"I feel like I'm a useful fool for the Ethereum Foundation." On October 19, 2025, an open letter written a year and a half earlier was published on Twitter, and this sentence instantly ignited discussions within the crypto community.

The author of the letter is not some fringe troll, but Péter Szilágyi—the former lead maintainer of the Geth client, which once ran over 60% of Ethereum nodes, and a core developer who worked in this ecosystem for a full nine years.

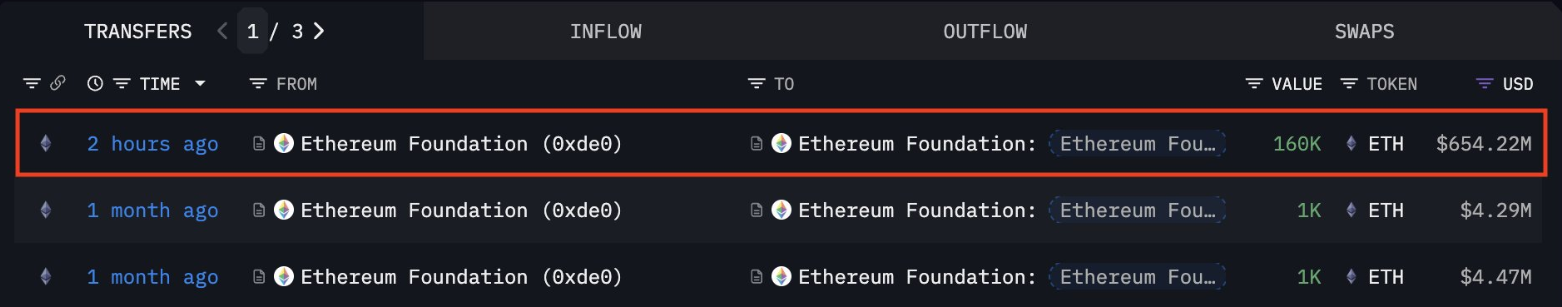

Meanwhile, blockchain data shows that the Ethereum Foundation had just completed a large transfer of ETH worth $654 million, moving 160,000 ETH to a wallet previously used for sales.

The collision of ideals and reality, the intertwining of beliefs and interests, and the concentration of power under the banner of decentralization—all these constitute the profound crisis currently facing the Ethereum Foundation.

01 Flashpoint: The "Resignation Manifesto" Delayed by 18 Months

This letter, written in May 2024, was initially circulated only within the Ethereum Foundation leadership, but was suddenly made public in October 2025, a year and a half later.

The timing is intriguing—coinciding with the Ethereum Foundation coming under scrutiny for large-scale asset transfers.

In the letter, Péter Szilágyi candidly admits that he has felt confused and in pain about Ethereum and his role at the Foundation for many years. He describes himself as a "useful fool," exposing the huge gap between the Foundation's public statements and its internal actions.

Even more shocking, this core developer's total income during his first six years (2015-2021) working on Ethereum—when ETH's market cap went from zero to $450 billion—was only $625,000, with no equity or incentives.

02 The Idealist's Dilemma: The "Leadership Role" Being Used

Szilágyi painfully describes how he was given a "perceived leadership role" within the Foundation. Whenever internal disputes arose in Ethereum, the Foundation would have him, the "troublemaker," stand up in opposition to showcase the Foundation's "democracy" and "inclusiveness."

He wrote: "I can choose to remain silent and watch Ethereum's values be trampled; or speak up, but gradually destroy my own reputation. Either way, the result is the same—Geth gets marginalized, and I get excluded."

This lose-lose dilemma reveals a harsh reality: behind the ideal of decentralization lies a subtle power manipulation by the Ethereum Foundation.

In June 2025, Péter Szilágyi finally left the Ethereum Foundation. According to reports, he rejected the Foundation's $5 million offer to spin Geth off into a private company, choosing instead to leave completely rather than turn his ideals into a business.

03 Systemic Dilemma: Low Salary Culture and Protocol Capture

Péter Szilágyi's experience is not unique. He revealed that almost all of the Foundation's early employees have already left, "because that was the only reasonable way to get compensation commensurate with the value they created."

He sarcastically quoted Vitalik: "If no one complains about their salary being too low, then the salary is too high."

The low salary culture has had serious consequences. Those who truly care about protocol development, due to meager internal income, are forced to seek external sources of income, resulting in various conflicts of interest.

Szilágyi pointed out: "The Foundation systematically suppresses the compensation of those who truly care about the protocol, forcing the most trustworthy people to seek compensation elsewhere." He bluntly stated that the recent advisory positions of Justin and Dankrad are the inevitable result of this policy—despite obvious conflicts of interest, their acceptance of funding is understandable in itself.

04 Power Structure: Vitalik and His "Inner Circle"

In the letter, Szilágyi sharply analyzes Ethereum's power structure. He expresses respect for Vitalik himself but points out an inescapable fact:

"Whether Vitalik wants to or not, he unilaterally decides the direction of Ethereum. Wherever Vitalik's attention goes, resources follow; whatever project he invests in, succeeds; whichever technical path he endorses, becomes mainstream."

