News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Quick Take Summary is AI generated, newsroom reviewed. Brad Garlinghouse urged an end to monthly paychecks in favor of XRP-powered instant payouts. XRPL processes payments in 3–5 seconds at near-zero cost, supporting second-by-second transfers. Ripple’s ODL handled $1 billion in 2025, proving large-scale adoption. Ripple’s ODL handled $1 billion in 2025, proving large-scale adoption. Daily, hourly, and micro-payouts are now technically possible with XRP. cThe 2023 SEC ruling cleared XRP’s retail sales, boo

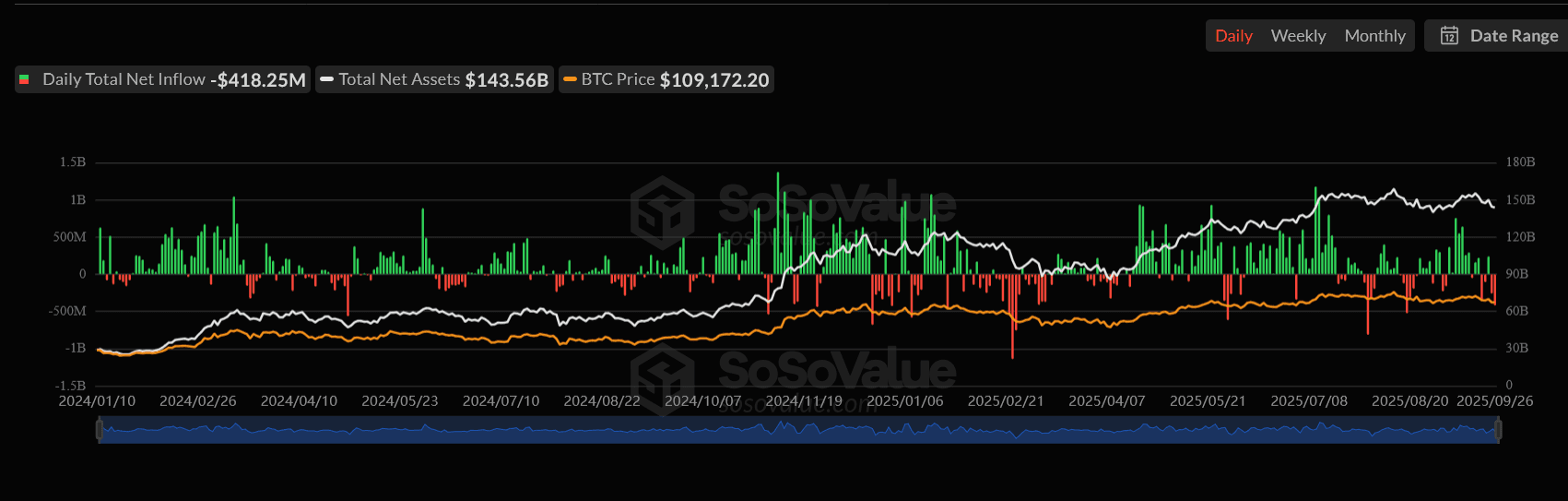

Record outflows have raised significant doubts about institutional confidence in Bitcoin and Ethereum.

