News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

![[October 11 Insider Whale] Twelve consecutive wins harvest 12.6 million, profiting from both long and short positions and leading market followers](https://img.bgstatic.com/multiLang/image/social/41e5d1ea953744c460d0cf212fd2c61b1761294785118.png)

A single address is suspected to have contributed over 60%. Will such "old-school" front-running still appear in 2025?

The role of cryptocurrencies in Argentina has fundamentally changed: from a novelty that once sparked curiosity and experimentation among the public, including Milei himself, to a financial tool used by citizens to protect their savings.

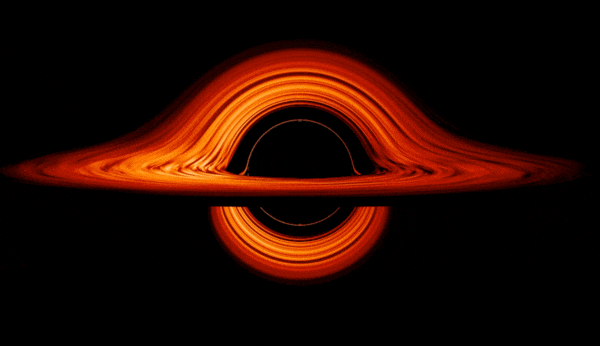

The harsh truth of the market may be that what we are creating is a liquidity black hole, not a flywheel.

The trend is set, but challenges remain.

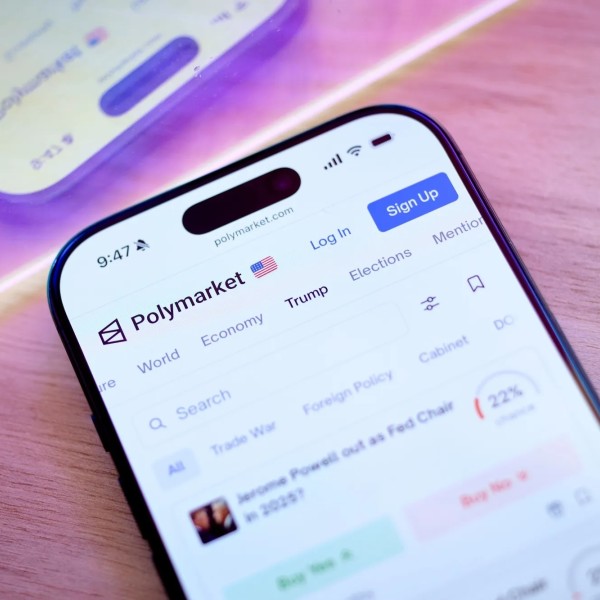

An in-depth analysis of the underlying logic and core value of prediction markets, along with a preliminary assessment of their key challenges and future development directions.

Is the Web3 phone truly an innovative product with real value, or is it merely a "pseudo-demand" that can only survive through external incentives?

- 09:21APRO announces the launch of its native token ATChainCatcher reported that APRO has announced the launch of its native token AT, which will be used to support business development, ecosystem expansion, incentive programs, and long-term sustainable growth. The total supply of the token is capped at 1 billion. According to the official token allocation plan: ecosystem 25%, staking 20%, investors 20%, public distribution 15%, team 10%, foundation 5%, liquidity 3%, and operational activities 2%. The official statement noted that AT will serve as the core driving force of the APRO ecosystem, promoting overall project growth and the improvement of the governance system.

- 09:21Barclays: Fed Rate Cut Expectations Unlikely to Change, Optimistic Economic Narrative ContinuesAccording to ChainCatcher, citing Golden Ten Data, Julian Lafargue, Chief Market Strategist at Barclays Private Bank, pointed out that unless there is a significant upside surprise in US inflation data, the market is unlikely to change its expectations for further rate cuts by the Federal Reserve. According to tracking data from the Atlanta Fed, US GDP growth in the third quarter is close to 4%, indicating that the economy remains resilient. Stephanie Link, Chief Investment Strategist at Hightower Advisors, stated that if CPI data comes in higher than expected, market volatility will intensify, but this will be seen as a buying opportunity.

- 09:21Bloomberg: JPMorgan to Allow Bitcoin and Ethereum as CollateralChainCatcher reported that JPMorgan plans to allow clients to use bitcoin and ethereum as collateral assets in its crypto business expansion. This move marks a significant step for the bank in integrating traditional finance with crypto assets.