News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

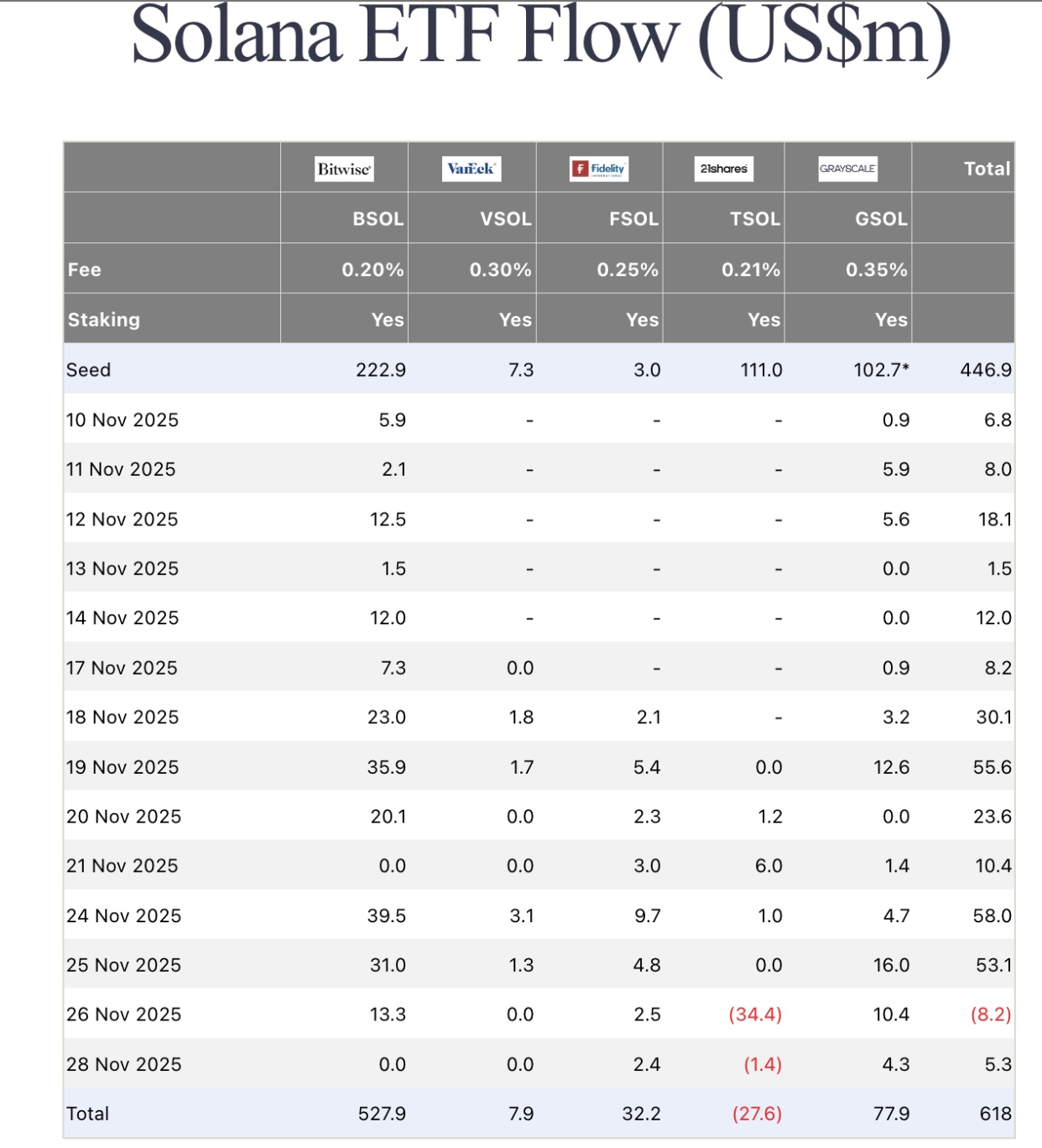

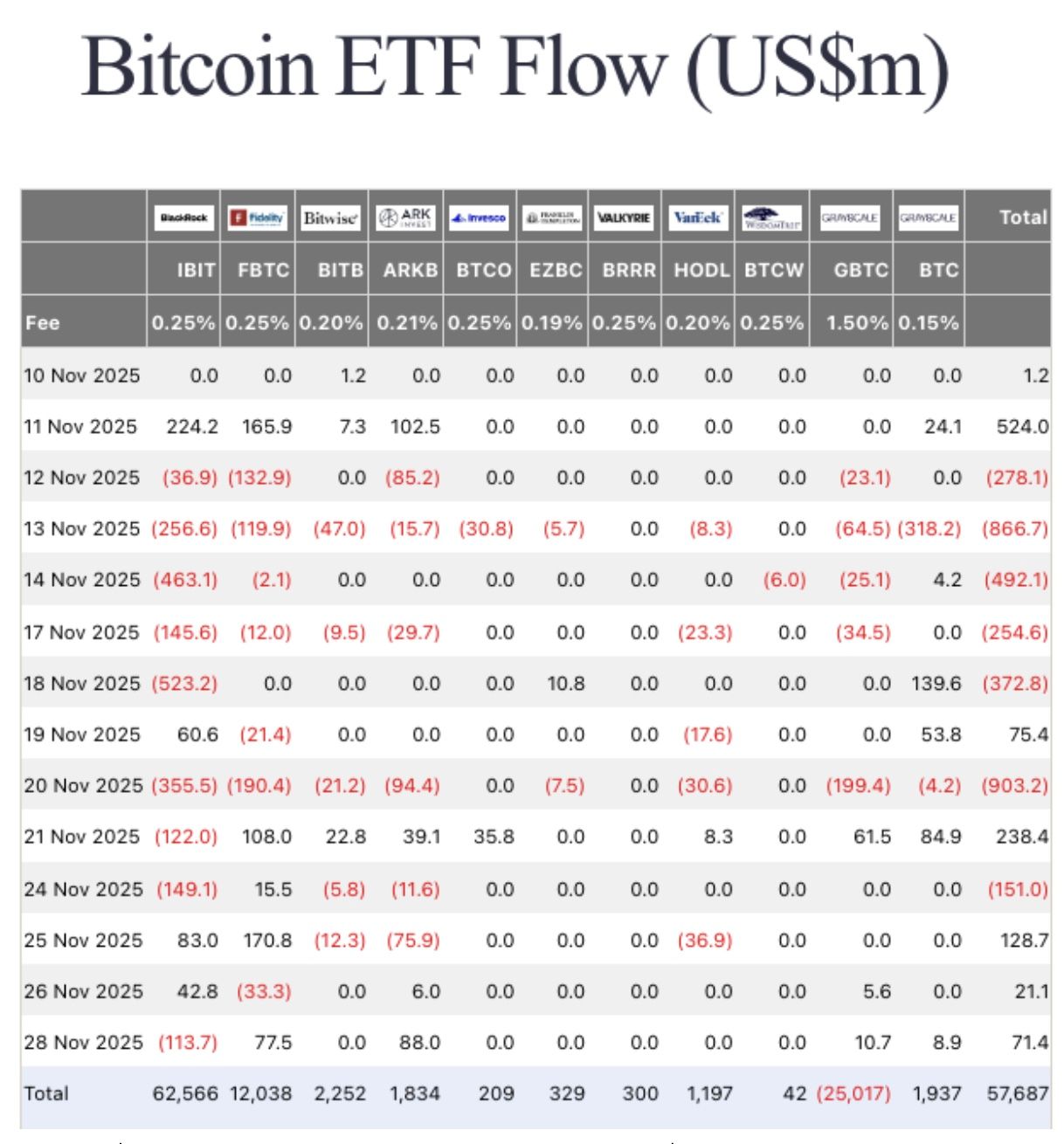

Quick Take U.S. spot bitcoin and Ethereum ETFs logged net positive inflows this week, shortened due to the Thanksgiving holiday, for the first time since late October. The bitcoin ETFs logged $70 million worth of inflows, breaking a four-week net outflow streak that saw outflows of over $4.3 billion. The Ethereum ETFs logged $313 million worth of inflows, breaking its own outflow streak of three weeks and $1.7 billion. Spot Solana ETFs, which broke a 21-day inflow streak with outflows on Wednesday, logged

Cardano price settled just above $0.41 on Nov 29, as a governance vote on a 70 million ADA budget allocation gained majority support while fresh derivatives data revealed a critical resistance barrier forming near $0.44.

Solana price stabilized above $135 this week as bullish leverage traders absorbed ETF-related headwinds and restored confidence across derivatives markets.

Prediction markets turned cautious even as Bitcoin price staged a 17% rebound from last week’s capitulation lows, with ETF inflows failing to generate a decisive breakout.

Quick Take China’s central bank reaffirmed its stance that digital assets have no legal status in the country following a multi-agency meeting on Friday. The PBoC specifically flagged stablecoins as failing to meet anti-money laundering and customer identification requirements, calling them a threat to financial stability.

