Stable deposit capped at 5 minutes—are retail investors becoming part of the project's "Play"?

A single address is suspected to have contributed over 60%. Will such "old-school" front-running still appear in 2025?

A single address appears to have contributed over 60%, and such an "old-school" front-running can still occur in 2025.

Written by: ChandlerZ, Foresight News

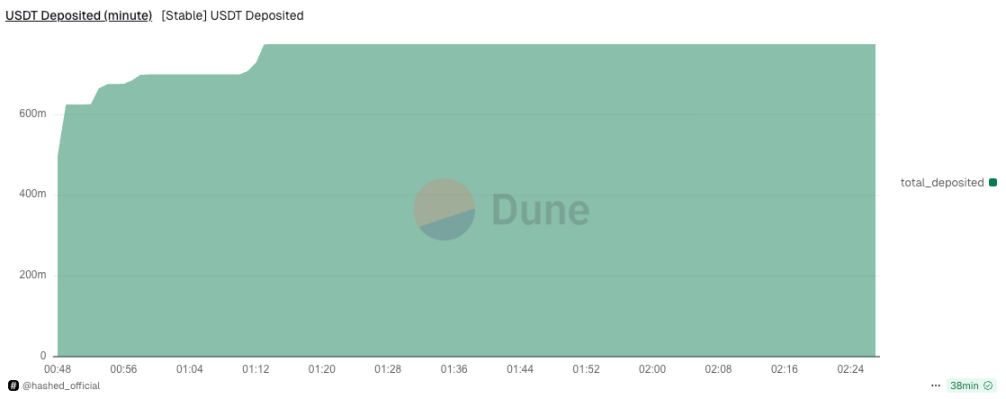

On October 24, 2025, Stable, a stablecoin public chain launched by USDT parent company Tether and Bitfinex, announced the start of its pre-deposit points campaign. The official announcement on social media at 9:10 (UTC+8) stated that Phase 1 had a cap of 825 million USDT. However, on-chain data showed a completely different pace: at 8:48 (UTC+8), before the announcement, the contract address had already seen large inflows, and within just 5 minutes (UTC+8), the quota was fully claimed.

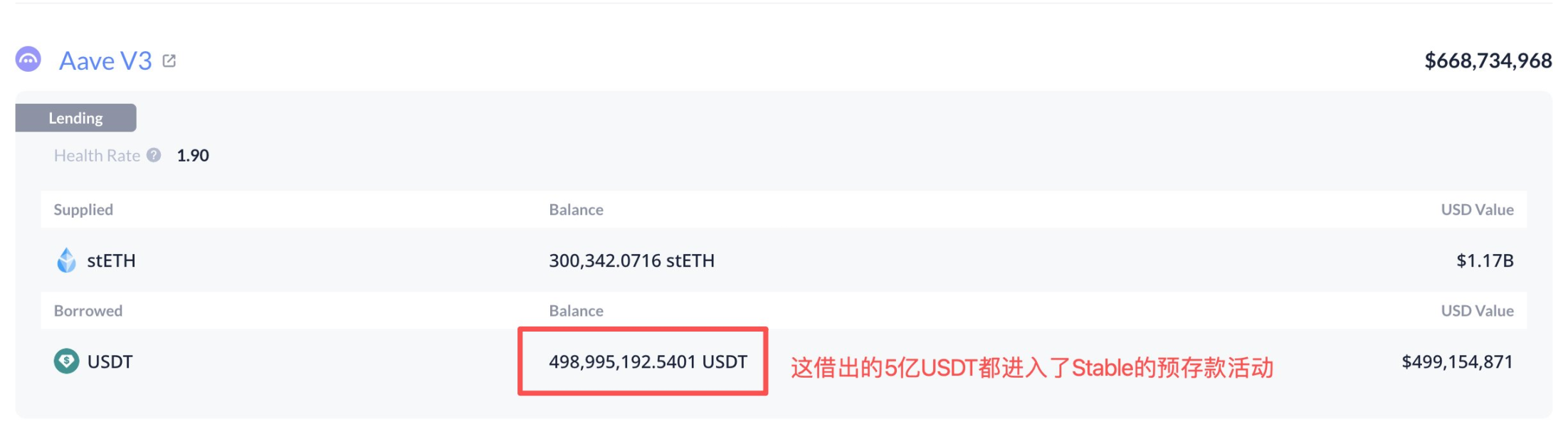

Final statistics show that only 274 addresses participated, with extremely high concentration, and a single address contributed over 60%. A suspected Bitfinex address collateralized 300,000 ETH to borrow 500 million USDT to participate in the Stable pre-deposit campaign, and both Plasma and Stable projects are invested in and supported by Bitfinex. Such a high degree of capital organization and timing difference quickly turned this round of pre-deposits from a "high-speed sell-out" performance into an industry-wide controversy over "front-running."

