News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 17)|U.S. seasonally adjusted nonfarm payrolls for November increased by 64,000; BlackRock transferred approximately $140 million worth of ETH to a CEX2Bitget US Stock Morning Brief | Fed Independence Reaffirmed; NFP Beats Expectations; Tech Rally Lifts Market (December 17, 2025)

Crypto Fear & Greed Index Plummets to 17: What Extreme Fear Means for Your Portfolio

Bitcoinworld·2025/12/18 00:27

XRP Poised to Benefit from Global Liquidity Shift, Says DAG CEO

TimesTabloid·2025/12/18 00:03

XRP Rich List: Can Long-Term Holders Realistically Retire on Crypto Gains?

TimesTabloid·2025/12/17 23:33

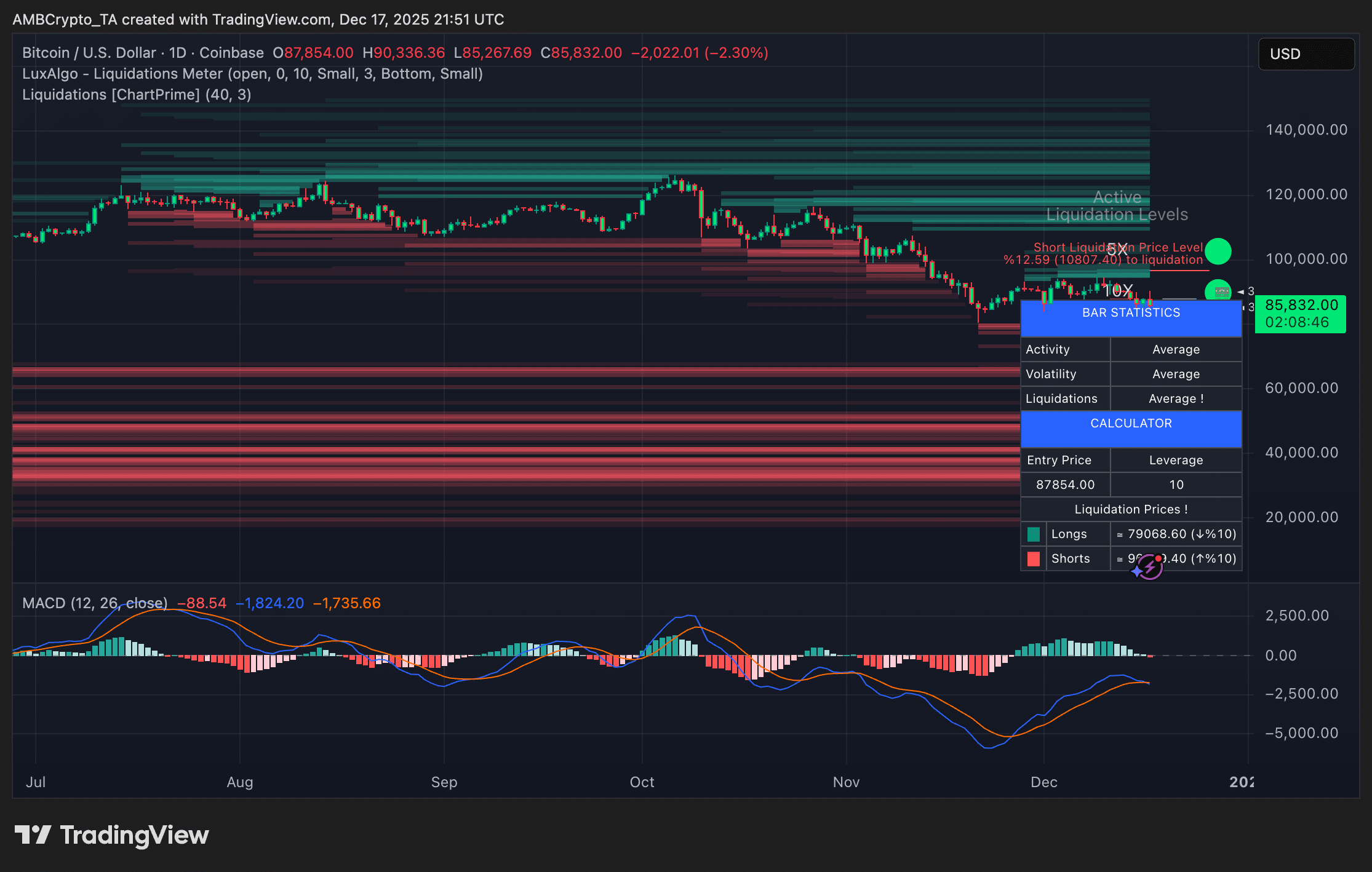

Santa Rally Hopes Fade as Bitcoin Jumps to $90K, Then Falls Even Harder

Decrypt·2025/12/17 23:01

Nexo Initiates Multi-Year Global Collaboration with Tennis Australia

BlockchainReporter·2025/12/17 23:00

Flash

00:27

A $230 million long whale is now at a floating loss of $73.18 million as the market declines.According to Odaily, on-chain analyst Yu Jin monitored that a whale holding a total of $700 million in long positions did not continue to add positions over the past two days. As the market declined, the whale's long positions are currently at an unrealized loss of $73.18 million. This whale holds 191,000 ETH ($540 million) in long positions, with an entry price of $3,167 and an unrealized loss of $64.28 million. The liquidation price is $2,083. The whale also holds 1,000 BTC ($86.15 million) in long positions, with an entry price of $91,506 and an unrealized loss of $5.35 million. Additionally, the whale holds 250,000 SOL ($30.83 million) in long positions, with an entry price of $137.5 and an unrealized loss of $3.55 million.

00:27

A certain whale's HYPE long position is facing an unrealized loss of $19.6 million, and they have deposited 2 million USDC to avoid liquidation.PANews reported on December 18, according to OnchainLens monitoring, as the price of HYPE fell below $25, a whale holding a HYPE (5x leverage) long position is currently facing an unrealized loss of over $19.6 million. This whale has deposited 2 million USDC to avoid liquidation; currently, the liquidation price is $20.65.

00:25

The total unrealized loss of the "1011 Insider Whale" has expanded to $73.18 million.PANews reported on December 18 that, according to on-chain analyst Ember, the "$230 million long whale (also known as the '1011 Insider Whale')" has not continued to increase its positions in the past two days and is still holding nearly $700 million in long positions. However, as the market continues to decline, his long positions are currently at an unrealized loss of $73.18 million. 191,000 ETH ($540 million) long, entry price $3,167, unrealized loss of $64.28 million, liquidation price $2,083; 1,000 BTC ($86.15 million) long, entry price $91,506, unrealized loss of $5.35 million; 250,000 SOL ($30.83 million) long, entry price $137.5, unrealized loss of $3.55 million.

News