News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Report (October 29)|Fed to Announce Rate Decision; Market Expects 25bp Cut; Visa Adds Multi-Chain Stablecoin Payments; Western Union to Launch Stablecoin on Solana2ARB/USDT Surges Amid Arbitrum Liquidity Influx and Rising On-Chain Trading Activity3DASH Rises Above $40–$42 Support, Eyes $60–$65 Breakout Momentum

XRP Price Finds Support at $3 Even as Whales Note $1.2 Billion Sell-Off

XRP holds at $3 despite whale sell-offs; retail investors buying to stabilize price, but support at $3.07 is crucial for recovery.

BeInCrypto·2025/08/15 23:30

Ether ETFs Record $17B Volume While BMNR Adds 135K ETH

Cryptotale·2025/08/15 22:37

U.S. PPI Rises 3.3%, Bitcoin Prices Tumble

Theccpress·2025/08/15 22:10

U.S. Treasury Denies Bitcoin Reserve Accumulation Claims

Theccpress·2025/08/15 22:10

Hong Kong’s Avenir Holds $691M in Bitcoin ETFs

Theccpress·2025/08/15 22:10

Google Acquires 8% Stake in TeraWulf

Theccpress·2025/08/15 22:10

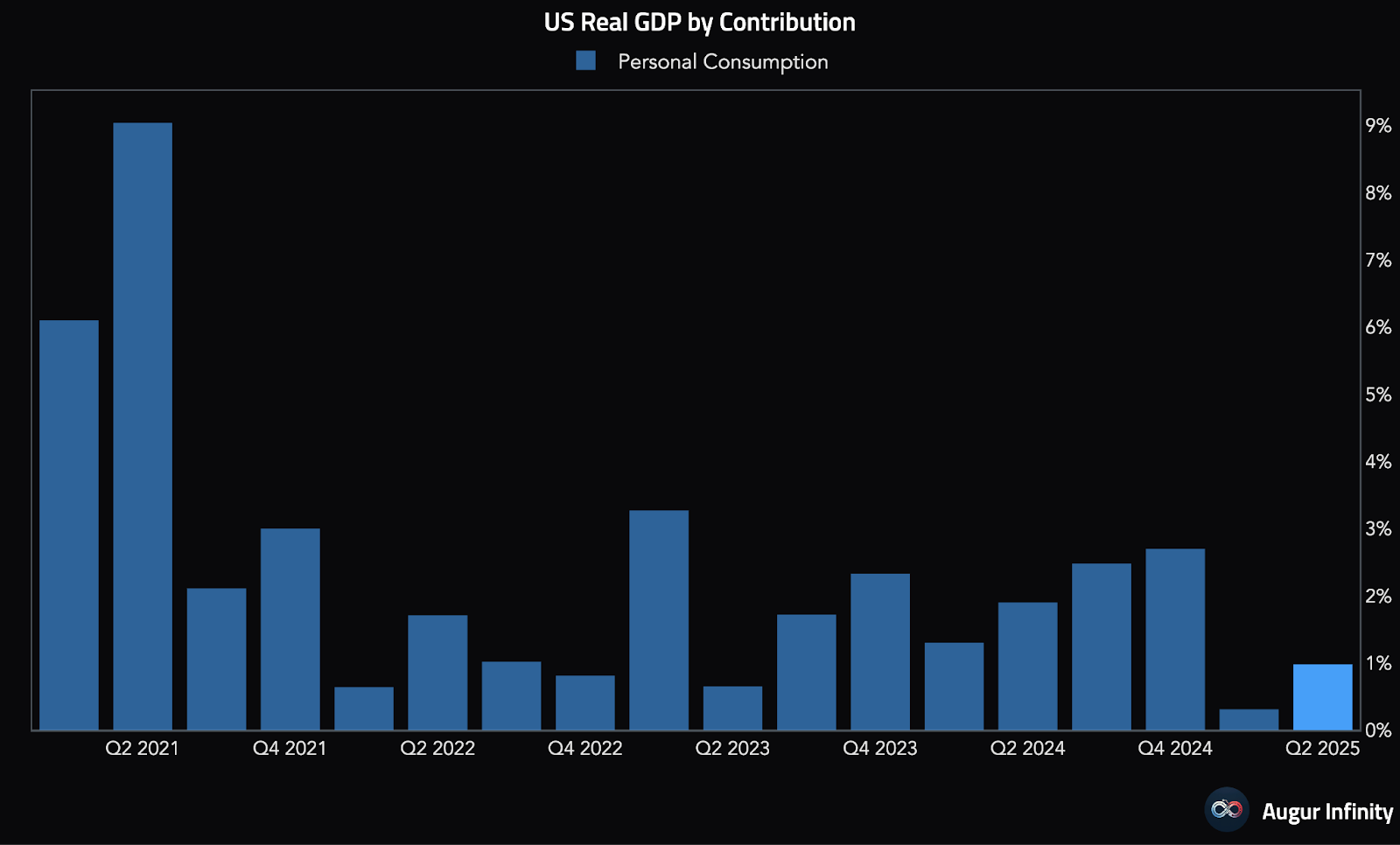

Should the Fed cut 50bps in September?

We’re beginning to price in the chance of not just a 25 basis point cut, but a 50 bps one

Blockworks·2025/08/15 20:50

BlackRock Bitcoin, Ether ETFs buy $1B as BTC price mostly fills CME gap

Cointelegraph·2025/08/15 18:30

Ether bull flag targets $6K as ETH supply on exchanges falls to 12%

Cointelegraph·2025/08/15 18:30

Price predictions 8/15: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, LINK, HYPE, XLM

Cointelegraph·2025/08/15 18:30

Flash

- 07:30Spot gold surged $20 in the short term, now quoted at $3992.21 per ounce.Jinse Finance reported that spot gold surged by $20 in the short term, with an intraday increase of 1.00%, currently quoted at $3992.21 per ounce. (Golden Ten Data)

- 07:30UBS says clients are increasingly focused on hedging downside risksJinse Finance reported that UBS Group stated its clients are preparing for a market downturn and warned that sentiment surrounding booming markets could shift rapidly. UBS, in its third-quarter earnings release on Wednesday, noted that with valuations high across most asset classes, "investors remain active but are increasingly focused on hedging downside risks." Looking ahead to the fourth quarter, UBS pointed out, "As confidence in the outlook is tested and seasonal factors come into play, market sentiment could shift quickly." Currently, there is little sign that this is happening.

- 07:30SOL Strategies provides institutional-grade security standards support for Solana staking servicesJinse Finance reported that SOL Strategies (Nasdaq: STKE) is a company that integrates a Solana asset pool with a “revenue-generating” validator business. The company announced that it has successfully passed both SOC 2 Type 2 and SOC 1 Type 2 audits, with no non-compliance issues found. It is reported that this audit has verified SOL Strategies’ control measures, effective risk management capabilities, and its adherence to industry best practices in validator operations. This milestone builds upon the company’s previously obtained certifications and reports, including ISO 27001 Information Security Management System certification, SOC 2 Type 1 audit report, and SOC 1 Type 1 audit report. These achievements fully demonstrate SOL Strategies’ strong commitment to maintaining security standards for institutional clients’ Solana staking business. Among them, the SOC 2 Type 2 audit is a “long-term independent assessment” of SOL Strategies’ security control measures, which not only verifies the soundness of the company’s security practices design but also the effectiveness of their actual implementation.