How to Trade Bitget Pre-Market Futures?

[Estimated reading time: 3 mins]

Pre-market perpetual futures are contracts offered on underlying assets that are not yet listed on spot markets (both DEXs and CEXs). Apart from how the index price is calculated, they function the same as standard perpetual futures.

How to trade pre-market futures

This tutorial covers pre-market futures trading on the Bitget platform. Assume that you have signed up for your account, completed identity verification, and deposited USDT (or other supported margin). Ensure you have logged in to the Bitget App or website.

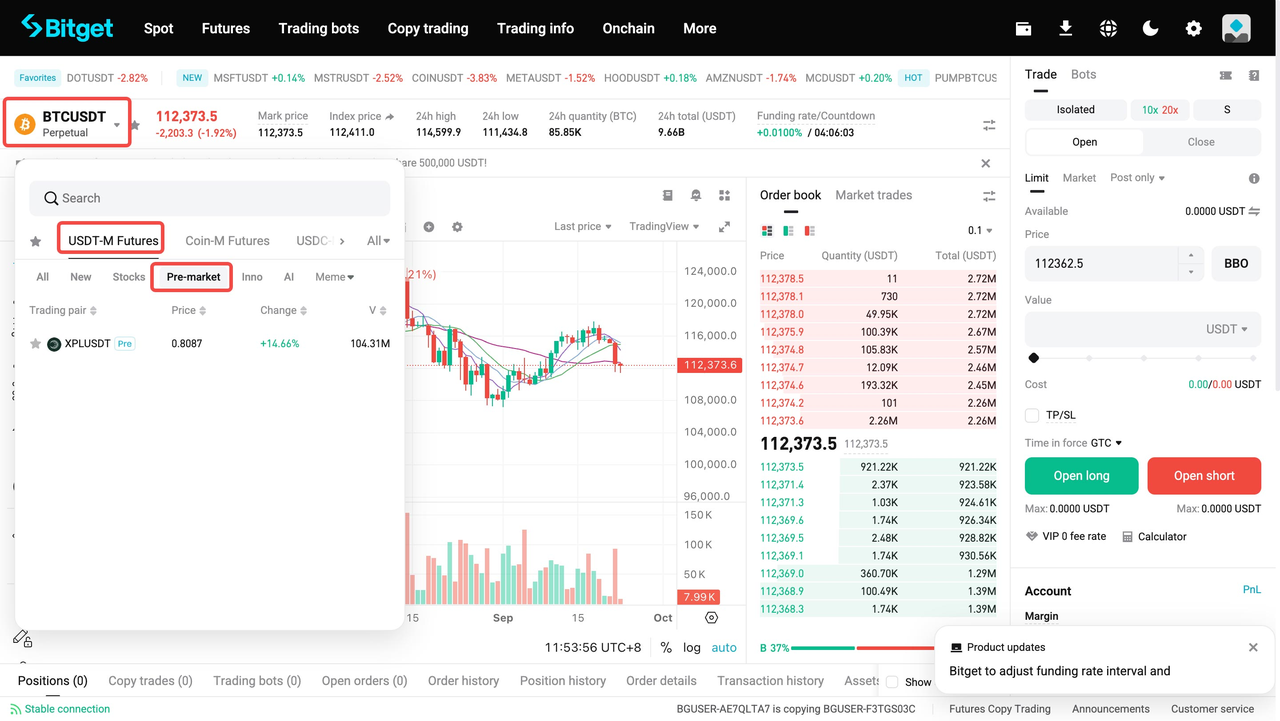

Step 1: Go to pre-market futures trading section

1. Open the Bitget App or visit the website.

2. Select Futures.

3. Select USDT-M Futures.

4. Select Pre-market. (Trading pairs are typically marked with "Pre" at the end.)

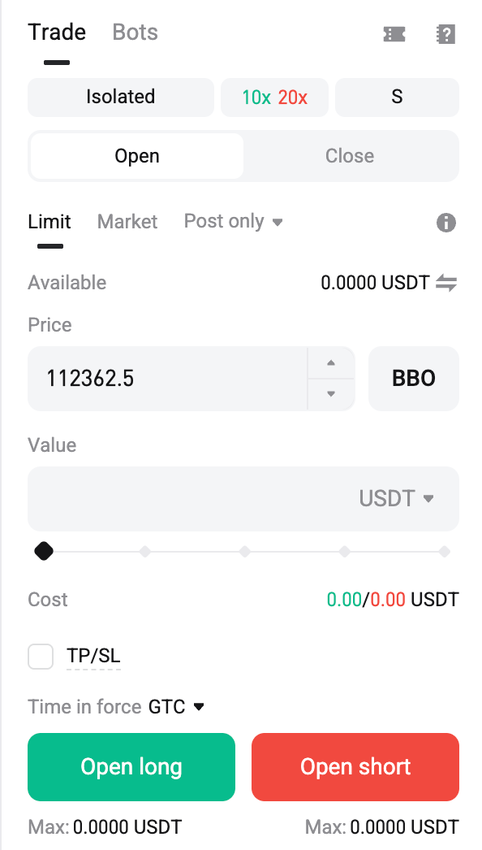

Step 2: Interface and settings

-

Order book: View the depth of buy/sell orders. Note that the depth of pre-market futures is relatively shallow.

-

Candlestick chart: Analyze price trends, but keep in mind that the index is based on a fitting algorithm and may differ from your expectations.

-

Leverage settings: The leverage for pre-market futures is relatively low (such as 5–20x). We recommend starting with the minimum leverage.

-

Margin mode: Select isolated or cross margin mode. We recommend starting with isolated margin mode to manage risk.

Step 3: Open a position

1. Select direction: Long (buy) or short (sell).

2. Enter amount: We recommend starting with a small amount to avoid large orders affecting liquidity.

3. Set price type: Market order (immediate execution) or limit order (specified price).

4. Confirm leverage and margin: Calculate the potential liquidation price and ensure you have sufficient buffer.

5. Click Buy/Open Long or Sell/Open Short to submit your order.

Step 4: Managing and closing positions

-

In Positions, you can view your current positions, including unrealized PnL.

-

Set TP/SL: Highly recommended to manage market volatility.

-

Close a position: Select either Market Close or Limit Close to release your margin.

-

Monitor funding rate: The funding rate for pre-market futures is calculated based on the depth-weighted price.

Important notes

-

Platform announcements: Stay updated on Bitget announcements, as the transition from pre-market to standard perpetual futures may involve price adjustments.

-

Leverage and risk control: Pre-market futures have higher volatility and lower liquidity than standard futures. Use moderate leverage, diversify your positions, and trade rationally.

