News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Quick Take Summary is AI generated, newsroom reviewed. Brad Garlinghouse urged an end to monthly paychecks in favor of XRP-powered instant payouts. XRPL processes payments in 3–5 seconds at near-zero cost, supporting second-by-second transfers. Ripple’s ODL handled $1 billion in 2025, proving large-scale adoption. Ripple’s ODL handled $1 billion in 2025, proving large-scale adoption. Daily, hourly, and micro-payouts are now technically possible with XRP. cThe 2023 SEC ruling cleared XRP’s retail sales, boo

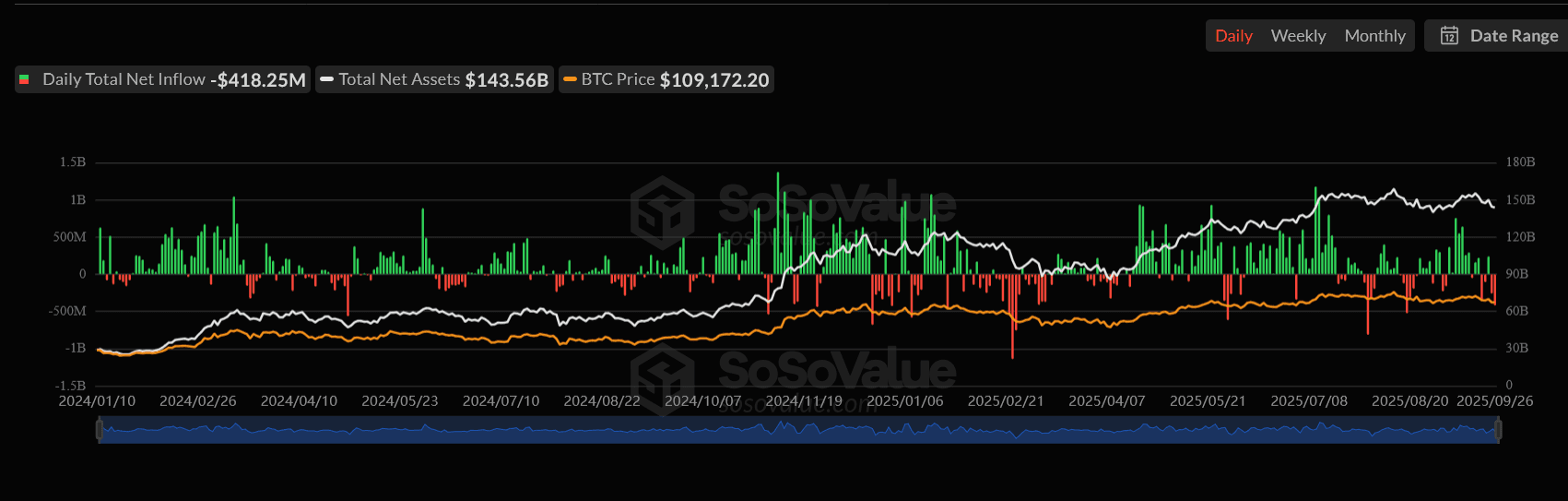

Record outflows have raised significant doubts about institutional confidence in Bitcoin and Ethereum.

