News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Bitcoin climbs above $115K as on-chain metrics signal potential rally

Coinjournal·2025/09/13 20:57

Glassnode Predicts New Bitcoin Peak Within Weeks

Cointribune·2025/09/13 20:54

OpenSea Doubles NFT Fees Ahead of SEA Token Launch

Cointribune·2025/09/13 20:54

Polkadot (DOT) To Soar Further? Key Harmonic Structure Hints at Potential Upside Move

CoinsProbe·2025/09/13 20:54

Is Algorand (ALGO) Poised for a Breakout? Key Pattern Formation Suggests So!

CoinsProbe·2025/09/13 20:54

Monero (XMR) To Rise Further? Key Harmonic Pattern Signals Potential Upside Move

CoinsProbe·2025/09/13 20:54

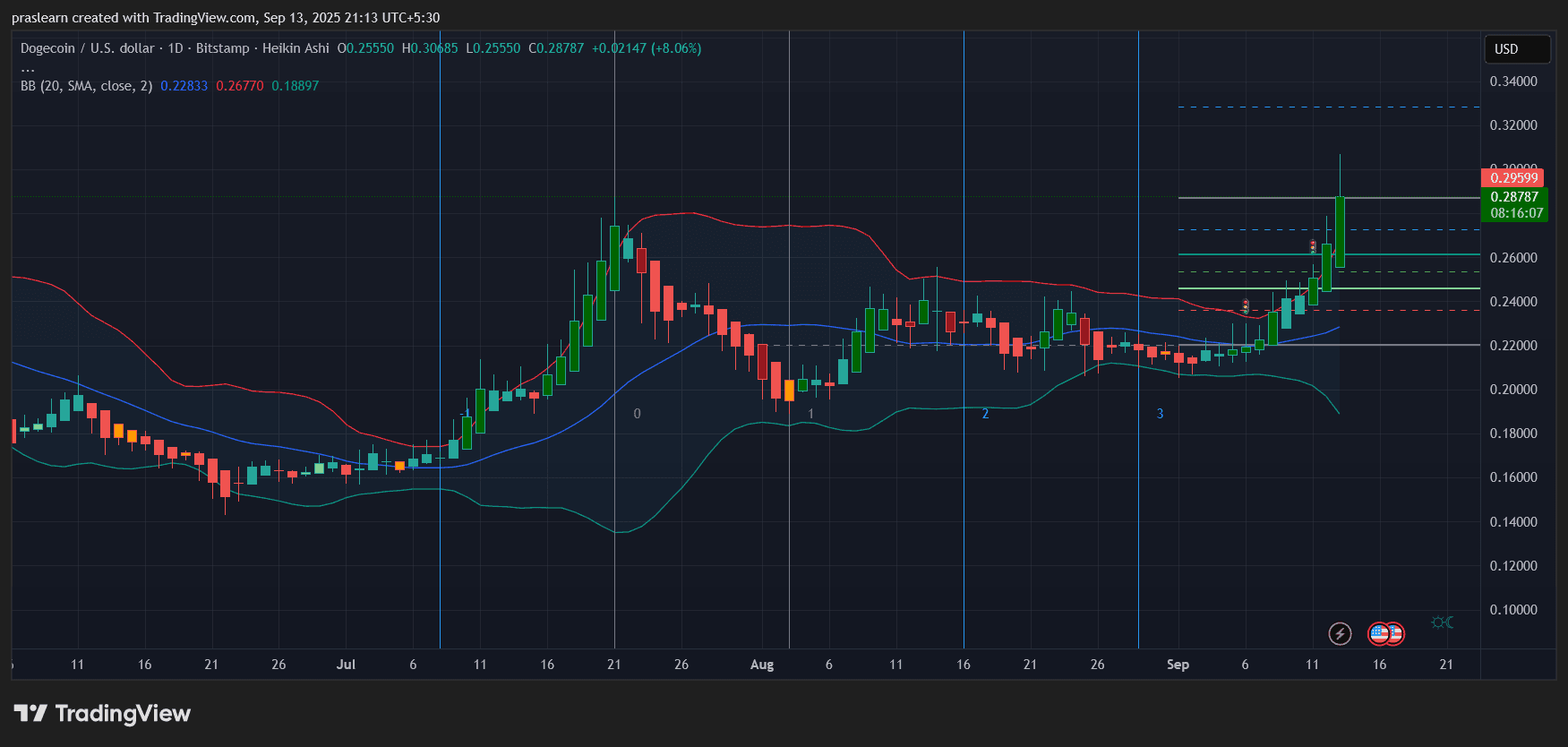

Dogecoin is Pumping: What’s Next?

Cryptoticker·2025/09/13 20:48

Bitget Expands Global Web3 Educational Efforts with ESN Luzern Partnership

Cryptoticker·2025/09/13 20:48

Will PayFi be the next narrative for RWA?

Can uncollateralized credit lending protocols work in the DeFi world?

雨中狂睡·2025/09/13 18:03

Why are the new DAT setups by Multicoin, Jump, and Galaxy underestimated?

ChainFeeds·2025/09/13 18:02

Flash

07:36

Institutions: If the unemployment rate rises by 0.1% per month, the Fed's room for interest rate cuts is underestimated. in November, the US inflation rate was far below economists' forecasts, while the unemployment rate unexpectedly rose that month. Due to information distortion and incompleteness caused by the 43-day federal government shutdown, investors have been reluctant to over-interpret this data. Michael Lorizio, Head of US Rates and Mortgage Trading at Manulife Investment Management, said: "Even taking this into account, it highlights that the current inflation data has very limited room for a significant upside surprise. If the labor market continues on its current trajectory, with the unemployment rate rising by 0.1 percentage points per month, I think the potential for further rate cuts next year may be somewhat underestimated."

06:37

Michael Lorizio: If the unemployment rate rises by 0.1% each month, the Federal Reserve's rate cut potential is being underestimatedChainCatcher News, according to Golden Ten Data, Michael Lorizio, Head of US Rates and Mortgage Trading at Manulife Investment Management, stated that the US inflation rate in November was significantly lower than economists' forecasts, and the unemployment rate unexpectedly rose. He pointed out that although the federal government shutdown caused some data distortion, there is limited room for current inflation data to significantly exceed expectations. If the labor market continues on a trajectory where the unemployment rate rises by 0.1 percentage points each month, the potential for further rate cuts next year may be underestimated.

06:30

Data: USDC circulating supply decreased by approximately 1.3 billions in the past 7 daysPANews reported on December 20 that, according to official data, in the 7 days ending December 18, Circle issued approximately 4.7 billion USDC and redeemed about 6 billion USDC, resulting in a decrease in circulation of around 1.3 billion tokens. The total USDC in circulation is 77.2 billion tokens, with reserves of about 77.5 billion US dollars. Of these reserves, overnight reverse repo agreements in US Treasuries account for approximately 53.3 billion US dollars; US Treasuries with maturities of less than 3 months account for about 14.3 billion US dollars; deposits at systemically important institutions are around 9.2 billion US dollars; and other bank deposits are about 700 million US dollars.

News