-

Price monitoring: The index price is derived from a synthetic algorithm and may differ from expectations. Always monitor price trends and funding rates.

-

Education and testing: Familiarize yourself with the platform interface and practice with small trades before committing larger amounts.

FAQs

1. How do I access pre-market futures on Bitget?

Log in to the Bitget App or website, go to the Futures section, select USDT-M Futures, and choose Pre-market trading pairs (marked with "Pre").

2. What leverage and margin modes are available for pre-market futures?

Leverage is generally lower (5×–20×). Traders can choose isolated or cross margin modes to manage risk.

3. How is the index price for pre-market futures determined?

The index price uses a synthetic algorithm based on the order book and previous index prices, rather than a spot-weighted price, because the underlying asset is not yet listed on spot markets.

4. How should I manage positions in pre-market futures?

Positions can be monitored for unrealized PnL, and traders can set take-profit (TP) and stop-loss (SL) levels. Funding rates are calculated based on the depth-weighted price and should be checked regularly.

5. Why is liquidity lower in pre-market perpetual futures?

Since the underlying asset does not have a spot market, liquidity comes only from the derivatives market, resulting in shallower order books and less frequent execution.

6. What risks should I be aware of when trading pre-market futures?

Pre-market futures typically have higher price volatility and lower liquidity than standard futures. This can increase slippage and potential liquidation risk.

7. Will trading be disrupted when pre-market futures transition to standard futures?

The transition is designed to be seamless. The synthetic index price will be replaced with a spot-weighted index price, and users generally will not experience interruptions.

Disclaimer and Risk Warning

All trading tutorials provided by Bitget are for educational purposes only and should not be considered financial advice. The strategies and examples shared are for illustrative purposes and may not reflect actual market conditions. Cryptocurrency trading involves significant risks, including the potential loss of your funds. Past performance does not guarantee future results. Always conduct thorough research, understand the risks involved. Bitget is not responsible for any trading decisions made by users.

Join Bitget, the World's Leading Crypto Exchange and Web3 Company

Share