Quota Dominated by Whales

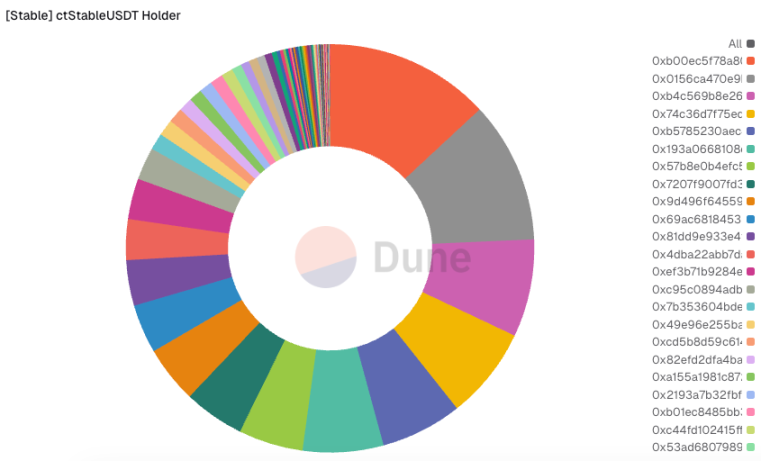

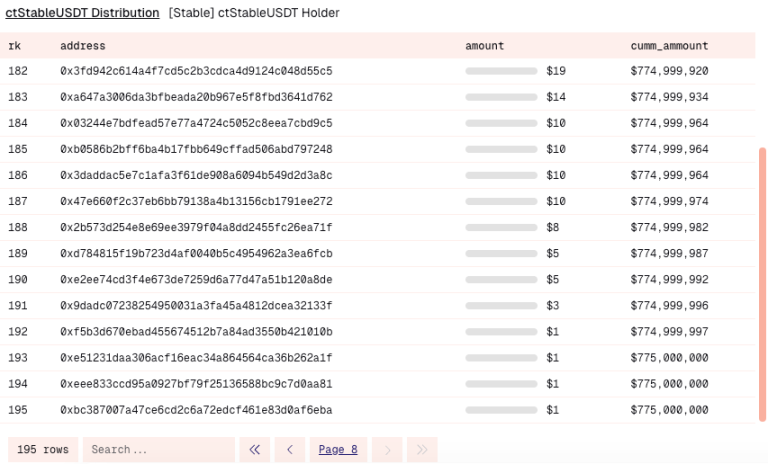

On-chain data shows that this Stable pre-deposit campaign has already exhibited the characteristics of being monopolized by a few whales.

Looking at just the top 25 addresses, they have deposited about 730 million USDT in total. Among them, the top addresses are extremely dominant: the top-ranked address (0xb00e…be50e) deposited about 101 million in a single transaction; the second (0x0156…33a3b) about 87 million; the top three combined about 248 million, accounting for 30% of the phase cap. Expanding the view to the top five, the total is about 355 million, accounting for 43%; the top ten combined about 546 million, further raising the share to 66%. In other words, less than a third of the top funds almost determined the majority of the campaign's outcome.

