digital during yesterday's rebound, possibly for selling purposes.

02:22

Hyperscale Data is launching a $50 million ATM Offering, intended to be used for purchasing Bitcoin and expanding data centers.BlockBeats News, December 20, AI data center company Hyperscale Data announced the launch of a maximum $50 million at-the-market (ATM) common stock offering program. The company stated that the majority of the funds raised will be used to purchase Bitcoin and advance its Michigan data center construction, with a small portion allocated for working capital and general corporate purposes. The stock offering will be conducted through Spartan Capital Securities as the sales agent.

News