News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

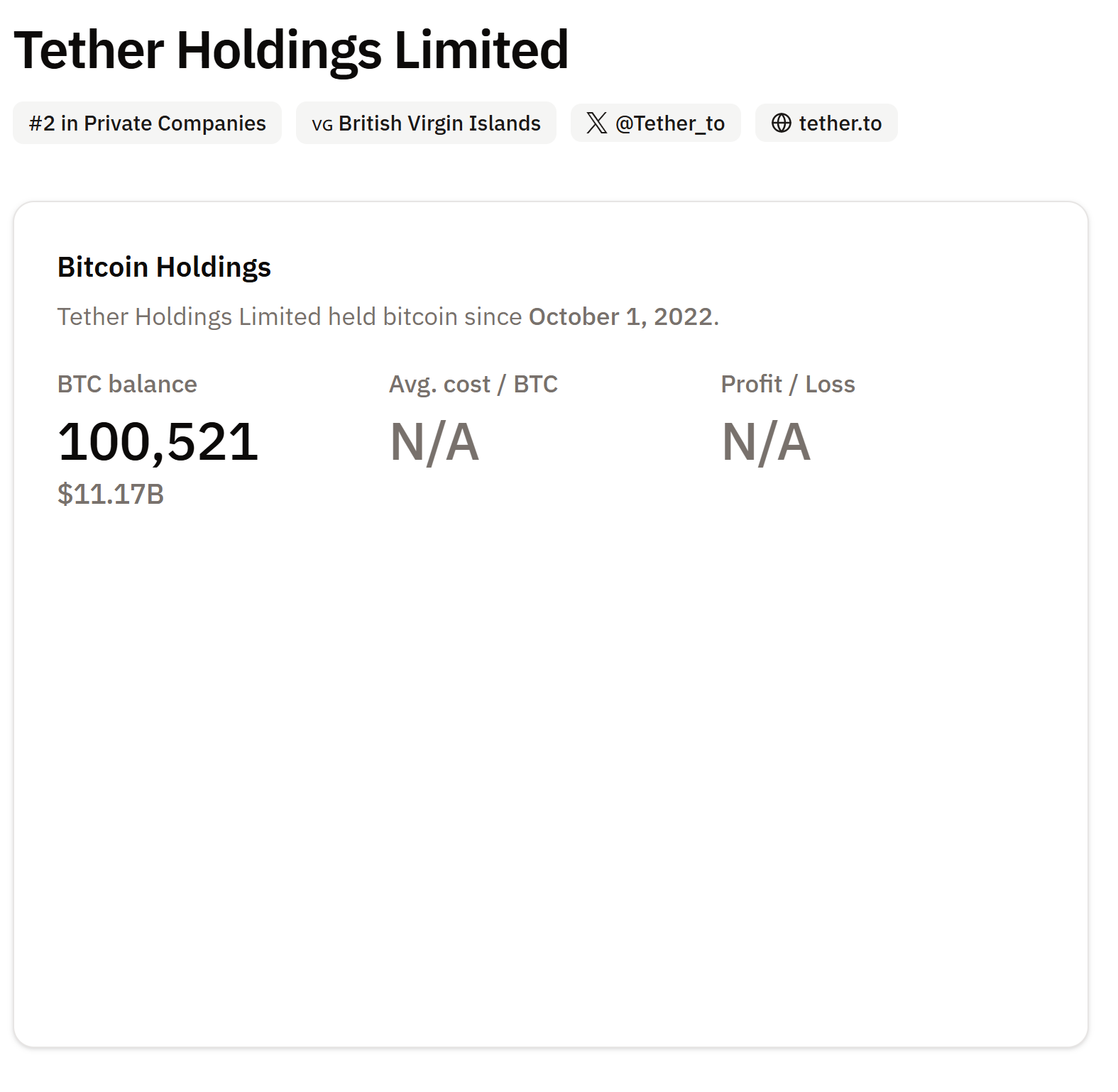

Tether denies Bitcoin sell-off rumors, confirms buying BTC, gold, land

CryptoNewsNet·2025/09/07 16:30

Solana (SOL) Founder Makes Statement About Ethereum: “What They’ve Been Able to Do Since 2015, We…”

CryptoNewsNet·2025/09/07 16:30

Stripe unveils Tempo, a blockchain dedicated to payments in stablecoins

Cointribune·2025/09/07 16:15

India Reconfigures Energy Imports Amid BRICS Push

Cointribune·2025/09/07 16:15

Bitcoin Mining Difficulty Hits Record High Amid Volatility and Centralization Concerns

