Bitget pre-market futures trading tutorial

What are pre-market perpetual futures?

Pre-market perpetual futures are contracts offered on underlying assets that are not yet listed on spot markets (both DEXs and CEXs). Apart from how the index price is calculated, they function the same as standard perpetual futures.

How to trade pre-market futures?

This tutorial covers pre-market futures trading on the Bitget platform. Assume that you have signed up for your account, completed identity verification, and deposited USDT (or other supported margin). Ensure you have logged in to the Bitget App or website.

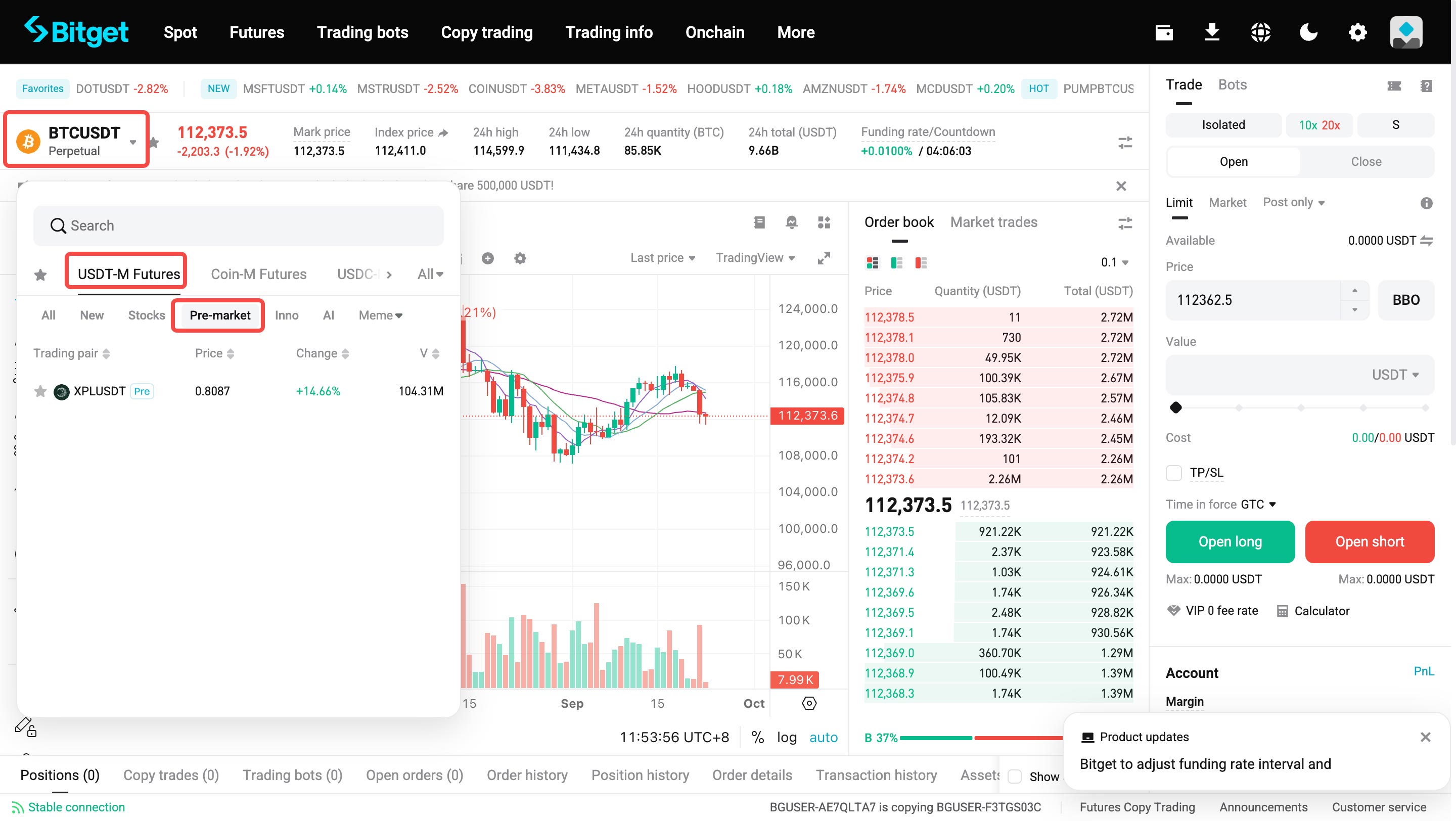

Step 1: Go to pre-market futures trading section

1. Open the Bitget App or visit the website.

2. Select Futures.

3. Select USDT-M Futures.

4. Select Pre-market. (Trading pairs are typically marked with "Pre" at the end.)

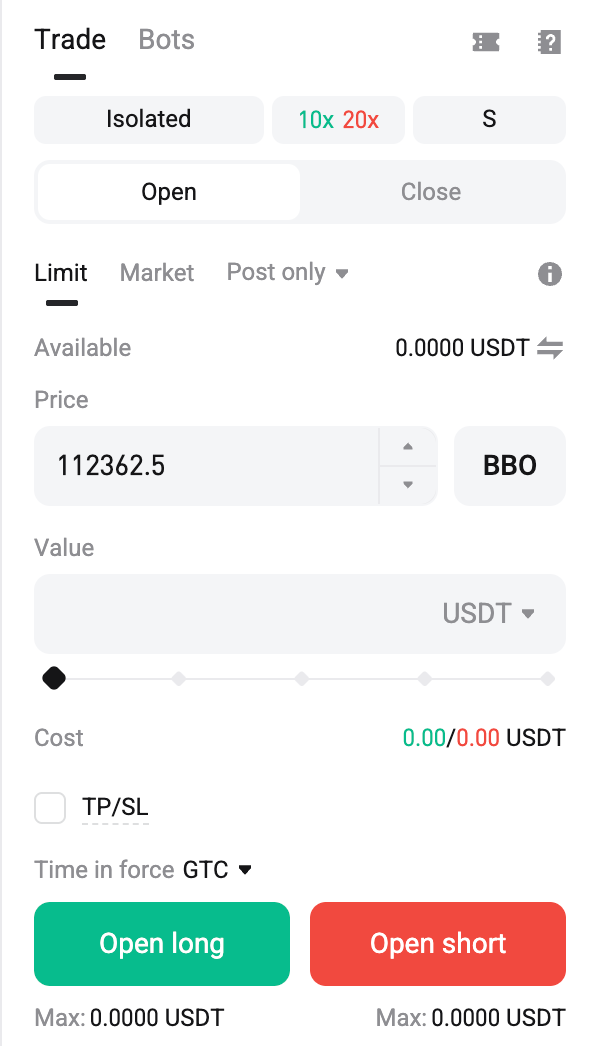

Step 2: Interface and settings

• Order book: View the depth of buy/sell orders. Note that the depth of pre-market futures is relatively shallow.

• Candlestick chart: Analyze price trends, but keep in mind that the index is based on a fitting algorithm and may differ from your expectations.

• Leverage settings: The leverage for pre-market futures is relatively low (such as 5–20x). We recommend starting with the minimum leverage.

• Margin mode: Select isolated or cross margin mode. We recommend starting with isolated margin mode to manage risk.

Step 3: Open a position

1. Select direction: Long (buy) or short (sell).

2. Enter amount: We recommend starting with a small amount to avoid large orders affecting liquidity.

3. Set price type: Market order (immediate execution) or limit order (specified price).

4. Confirm leverage and margin: Calculate the potential liquidation price and ensure you have sufficient buffer.

5. Click Buy/Open Long or Sell/Open Short to submit your order.

Step 4: Managing and closing positions

• In Positions, you can view your current positions, including unrealized PnL.

• Set TP/SL: Highly recommended to manage market volatility.

• Close a position: Select either Market Close or Limit Close to release your margin.

• Monitor funding rate: The funding rate for pre-market futures is calculated based on the depth-weighted price.

Step 5: Important notes

• Platform announcements: Keep an eye out for announcements, as there may be price adjustments when switching to standard futures.

• Risk control: Use moderate leverage, diversify your positions, and trade rationally.

• If you have any questions, contact Bitget customer service or view the Help Center.

Share