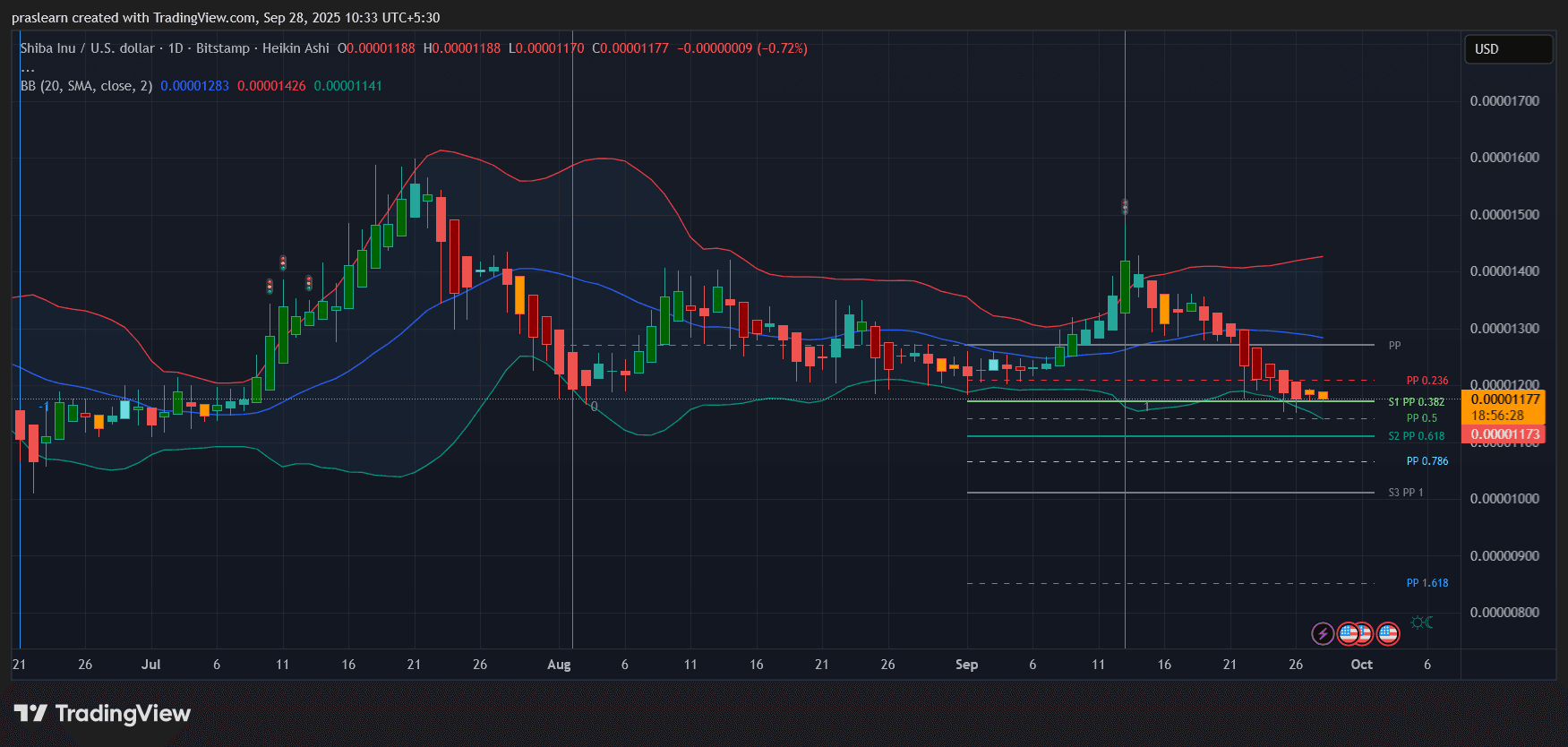

Declining savings, rising inflation, and bearish charts all point to one issue: SHIB's problems may have only just begun.

- 15:50Analysis: The bull-bear dividing point was already experienced in June 2025, and a long-term stable upward trend may be on the horizonJinse Finance reported that analyst PlanB stated, as you know, I believe the bitcoin bull market is not over yet and will continue. This is likely to be a long-term and steady upward trend, without FOMO or crashes. We already experienced the bull-bear dividing point (the yellow dot in the chart) in June 2025, similar to October 2020, February 2017, and January 2013.

- 15:44Delin Holdings plans to acquire Bitcoin mining machines through the issuance of convertible bonds and warrants, and has signed a letter of intent with BMChainCatcher news, Delin Holdings (01709.HK) announced that the company has entered into a formal agreement with the seller, Evergreen Wealth, regarding bitcoin mining machines. According to the agreement, the company has conditionally agreed to acquire, and the seller has conditionally agreed to sell, bitcoin mining machines (2,200 units of S21XP HYD bitcoin miners), with a total consideration of 21.8526 million US dollars. The consideration for the bitcoin mining machines will be paid through the issuance of the following: convertible bonds with a principal amount of 21.8526 million US dollars; 40 million warrants; and, upon achieving profit conditions, the company will issue 13.4425 million profit shares. At the same time, legally binding letters of intent have been signed with BM1 and BM2 to purchase an additional 1,900 units of S21e Hyd. and 1,095 units of S21e XP Hyd., with total considerations of 8.349 million US dollars and 10.8766 million US dollars, respectively. The above transactions are subject to authorization by a special shareholders' meeting and approval by the Stock Exchange.

- 15:28Peter Schiff: If Strategy had invested in gold instead of BTC, it might have achieved safer paper profitsChainCatcher News, Economist Peter Schiff posted on X, pointing out that the bitcoin purchased by Michael Saylor for Strategy has gained about 47%. If he had bought gold and invested the same amount at the same time, the book profit would be about 30%, so the difference between the two is not significant. However, the difference is that Michael Saylor could easily sell $61.5 billion worth of gold without affecting the overall gold market price, thus realizing actual profits. But if he tries to sell $69.5 billion worth of bitcoin, the market would collapse, because such a large-scale transaction could trigger a chain reaction in the community and cause massive liquidations, making all of Strategy's book profits disappear and resulting in huge losses.