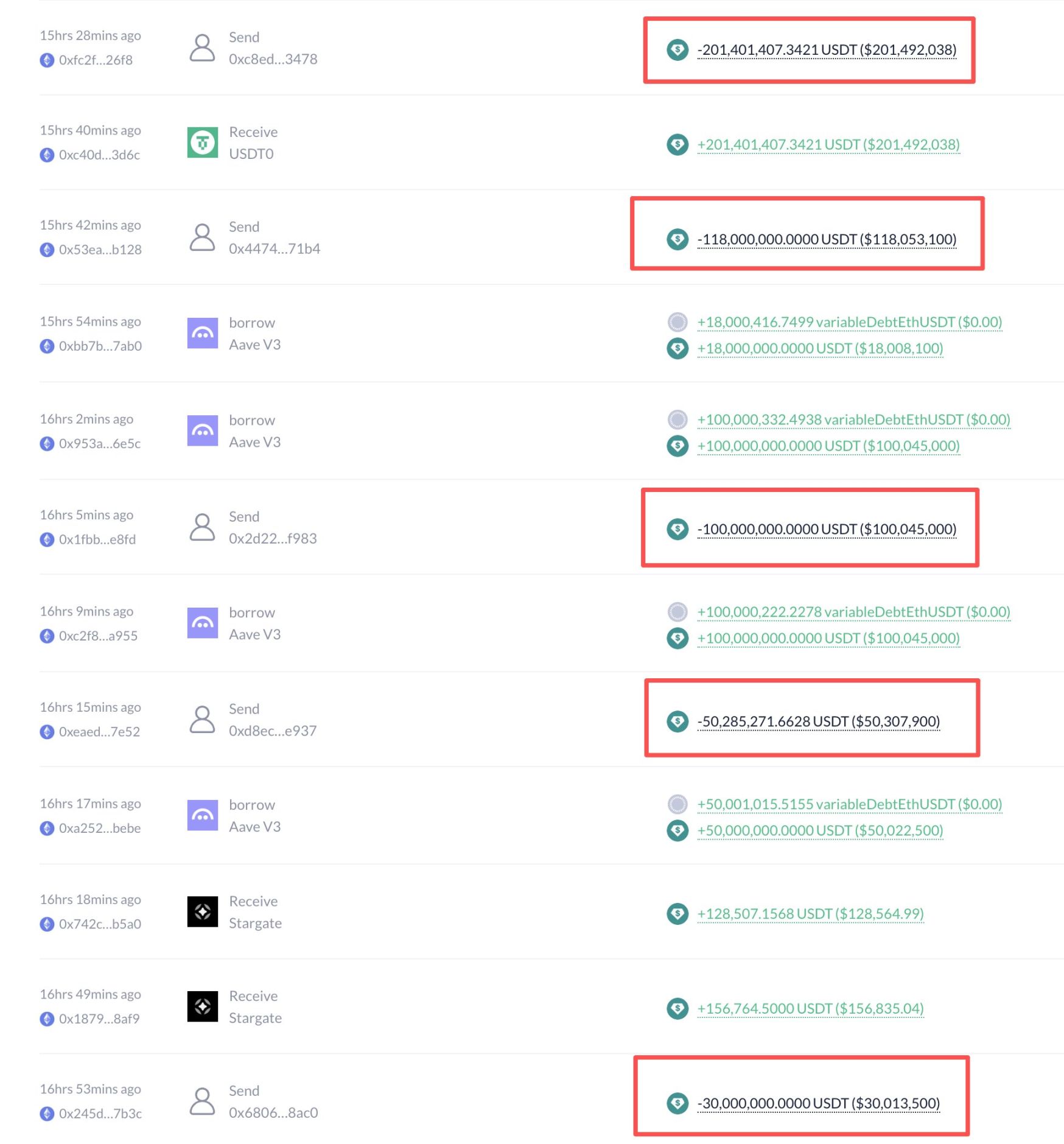

Judging from transaction habits and amount slices, the capital profile of these addresses is more similar to institutions and internal channels, with round numbers like 50 million (UTC+8), 60 million (UTC+8), and 30 million (UTC+8) repeatedly appearing. In contrast, among the participating addresses, there are many symbolic deposits of 1–20 USDT at the tail end, which contribute almost nothing to the total but mainly inflate the number of participating addresses; the truly decisive funds are concentrated at the top, with the top 10 taking about two-thirds of the quota, and the top 25 nearly 90%, meaning almost all the quota is in the hands of a few large holders.

In addition, according to Ember monitoring, a suspected Bitfinex address (0xc6b…c7) collateralized 300,000 ETH (about 1.17 billion USD) on Aave, borrowed 500 million USDT, and transferred it out. This address had deposited 200 million USDT to increase TVL when the Plasma mainnet launched at the end of September, and yesterday redeemed this 200 million USDT from Plasma to deposit into Steble. Both Plasma and Steble projects are invested in and supported by Bitfinex.

According to X user @0xBarri (Twitter nickname), due to the high yields of the Plasma project, he and his friends began monitoring all mainnet transfers over 5 million (UTC+8), and filtered out addresses related to Bitfinex, XPL, and BTSE (a US-backed exchange). The monitored addresses include: 0x2D22...CAf983, 0x4474...471b4, 0xB00e...BE50e, 0xC830...DaFCd, and 0xb01e...29bc4. Through Arkham analysis, it was found that these addresses had concentrated inflows this morning, suspected to be related to the ctStablePreDeposit contract, further confirming these were Stable deposits.

He also found that @Cbb0fe received an allocation of 16 million (UTC+8), and claimed it was earlier than the official announcement.

The discussion around this incident centers on fairness and transparency. The first issue is timing: when significant inflows appear on-chain before the announcement, the public naturally questions whether there are whitelist arrangements, role privileges, or internal exchange bookkeeping before batch on-chain operations, leading to information and timing asymmetry. Filling 825 million USDT with fewer than 200 addresses, with over 60% in a single point, is hard to reconcile with the blockchain narrative. If early shares are overly concentrated, future governance, ecosystem guidance, points, or potential airdrop allocations may be labeled as unbalanced.

