News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 27)| JPMorgan backs BTC & ETH collateral; U.S. drops China tariff plan; Saylor teases new BTC buys2Vitalik's New Article: The Possible Future of the Ethereum Protocol - The Verge3XRP ETF surpasses $100 million in assets under management

JPMorgan to Accept Bitcoin, Ethereum as Loan Collateral

Coinlive·2025/10/27 20:42

Crypto New Token Launch Craze: Reviewing the New Wave of Wealth Opportunities

A quick overview of new project investment opportunities such as MegaETH, Momentum, and zkPass.

Chaincatcher·2025/10/27 20:27

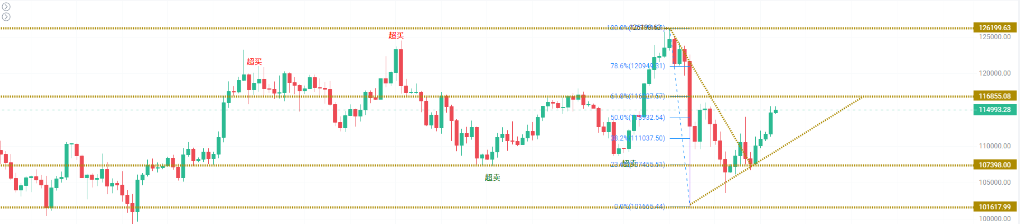

Tariff clouds temporarily ease, is the bull market horn sounding again?

This article analyzes the reasons behind the recent significant surge in the crypto market, mainly attributing it to progress in tariff negotiations between China and the United States, as well as positive signals released by macroeconomic data.

Chaincatcher·2025/10/27 20:27

The Fed is about to cut interest rates, marking a key turning point for the crypto market!

AICoin·2025/10/27 20:01

China-US Trade Truce Brings Risk Appetite Back to Crypto Market

AICoin·2025/10/27 20:00

Cardano Support Wobbles, Ethereum Slides to $3.8K; BlockDAG’s Tech Could Turn It Into Bitcoin 2.0

DailyCoin·2025/10/27 19:28

How can the x402 protocol overcome the trust bottleneck to achieve mass adoption?

Bitpush·2025/10/27 19:24

From "resistance" to "collateral": Why did JPMorgan suddenly embrace Bitcoin?

Bitpush·2025/10/27 19:24

Flash

- 20:42The US Dollar Index fell by 0.17% on the 27th.Jinse Finance reported that the US Dollar Index fell by 0.17% on the 27th, closing at 98.782 in the late foreign exchange market.

- 20:38ETHZilla has sold approximately $40 million worth of ETH for stock buybacksAccording to a report by Jinse Finance, a certain exchange company (Nasdaq: ETHZ) announced that it has sold approximately $40 million worth of Ethereum (ETH) for stock buybacks. Since the sale was executed on October 24, the company has repurchased about 600,000 shares of common stock for approximately $12 million and plans to continue using the remaining funds for further stock buybacks. The company still holds about $400 million in ETH for future strategic planning.

- 20:30Analysis: If the US SEC does not intervene temporarily, Bitwise Solana Staking ETF, as well as LTC and HBAR ETFs, will be listed at the opening tonight (GMT+8).According to Jinse Finance, Bloomberg ETF analyst Eric Balchunas stated in a post that "the New York Stock Exchange (NYSE Arca) has issued an announcement that the Bitwise Solana Staking ETF, Canary Litecoin, and Canary HBAR ETF will begin trading on October 28 (after the US stock market opens in the evening of the 28th, East 8th District time), while Grayscale Solana will undergo a share conversion the following day. Unless there is temporary intervention by the US SEC, the above trades are expected to proceed as scheduled."