News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

STX has never missed out on market speculation surrounding the BTC ecosystem, but previous hype was more like "castles in the air" without a solid foundation. After the Nakamoto upgrade, Stacks will provide the market with higher expectations through improved performance and sBTC.

Hyperliquid continues to impress traders with its ability to process more than $330 billion in monthly volume with a tight development team.

Qiao Wang of Alliance DAO doubts the long-term value of L1 tokens, citing lack of a strong moat. He views L1 tokens as “low-quality bets” but doesn’t believe they are bad investments overall. Wang suggests the app layer offers more secure investment opportunities with stronger value capture.

Quick Take European asset manager CoinShares has pulled SEC registration filings for its planned XRP, Solana (with staking), and Litecoin ETFs. The asset manager will also wind down its leveraged bitcoin futures ETF. The withdrawal comes as the firm prepares for a US public listing via a $1.2 billion SPAC merger with Vine Hill Capital. CEO Jean-Marie Mognetti cited the dominance of traditional finance giants in the US crypto ETF market in a statement explaining the shift in strategy.

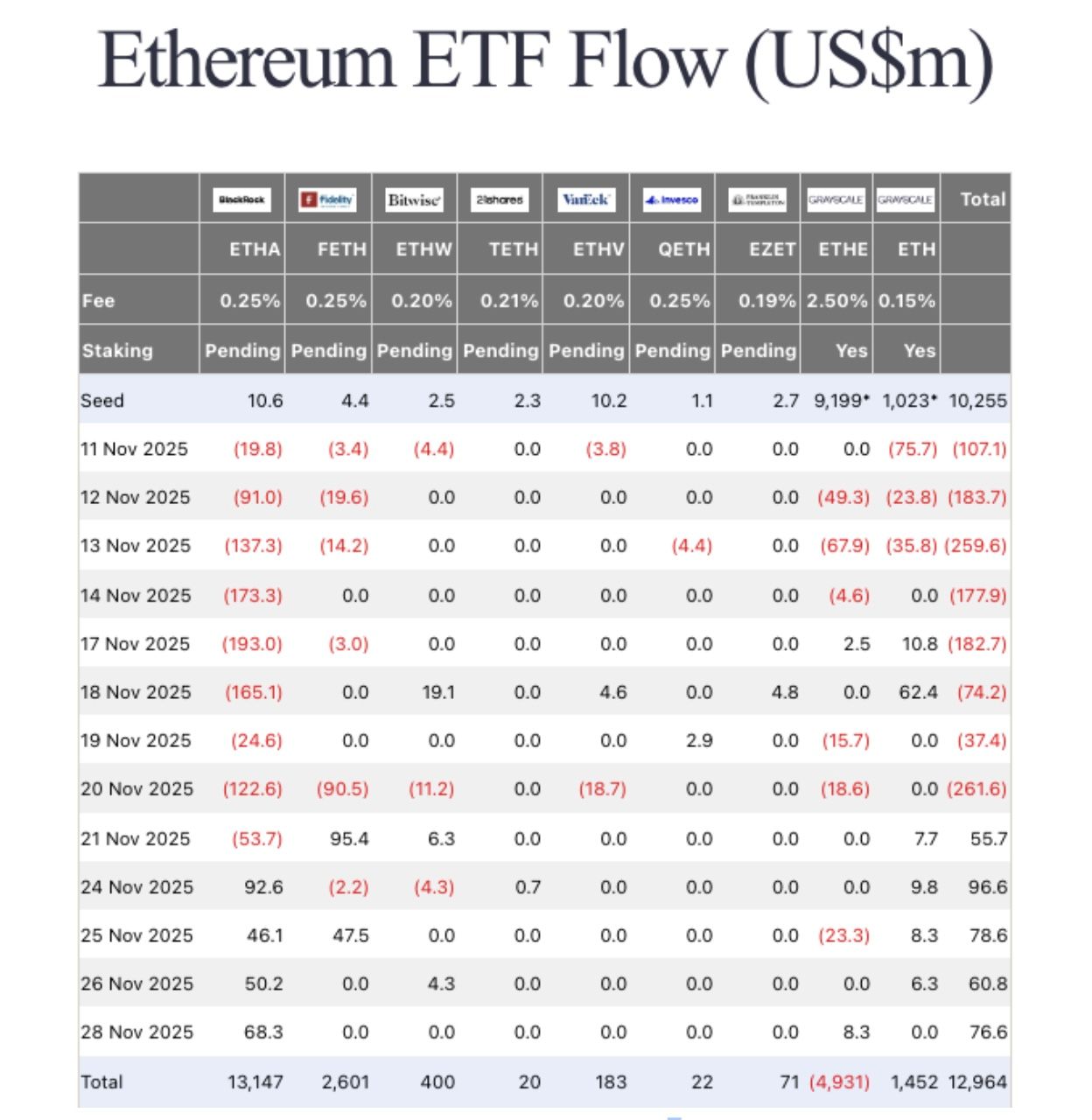

Ethereum’s price closed November down 21%, but derivatives market positioning and renewed whale demand hint at a positive start to December.

