News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Top 3 Altcoins to Buy in September 2025

Cryptoticker·2025/09/07 16:05

HBAR ETF Approval Odds Hit 90%: Can the Price Rally From Here?

Cryptoticker·2025/09/07 16:05

Cardano Price Prediction: Can ADA Hold Its Ground Above $0.80?

Cryptoticker·2025/09/07 16:05

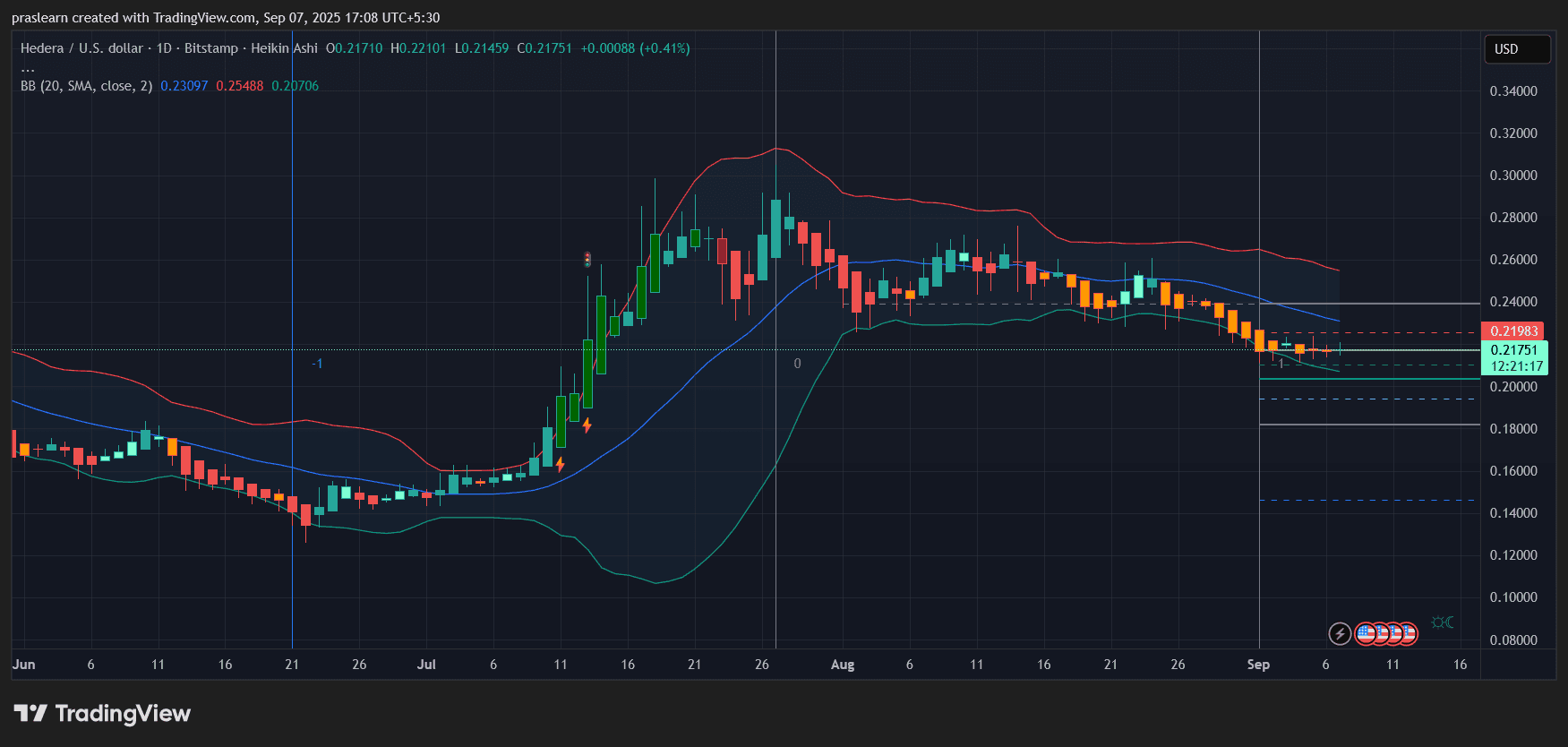

Hedera (HBAR) Price Eyes a Strong Breakout With 80% Upside

Hedera price is consolidating in a bull flag pattern, with analysts projecting a potential breakout that could drive prices toward the $0.40 level.

Coinspeaker·2025/09/07 16:00

Bittensor (TAO) Price Alert: Halving Is Less Than 90 Days Away

Bittensor (TAO) daily chart shows that a breakout could target $440 short term, and potentially $1,000 in 2025.

Coinspeaker·2025/09/07 16:00

D.C. AG accuses Bitcoin ATM operator of actively enabling fraudsters

Crypto.News·2025/09/07 16:00

David Schwartz’s Phoenix Profile Sparks Speculation XRP Could See Resurgence Following SEC Lawsuit

Coinotag·2025/09/07 16:00

European Crypto Giant CoinShares Plans US Market Entry with $1.2B Merger

CoinShares International Limited announced a definitive $1.2 billion business combination agreement with Vine Hill Capital Investment Corp. to list on US Nasdaq by December 2025.

Coinspeaker·2025/09/07 16:00

Nasdaq Files SEC Proposal to Enable Tokenized Securities Trading

Nasdaq submitted an SEC filing to allow trading of tokenized equities and ETPs on its exchange, potentially reducing settlement times and market friction through blockchain integration.

Coinspeaker·2025/09/07 16:00

WLFI and ABTC lift Trump wealth by $1.3B but prices drop

Newscrypto·2025/09/07 16:00

Flash

05:38

Machi's BTC, ZEC, and HYPE long positions turned profitable as the market reboundedPANews, December 20 — According to monitoring by Onchain Lens, as the market saw a slight rebound, Machi returned to profitability. Machi also opened new long positions in bitcoin (40x leverage), as well as ZEC and HYPE (10x leverage). Machi still needs $23 million to break even.

05:35

Data: The daily transaction volume of stablecoins USDT and USDC is nearly $200 billions, about twice that of the top five crypto assets.Jinse Finance reported that glassnode posted on X, stating that, based on the 90-day simple moving average (90D-SMA), the daily transfer volume of stablecoins (USDT+USDC) is currently around $192 billion, which is almost twice the combined daily transfer volume of the top five crypto assets (approximately $103 billion). This highlights that liquidity and settlement activities in the market are increasingly concentrated in stablecoins.

05:35

Ethereum spot ETFs saw a total net outflow of $75.89 million yesterday, marking seven consecutive days of net outflows.According to data from SoSoValue, yesterday (Eastern Time, December 19), the total net outflow of Ethereum spot ETFs was 75.89 million USD. The Ethereum spot ETF with the largest single-day net outflow yesterday was Blackrock ETF ETHA, with a single-day net outflow of 75.89 million USD. Currently, ETHA's historical total net inflow has reached 12.672 billions USD. As of press time, the total net asset value of Ethereum spot ETFs is 18.209 billions USD, with the ETF net asset ratio (market value as a proportion of Ethereum's total market value) reaching 5.04%. The historical cumulative net inflow has reached 12.444 billions USD.

News