More crucially, an 'elite ruling circle' of 5-10 people has formed around Vitalik. These people invest in each other, serve as each other's advisors, and control the allocation of resources in the ecosystem.

New projects no longer do public fundraising but go directly to these 5-10 people. Getting their investment is equivalent to getting a ticket to success.

05 Chain Reaction: Collective Voices from Ecosystem Leaders

Less than 24 hours after Péter Szilágyi's letter was made public, Polygon founder Sandeep Nailwal stepped forward to express his own frustration.

As one of Ethereum's largest Layer 2 projects, Polygon has made huge contributions to Ethereum's scalability. But Sandeep complained that the Ethereum community has never truly accepted Polygon.

He pointed out a strange double standard: "When Polymarket succeeds, the media calls it an 'Ethereum victory.' But Polygon itself? Not considered Ethereum."

Even more shocking, Sandeep revealed that if Polygon announced itself as an independent L1 instead of Ethereum's L2, its valuation could immediately multiply by 2-5 times. But out of moral loyalty to Ethereum, he didn't do so—even though this loyalty may have cost him billions of dollars in valuation.

Also speaking out was DeFi legend Andre Cronje. He asked in confusion: "If the money didn't go to core builder Peter and Geth, nor to the loudest L2 supporter Sandeep and Polygon, then where did the money go?"

06 Foundation Transfer Suspicion: Timing and Motivation of Huge Asset Transfers

While the community was still digesting these internal criticisms, blockchain data brought new developments—the Ethereum Foundation transferred 160,000 ETH worth $654 million to a wallet labeled by Arkham Intelligence as one previously used for sales.

The Foundation's co-executive director Hsiao-Wei Wang quickly explained on social media that this transfer was part of a planned wallet migration.

However, such an explanation seemed weak to the community. After all, this is not the first time the Foundation has sparked controversy over large transfers:

-

In July 2024, the Ethereum Foundation transferred 3,631 ETH worth $12.5 million to the Kraken exchange

-

In October 2024, another Foundation-linked wallet transferred 1,250 ETH worth about $3.03 million to Bitstamp

-

In 2025, the Foundation executed multiple ETH sales via CoW Swap, totaling about 36,000 ETH

07 The Foundation's Crisis PR: The Gap Between Transparency Promises and Actual Actions

Facing growing doubts, the Ethereum Foundation had previously promised to improve financial transparency. In September 2024, the Foundation announced it was preparing to release a detailed financial report to address community concerns about its spending behavior.

Ethereum researcher Justin Drake revealed in an AMA that the Foundation's main wallet holds about $650 million, enough to fund about ten years of operations.

Vitalik Buterin himself also explained the Foundation's budget strategy on Reddit, roughly spending 15% of remaining funds each year. This approach means "the EF will exist forever, but as part of the ecosystem, it will become smaller and smaller over time."

However, these efforts have not fully resolved the trust crisis. Especially after Szilágyi's letter was made public, community doubts about the Foundation's use of funds became even more intense.

08 Structural Contradiction: The Ideal of Decentralization vs. the Reality of Power Concentration

The Ethereum Foundation faces not only a trust crisis but also a structural contradiction between ideals and power.

Szilágyi lamented in his letter: "We wanted to build a world where everyone is equal, but now the most successful projects are all supported by the same 5-10 people, and behind them are the same few VCs. All the power is concentrated in Vitalik's circle of friends."

He pointed out that the direction of Ethereum's development ultimately depends on your relationship with Vitalik. "It's actually very simple: people are always more tolerant of friends than outsiders—so, to succeed, be friends with the 'kingmakers.'"

As for himself, Szilágyi said: "I chose to always keep my distance, because I find it disgusting to build friendships for monetary gain."

09 The Struggle Between Power and Ideals: Ethereum at a Crossroads of Fate

In June 2025, the Ethereum Foundation announced layoffs and a restructuring of its core development team, focusing on scaling the protocol, increasing blobspace, and improving the Ethereum user experience.

The Foundation also shifted to a funding strategy driven by DeFi lending yields, rather than its traditional method of selling ETH on the open market to fund operations.

But whether these reforms can resolve the systemic trust crisis remains an open question.

At the end of his letter, Péter Szilágyi reveals deep exhaustion and confusion: "I feel that in Ethereum's grand blueprint, Geth is seen as a problem, and I am at the center of that problem."

Over the years, he has turned down countless high-paying offers because he believed in Ethereum's ideals. But now the whole ecosystem is saying "it's just business." He cannot accept this mentality, but also sees no way out. In the end, Péter Szilágyi completely left the Ethereum Foundation in June 2025.

This choice is highly symbolic: in the struggle between technological idealism and capital logic, yet another core builder chose to stick to his ideals, even at the cost of leaving a project he had devoted nine years of his life to.

On one side is the disillusionment of core developers, on the other is the Foundation's massive capital operations—in this collision between idealism and capitalist reality, we have to ask: where exactly did Ethereum's original intention get lost?