The second issue is brand spillover effect. Stable is widely seen as closely linked to Bitfinex/Tether, and if the initial allocation feels non-transparent, the trust discount will not be limited to a single event but will spill over into the broader narrative of stablecoins and partners.

What is Stable: An L1 Born for USDT Payments

Stable is a payment-oriented Layer1, specifically optimized for USDT, targeting the pain points of unpredictable real-world payment fees, slow settlement, and complex user experience. Its market strategy is to directly cooperate with PSPs, merchants, business integrators, suppliers, and digital banks, focusing on:

- No need to manage volatile gas tokens (fees are denominated and paid in stablecoins);

- Transfer costs are predictable (through "enterprise-grade block space" subscriptions, ensuring VIP transactions are confirmed in the first block and costs are smoother during congestion).

- The regional strategy prioritizes Asia-Pacific, then expands to USDT-dominated regions such as Latin America and Africa.

On July 31, Stable announced the completion of a 28 million USD seed round led by Bitfinex and Hack VC, with other supporters including Franklin Templeton, Castle Island Ventures, and KuCoin Ventures, as well as angel investors such as Tether CEO Paolo Ardoino and Braintree founder Bryan Johnson. The official roadmap is divided into three phases: the first phase enables USDT to pay gas fees and sub-second block confirmation; the second phase provides block space guarantees for enterprise-grade payments; the third phase focuses on developer tools and performance upgrades.

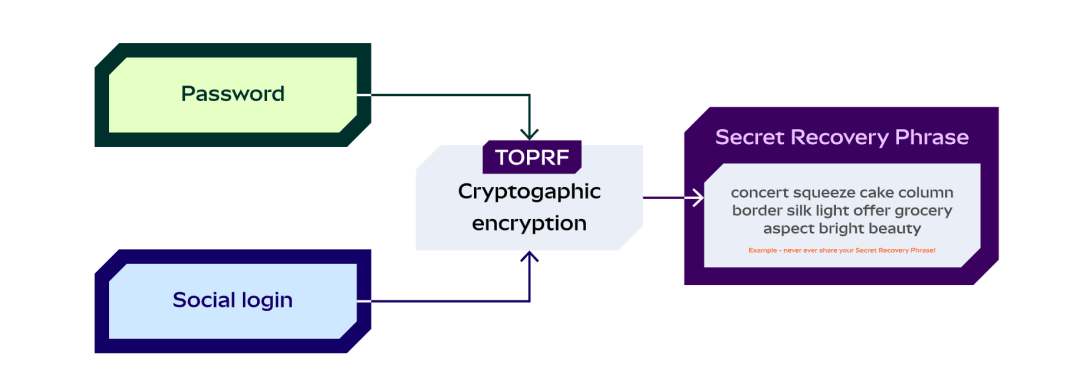

On September 29, Stable launched the beginner-friendly payment app app.stable.xyz, emphasizing instant settlement and gas-free transfers in daily scenarios, and attracted over 100,000 registrations through offline events in Korea. The key to gas-free transactions lies in EIP-7702, where users' existing wallets can be temporarily upgraded to smart wallets in a single transaction, with the Paymaster sponsoring and settling the fees, so users only need to hold USDT to complete payments. At the end of September, Stable opened the waitlist for the non-custodial payment wallet Stable Pay. Joining the waitlist gives priority access when the product launches, as well as exclusive product updates and early access to new features.

On September 22, PayPal's global venture capital arm PayPal Ventures announced its participation in Stable's latest funding round, and Stable has integrated PayPal's stablecoin PYUSD into Stablechain.

Summary

Overall, the launch pace and capital structure of this round of pre-deposits were clearly unbalanced: the official announcement was at 9:10 (UTC+8), but on-chain inflows appeared at 08:48 (UTC+8); a single entity took about 500 million USDT, accounting for about 60% of the quota, and only 274 addresses successfully participated. Such a prominent timing gap and concentration essentially turned the pre-deposit into a private event, undermining the fairness and accessibility of the campaign.

To stabilize the narrative and reputation, the project team may need to quickly provide a verifiable corrective plan. If PR measures are lacking, negative sentiment is likely to persist and be amplified in the next round.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Galaxy Digital, Which Manages Billions of Dollars, Reveals Its Bitcoin, Ethereum, and Solana Predictions for 2026

A Brief History of Blockchain Wallets and the 2025 Market Landscape

Tom Lee responds to X's debate with Fundstrat over differing bitcoin outlooks

Egrag Crypto: Selling XRP Now Makes No Sense. Here’s Why