Quick Take Bitcoin fell below $86,500 on Sunday mainly due to macro pressures and news that Yearn Finance was hacked for millions. Still, analysts predict upside from Federal Reserve’s December rate cut decision, with the odds of a 25 basis point cut having increased recently.

Quick Take This is an excerpt from the 40th edition of The Funding sent to our subscribers on Nov. 30. The Funding is a fortnightly newsletter written by Yogita Khatri, The Block’s longest-serving editorial member. To subscribe to the free newsletter, click here.

Quick Take An attacker has apparently attacked Yearn’s yETH, an index token consisting of several popular liquid staking tokens, profiting millions of dollars. About $3 million worth of ETH was sent through mixing service Tornado Cash as a result of the attack, blockchain data show. The attacker was seemingly able to mint infinite yETH through an exploit. This is a developing story.

- 02:25Data: The entire crypto market pulls back, PayFi sector drops nearly 4%ChainCatcher News, according to SoSoValue data, after consecutive increases, most sectors in the crypto market have generally experienced a pullback. Among them, the PayFi sector fell by 3.78% in the past 24 hours. Within the sector, XRP (XRP) dropped by 4.37%, but Dash (DASH) and Ultima (ULTIMA) bucked the trend and rose by 3.32% and 5.06% respectively. In addition, Bitcoin (BTC) fell by 1.06%, dropping below $93,000; Ethereum (ETH) fell by 1.73%, dropping below $3,200. In other sectors, the CeFi sector fell by 1.96% in the past 24 hours, with a certain exchange remaining relatively strong, rising by 1.91%. The Layer1 sector dropped by 2.24%, but TRON (TRX) and Zcash (ZEC) rose by 2.43% and 10.02% respectively. The Layer2 sector fell by 3.01%, with Merlin Chain (MERL) surging 9.93% intraday. The Meme sector dropped by 3.09%, but Fartcoin (FARTCOIN) bucked the trend and rose by 5.93%. The DeFi sector fell by 3.41%, but MYX Finance (MYX) climbed 7.08% intraday. The crypto sector indices reflecting historical sector performance show that the ssiCeFi, ssiLayer1, and ssiDeFi indices fell by 2.03%, 2.01%, and 4.40% respectively.

- 02:10User data from Argentine crypto platform Lemon Cash leaked due to a hack on a third-party service providerChainCatcher reported that Argentine cryptocurrency platform Lemon Cash confirmed on December 4 that due to its external analytics service provider Mixpanel being hacked on November 9, some users' names and email addresses were leaked. Lemon Cash emphasized that the platform's own systems were not attacked, and sensitive information such as users' private keys, mnemonic phrases, funds, and account balances were not affected. The company has sent emails to affected users, warning them to be cautious of potential phishing attacks. Notably, OpenAI is also a Mixpanel client and has terminated its partnership with the service provider following this incident.

- 02:10Delphi Digital: The Federal Reserve's liquidity buffer has been depleted, and a key resistance in the crypto market may be fading.ChainCatcher News, Delphi Digital posted on X that the Federal Reserve's reverse repurchase agreement (RRP) balance has dropped from a peak of over $2 trillion to almost zero, meaning its liquidity buffer has been depleted. In 2023, the scale of RRP was sufficient to buffer the Treasury General Account (TGA) replenishment by absorbing Treasury issuance, thus avoiding the depletion of bank reserves. As the RRP balance bottoms out, this buffer no longer exists. Any future Treasury issuance or TGA rebuilding will have to directly consume bank reserves. The Federal Reserve faces two choices: allow reserves to decline and risk another spike in repo rates, or directly expand its balance sheet to provide liquidity. Given the situation in 2019, the second option is more likely. This means the Fed will shift from withdrawing liquidity to injecting liquidity back into the market, marking a significant change from the past two years. With the end of quantitative tightening (QT) and the imminent reduction of the TGA, marginal liquidity has turned net positive for the first time since early 2022. A key resistance in the cryptocurrency market may be fading.