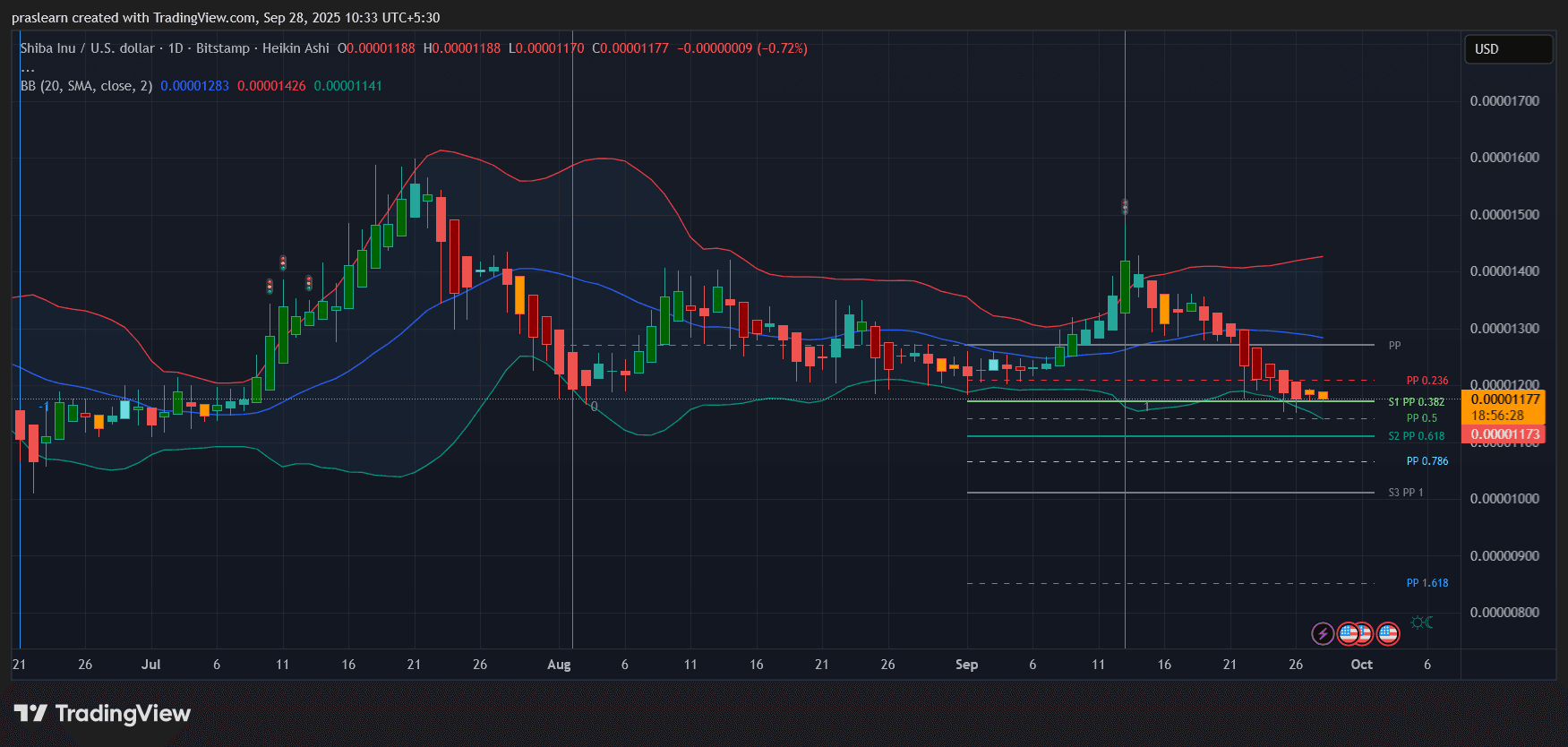

Declining savings, rising inflation, and bearish charts all point to one issue: SHIB's problems may have only just begun.

- 16:47HyperLiquid has deployed and distributed Hypurr NFTOn September 29, HyperLiquid officially announced that the Hypurr NFT collection has been deployed and distributed on HyperEVM, with a total of 4,600 NFTs. Of these, 4,313 NFTs were allocated to Genesis event participants, 144 were allocated to the Hyper Foundation, and 143 were distributed to core contributors, including Hyperliquid Labs, NFT artists, and other contributors. Ownership and use of Hypurr NFTs are subject to the Hypurr NFT terms and license. Participants who choose to receive Hypurr NFTs in the Genesis event will be screened according to the Foundation's risk assessment program. In addition, HyperLiquid conducted cluster analysis to prevent Sybil attacks and limit the total number of NFTs each user can receive. The goal of the Hypurr NFT collection is to share a commemorative token with users who believed in and contributed to the development of Hyperliquid in its early days. As depicted by Hypurr, each NFT is unique, capturing the different emotions, hobbies, tastes, and quirks of the Hyperliquid community.

- 16:11Data: $168 million liquidated across the network in the past 24 hours, mainly long positionsChainCatcher News: In the past 24 hours, the total liquidation amount in the cryptocurrency market reached 168 million US dollars, with long positions liquidated for 111 million US dollars and short positions liquidated for 57.2838 million US dollars. A total of 93,542 people were liquidated globally, with the largest single liquidation occurring on Hyperliquid - ASTER-USD, valued at 1.5104 million US dollars.

- 16:11Data: If BTC breaks $114,220, the cumulative short liquidation intensity on major CEXs will reach $969 millions.According to ChainCatcher, citing data from Coinglass, if BTC surpasses $114,220, the cumulative short liquidation intensity on major CEXs will reach $969 millions. Conversely, if BTC falls below $104,841, the cumulative long liquidation intensity on major CEXs will reach $969 millions.