News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The boundaries between the consumer market and the enterprise market are gradually becoming blurred to some extent.

Quick Take Native Markets, a Hyperliquid ecosystem team, emerged as the victor from a competitive bidding process for the USDH ticker on the perpetuals exchange, and plans to launch a stablecoin. Numerous major crypto firms submitted bids for the ticker, from institutional players like Paxos and BitGo to crypto native firms such as Ethena and Frax. Native Markets, the first firm to submit a proposal, was chosen by a two-thirds supermajority of staked HYPE, and plans to launch the token in a test phase “wit

Ripple (XRP) price consolidates above $3 despite a considerable decline in trading volumes over the weekend. Can bullish expectations on Rabby Wallet integration of XRPL EVM contracts nullify US inflation jitters?

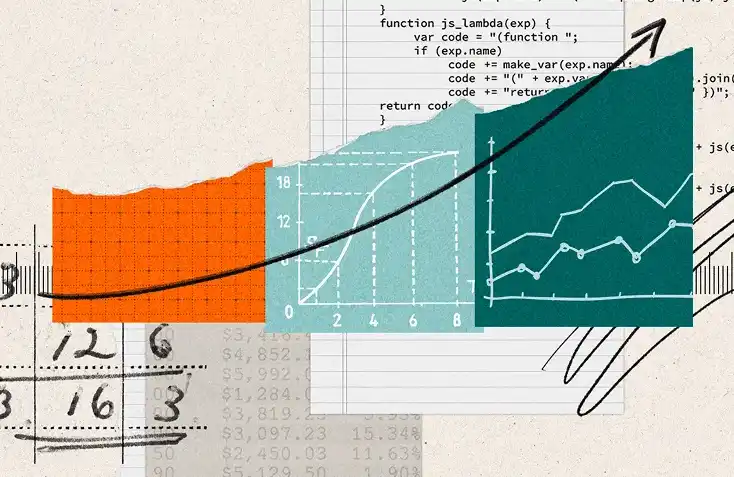

The chances of being at the market top have increased by 3% despite multiple bullish indicators from both retail and institutional investors.