Quick Take Visa has partnered with crypto infrastructure provider Aquanow to bring stablecoin settlement capabilities to Central and Eastern Europe, the Middle East, and Africa. The expansion comes as Visa’s stablecoin settlement volume has reached a $2.5 billion annualized run rate.

- 08:22Bitcoin treasury companies enter the "Darwin phase," Galaxy warns of premium collapseAccording to ChainCatcher, the price of bitcoin dropped from a high of $126,000 to the $80,000 range, causing Bitcoin Treasury Companies (DAT) to enter the "Darwin phase," with equity premiums collapsing, leverage becoming a burden, and most DAT stocks turning to discount trading. A Galaxy Research report pointed out that some companies, such as NAKA, have plummeted 98% from their peak, while Strategy has raised $1.44 billion in cash reserves to cope with market volatility.

- 07:31Maryland man sentenced to 15 months in prison for assisting North Korea in infiltrating U.S. tech companiesJinse Finance reported that Minh Phuong Ngoc Vong, a 40-year-old man from Maryland, was sentenced to 15 months in prison and three years of supervised release for assisting North Korean agents secretly embedded within U.S. technology companies. Between 2021 and 2024, Vong used false identification to secure software development positions at at least 13 U.S. companies, which paid him over $970,000 in salaries, while the actual work was performed remotely by North Korean agents based in China. Some companies even subcontracted Vong's services to U.S. government agencies, including the Federal Aviation Administration (FAA), resulting in these agents gaining unauthorized access to sensitive government systems.

- 07:11Aave founder: The UK's new tax rules simplify taxation and promote institutional adoption of cryptocurrenciesAccording to ChainCatcher, as reported by Yahoo Finance, Aave founder Stani Kulechov stated that the recent DeFi tax guidelines released by HM Revenue & Customs (HMRC) may mark a turning point for crypto lending in the UK. The document points out that depositing digital assets or stablecoins such as USDC or USDT into DeFi platforms will not be considered a taxable disposal at the time of deposit. In other words, when users deposit their crypto assets into DeFi platforms for lending, staking, or borrowing, it will not trigger capital gains tax. Capital gains tax is only required when users actually dispose of their assets (for example, by selling, converting, or otherwise cashing out), rather than simply transferring tokens into or out of DeFi protocols. According to the new approach, these routine DeFi transactions fall under the category of "no gain, no loss," thereby providing investors with clearer and more practical tax guidance. Kulechov added that the simplified tax approach reduces the burden, enabling broader institutional adoption while also making operations easier for ordinary retail users.