News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Quick Take Summary is AI generated, newsroom reviewed. The Ethereum Fusaka upgrade has entered its final testnet phase. It introduces a gas cap per transaction to improve block efficiency. The upgrade prepares Ethereum for parallel transaction processing. Mainnet launch is planned for December 3, 2025, marking a key milestone.References UPDATE: Ethereum's Fusaka upgrade enters final testnet phase ahead of Dec. 3 mainnet rollout.

Collaboration Aims to Develop Multi-Stablecoin Liquidity-Powered Global Settlement Layer

Near Protocol Validators Require 80% Approval for Proposed Annual Inflation Reduction, with Decision Expected by October 2025

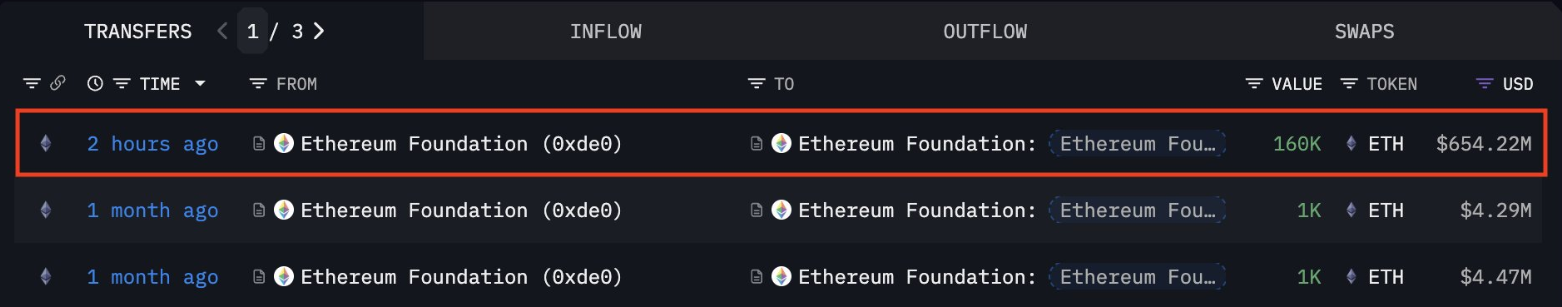

The overall crypto market is experiencing a decline, with significant price drops in bitcoin and ethereum. Altcoins are leading the downward trend, and the total liquidation amount across the network is substantial. Large investors are adjusting their positions to cope with the volatility. Summary generated by Mars AI This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

DraftKings has acquired the CFTC-licensed Railbird exchange, entering the prediction market sector to counter competitive threats, resulting in an 8.3% increase in its stock price. This move expands its business into states where traditional gambling is prohibited, but also faces regulatory challenges. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

- 08:52Senator Lummis urges US regulators to promptly implement open banking rules to prevent large banks from blocking public access to crypto platforms.ChainCatcher news, U.S. Senator Cynthia Lummis (Wyoming, Republican) sent a letter to Consumer Financial Protection Bureau (CFPB) Acting Director Russ Vought, strongly supporting the implementation of Open Banking rules and urging regulators to "finalize the rules as soon as possible" to prevent large banks from blocking public access to digital asset platforms and other financial services for political reasons. In the letter, Lummis pointed out that large banks abuse their financial gateway status to restrict access to financial services for industries and individuals they disagree with, including digital asset companies, firearms manufacturers, religious institutions, and even the President himself. She emphasized: "We cannot allow opponents of crypto assets to rewrite the rules, stifle innovation, and drive up costs. This will only force entrepreneurs to go overseas and weaken the United States' leadership in the fintech sector." The Open Banking framework was first proposed by the Biden administration in 2022 and finalized in 2024, aiming to allow users to securely share financial data with third-party applications via APIs, thereby connecting bank accounts with digital asset platforms. This rule is regarded as a key infrastructure for promoting crypto adoption. Lummis stated, "Without Open Banking rules, it is impossible to securely connect bank accounts to crypto exchanges. Especially when some bank executives, such as JPMorgan CEO Jamie Dimon, openly oppose digital assets, users need even more protection." On the same day, several crypto industry organizations, including the Blockchain Association and the Crypto Council for Innovation, also sent letters to the CFPB, calling on regulators to clarify that "Americans own their financial data, not big banks."

- 08:52Institutions allocated 1 million SOL in investments have sold HYPE and bought SOL for three consecutive daysAccording to ChainCatcher, as monitored by crypto analyst Ember (@EmberCN), an institutional address that received an allocation of 1 million SOL has sold HYPE for the third consecutive day and cycled the proceeds back to Solana to purchase SOL. In the past 4 hours, this address sold 675,000 HYPE, exchanged for 23.44 million USDC, bridged the funds to Solana, and bought 126,900 SOL. Since three days ago, the institution has cumulatively sold 1.817 million HYPE, with a total transaction amount of 65.43 million USDC, and an average selling price of $36; all proceeds have been used to repurchase 350,000 SOL at an average purchase price of $186.5. Currently, the address still holds 743,000 HYPE (approximately $26.12 million) and is expected to continue selling HYPE to exchange for SOL in the future.

- 08:28BTC Long and Short Positions in Stalemate, Bulls Dominate Among Newly Opened Million-Dollar PositionsAccording to ChainCatcher, monitored by HyperInsight, in the past 4 hours, the price of BTC has continued to fluctuate narrowly between $107,500 and $108,600, with the market entering a short-term consolidation phase. During this period, a total of 11 BTC whales opened new positions exceeding $1 million, of which 10 chose to establish long positions and only 1 opened a short position, resulting in a long-short ratio as high as 10:1. From the active trading data of major exchanges, the ratio of active buy and sell orders in the past four hours shows that long positions accounted for 51.6%: one exchange's long positions accounted for 51.27%; another exchange's long positions accounted for 52.31%; and another exchange's long positions accounted for 51.82%. ChainCatcher reminds investors that the recent volatility in the cryptocurrency market has increased significantly, and investors should pay attention to risk control.