Cryptocurrency Market Forecast: Bitcoin’s Perfect Recovery Outlook, Ethereum (ETH) Recovery Timing Arrives, Is Cardano (ADA) Facing Its Best Market Opportunity?

The bitcoin market appears to have emerged from its trough, rather than being in a state of free-fall decline. The recent drop to the mid-$80,000 range seems to have shaken out weak-handed investors, eliminated excessive leverage, and may have formed a local bottom. Ethereum (ETH) and Cardano (ADA) are also showing similar patterns, entering a consolidation phase after a rapid decline.

Bitcoin's Trend

From a structural perspective, this is exactly how it operates. Bitcoin has taken action. In previous bull markets, price action typically involved a sharp drop, followed by massive sell-offs, and then stabilization, rather than a continued rise. The current price has reacted significantly to the lows on the chart, indicating that buyers are showing strong interest in the price area below $86,000. This area has already experienced real selling pressure, consistent with previous demand.

Crucially, after touching this area, the sell-off did not accelerate. Instead, the price began to narrow and trading volume increased, which usually indicates that the market is absorbing rather than panic selling. There is a significant difference between a real decline and a pullback within a larger upward trend.

Momentum indicators also support this view. The RSI indicator is still in a range that usually signals a rebound rather than a trend reversal, but it is no longer clearly oversold.

Meanwhile, bitcoin is trading well below its short- and medium-term moving averages, setting the stage for a mean reversion bounce. The market does not remain in this overextended state for long; it will either fall further or rise again. A crash has not yet occurred.

What investors should expect next is market volatility, followed by clarification. The recovery process is rarely linear. The market is reshaping its structure and bitcoin's price is expected to experience sharp fluctuations, short-term pullbacks, and failed breakouts. However, as long as bitcoin can stay above its recent lows, the likelihood of a long-term price increase is greater than another sharp drop.

Ethereum is Testing

Hesitation is no longer an option, as Ethereum is at a technical turning point. After ETH broke below the $3,000 mark and fell to the high $2,900 range, it is now at the critical point between the start of a strong downtrend and a corrective pullback. The price action here is significant, not only for its short-term impact but also for its importance to the overall trend structure.

From a chart perspective, Ethereum is barely holding on as the price continues to run along the remnants of a high time-frame uptrend. The current price is below key short- and medium-term moving averages and is pressing against the rising support line. To maintain a bullish structure, the price needs to rebound within this limited timeframe.

If Ethereum can recover to the $3,100-$3,200 range and hold that level, the recent volatility is likely to be seen as a healthy correction rather than structural damage. Momentum indicators also confirm the urgency of this area. Since the Relative Strength Index (RSI) is not severely oversold but is in a neutral-to-weak range, price action could go either way. This is where the risk lies.

Ethereum cannot remain range-bound for weeks. If the price consolidates below $3,000, spot and derivatives traders will increase selling pressure and gradually reverse the bearish trend. If the price falls sharply below the current support level and fails to rebound, the consequences will be even more severe.

Continued declines will turn previous support levels into resistance and confirm a longer-lasting lower high. At that point, Ethereum will enter a new, stronger downtrend, with downside targets expanding rapidly rather than simply being a pullback within an uptrend.

Ethereum's current recovery keeps it in line with the overall bull cycle and maintains confidence in higher targets for the future. However, once the recovery fails, the situation will change completely. Now, Ethereum needs not hype, but timely and comprehensive follow-up action.

Cardano's Opportunity

Cardano's trading environment is often a mix of opportunity and panic. ADA's price has been compressed well below all major moving averages, and after months of continuous decline, it is now hovering near the lower end of its larger volatility range. From a purely structural perspective, this is usually a late-stage sign of exhausted downward momentum.

This sell-off, while not chaotic, has been intense. The price has continued to fall rather than crash in a straight line, which is crucial. This kind of movement usually indicates that the market has completed distribution, with remaining selling power being weaker and reactions slower.

Trading volume also confirms this: despite the continued price decline, selling volume has not continued to increase. This is a classic sign of bearish momentum fading. The Relative Strength Index (RSI) is another important indicator. Cardano's RSI has hovered around 40 for quite some time, and after a brief drop, there has been no obvious continuation.

While it is not yet possible to provide a strong bullish signal, this does indicate that ADA is about to enter an oversold state compared to the recent trend. While persistent weakness without an accelerated rise is often a precursor to a rebound, the market does not reverse simply because the RSI is low.

From a technical perspective, ADA is currently in an oversold state, trading well below its medium- and long-term moving averages. This sideways consolidation is not permanent. It will eventually end either with high-volume selling or with a rebound that recovers lost ground.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Bearish Pressure Intensifies: 3 Critical Factors Threatening ETH’s Price

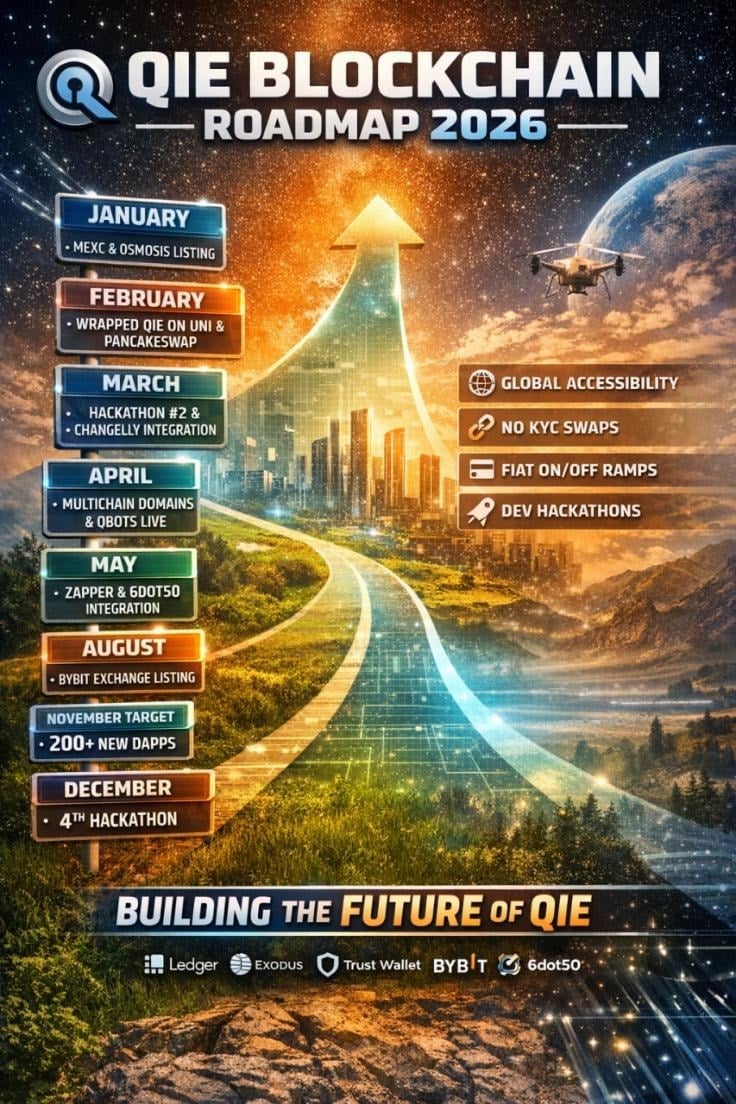

QIE 2026 Roadmap: Building the Infrastructure for Real Web3 Use

Ripple advances protocol safety with new XRP Ledger payment engine specification

Tempo Introduces Crypto-Native Transactions to Scale Stablecoin Payments On-chain