Bitcoin price is trading at $63,482 after a 6.34% intraday drop, but strong long-term support near $30,000–$40,000 and Power Law signals indicate the current bull cycle likely has more upside. Monitor volume and breakout confirmation for the next leg higher.

-

Bitcoin holds key long-term support near $30k–$40k, signaling continued bullish structure.

-

Halving cycles historically precede major rallies; the 2020 halving led to the 2021 peak.

-

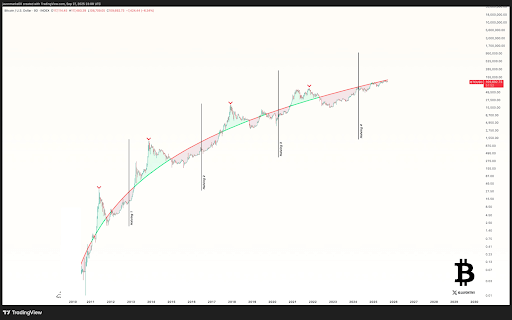

Javon Marks’ Power Law chart and rising volume during breakouts support further upside momentum.

Bitcoin price $63,482 — Power Law and long-term support point to upside; read analyst-backed analysis and key takeaways. Follow levels and volume for confirmation.

Bitcoin trades at $63,482 after a sharp dip, yet strong support levels and Power Law signals point to continued upside momentum.

What is the current Bitcoin price outlook?

Bitcoin price is at $63,482 following a 6.34% intraday pullback, but the broader outlook remains constructive. Long-term support in the $30,000–$40,000 band, historical halving cycles, and Power Law analysis suggest the bull cycle may continue unless structural support is breached.

How does the Power Law signal influence Bitcoin’s trend?

Power Law analysis, highlighted by analyst Javon Marks, tracks median thresholds across cycles to identify regime shifts. Marks noted that “Bitcoin’s bull cycles only ended AFTER prices crossed above the Power Law’s median threshold,” implying current readings indicate unfinished upside. The chart spans 2010–2025 on a logarithmic scale.

Why do halving cycles matter for Bitcoin?

Halvings reduce new supply and historically precede sustained rallies. The 2012, 2016, and 2020 halvings each preceded major price advances within 12–18 months. Institutional adoption and corporate treasury allocations amplified the 2020–2021 cycle, driving a peak near $69,000.

Historical cycle comparison

| 2013 | $1,000 | ~80–85% |

| 2017 | $19,700 | ~85% |

| 2021 | $69,000 | ~65–70% |

What does current market structure reveal?

Price is well above prior cycle highs and holding long-term support near $30k–$40k. Trend lines and volume confirm that breakouts and corrective phases are accompanied by meaningful participation. Volume spikes during breakouts suggest conviction from larger market participants.

Source: Javon Marks

Source: Javon Marks

What are the near-term risks?

Near-term risks include short-term volatility, rapid intraday drawdowns (the latest session fell over $4,200), and broader macro shifts that could pressure risk assets. A decisive break below the $30k support band would alter the bullish thesis.

Frequently Asked Questions

Is the recent pullback a trend reversal?

The 6.34% pullback is a normal correction within an ongoing uptrend; current technical structure and long-term support levels indicate resilience rather than reversal, provided $30k–$40k holds.

How should investors confirm the next leg higher?

Watch for rising volume on breakouts above key resistance and sustained closes above recent highs. Confirmations include higher highs on daily charts and Power Law median remaining supportive.

How long do halving-driven rallies typically last?

Historically, major post-halving rallies have unfolded over 12–18 months. Each cycle varies due to market structure, participation, and macro factors; past performance is not a guarantee of future results.

Key Takeaways

- Support intact: Bitcoin is holding long-term support near $30k–$40k, indicating structural resilience.

- Power Law confirms momentum: Javon Marks’ Power Law signals suggest the bull cycle may not be over.

- Confirm with volume: Higher volume during breakouts provides the clearest sign of sustained upside.

Conclusion

Bitcoin’s current placement at $63,482 after a sharp pullback highlights normal volatility within a constructive long-term trend. Bitcoin price, halving history, and Power Law thresholds collectively point to continued upside potential if core support holds. Monitor volume and breakout confirmation for the next decisive move.