Cointribune·2025/09/07 16:15

Crypto: A Historic Signal on Ethereum Opens the Way to $7,000

Cointribune·2025/09/07 16:15

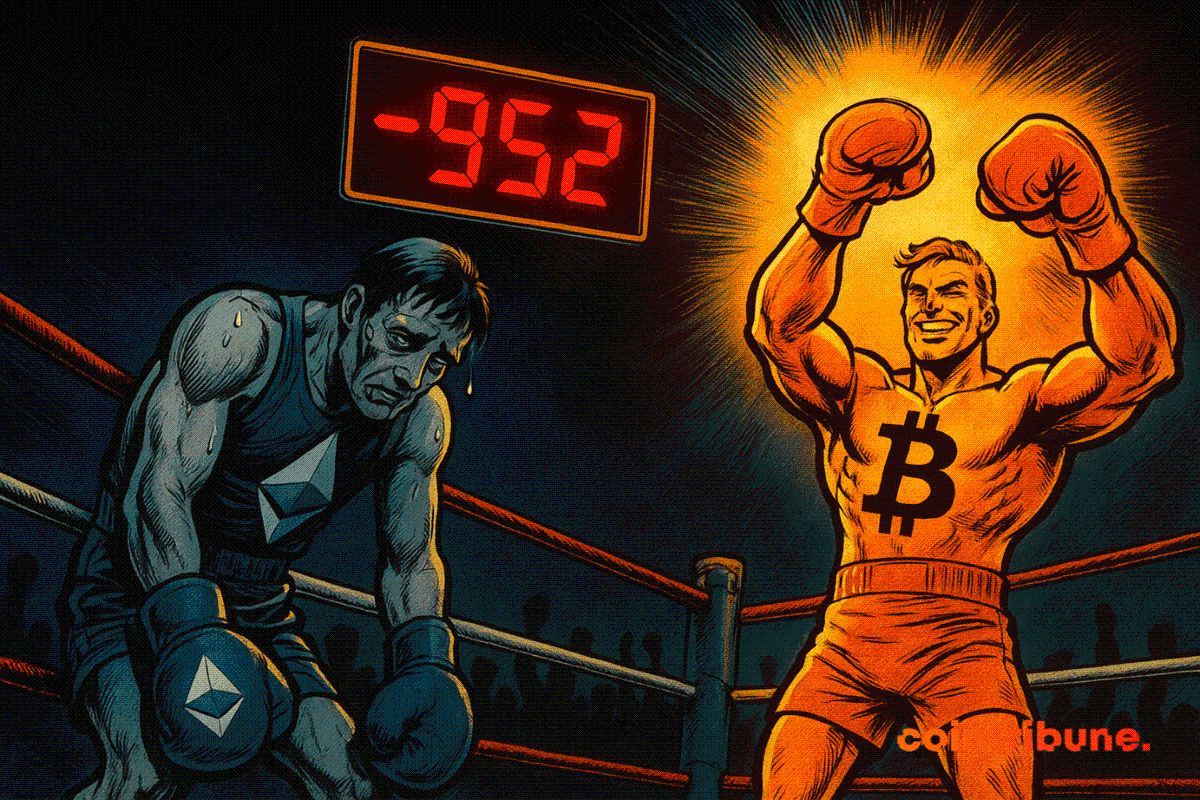

Ether ETFs Face $952M Outflows as Bitcoin Funds Gain Flows

Cointribune·2025/09/07 16:15

Bittensor (TAO) To Dip Further Before Bounce Back? Key Emerging Harmonic Pattern Saying Yes!

CoinsProbe·2025/09/07 16:15

Is Artificial Superintelligence Alliance (FET) Poised for a Breakout? Key Pattern Formation Suggests So!

CoinsProbe·2025/09/07 16:15

Tether Clarifies Bitcoin Holdings Strategy Following Speculation About Asset Sales

BTCPEERS·2025/09/07 16:10

Flash

05:38

Machi's BTC, ZEC, and HYPE long positions turned profitable as the market reboundedPANews, December 20 — According to monitoring by Onchain Lens, as the market saw a slight rebound, Machi returned to profitability. Machi also opened new long positions in bitcoin (40x leverage), as well as ZEC and HYPE (10x leverage). Machi still needs $23 million to break even.

05:35

Data: The daily transaction volume of stablecoins USDT and USDC is nearly $200 billions, about twice that of the top five crypto assets.Jinse Finance reported that glassnode posted on X, stating that, based on the 90-day simple moving average (90D-SMA), the daily transfer volume of stablecoins (USDT+USDC) is currently around $192 billion, which is almost twice the combined daily transfer volume of the top five crypto assets (approximately $103 billion). This highlights that liquidity and settlement activities in the market are increasingly concentrated in stablecoins.

05:35

Ethereum spot ETFs saw a total net outflow of $75.89 million yesterday, marking seven consecutive days of net outflows.According to data from SoSoValue, yesterday (Eastern Time, December 19), the total net outflow of Ethereum spot ETFs was 75.89 million USD. The Ethereum spot ETF with the largest single-day net outflow yesterday was Blackrock ETF ETHA, with a single-day net outflow of 75.89 million USD. Currently, ETHA's historical total net inflow has reached 12.672 billions USD. As of press time, the total net asset value of Ethereum spot ETFs is 18.209 billions USD, with the ETF net asset ratio (market value as a proportion of Ethereum's total market value) reaching 5.04%. The historical cumulative net inflow has reached 12.444 billions USD.

News