News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Quick Take Summary is AI generated, newsroom reviewed. SEC approves Hashdex Nasdaq Crypto ETF XRP under new generic listing rules. XRP, Solana, and Stellar join Bitcoin and Ethereum in the ETF basket. The approval allows regulated investors easier access to multiple cryptocurrencies. ETF inclusion doesn’t guarantee price gains, but boosts legitimacy and liquidity.References Hashdex Nasdaq Crypto Index US ETF has been approved under the SEC's new generic listing standards. Hashdex Nasdaq holds XRP!

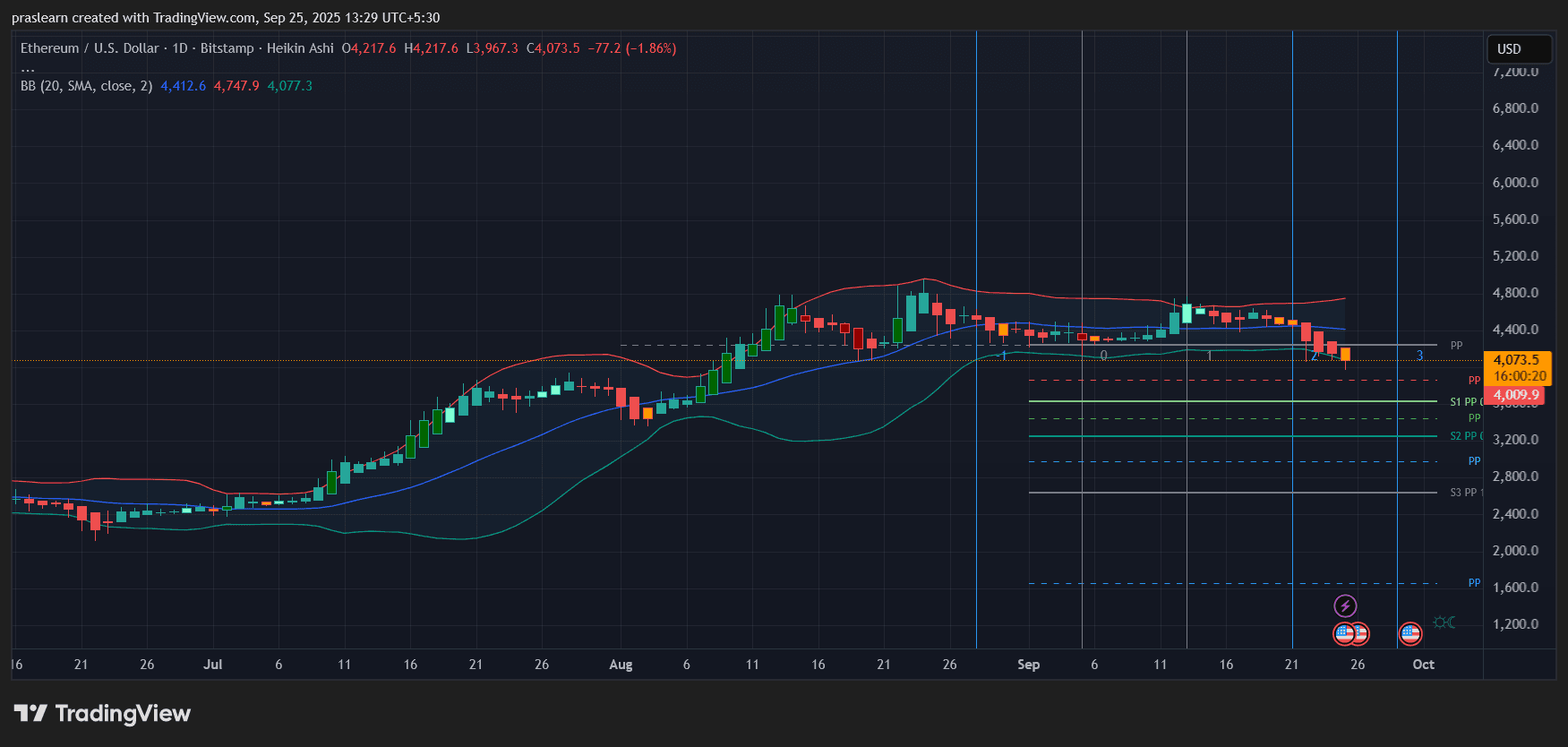

Andrew Kang believes that Tom Lee is arbitrarily drawing lines under the guise of technical analysis to support his own biases.

They allow you to get ahead of the curve earlier.

This figure means that Tether's scale will be directly comparable to top global tech unicorns such as OpenAI and SpaceX.

The U.S. Senate Finance Committee will hold a key hearing to discuss digital asset tax policies, aiming to establish a comprehensive regulatory framework for the crypto industry, address tax ambiguities, and impact global capital flows. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

- 09:27French investment firm Melanion plans to raise 50 million euros, all to be used for purchasing Bitcoin.ChainCatcher news, according to PR Newswire, French investment firm Melanion Capital has announced the launch of a new strategic initiative, positioning itself as a private asset management company implementing the Bitcoin Treasury Operating Company (BTOC) model. Melanion claims: "Unlike the public company model, Melanion's private structure gives it greater flexibility in dealing with volatility, structuring trades, and managing liquidity; the company will apply this strategy directly to its own balance sheet, taking the lead in demonstrating what a sustainable bitcoin reserve looks like before providing a framework for other private enterprises to become BTOCs." To accelerate the implementation of this strategy, Melanion's board plans to raise 50 million euros, all of which will be allocated to bitcoin.

- 09:14ECB's Villeroy: Europe Risks Falling Behind the US in StablecoinsChainCatcher news, according to Bloomberg, Francois Villeroy de Galhau, a member of the European Central Bank's Governing Council, stated in an interview with Der Spiegel that with the rapid development of stablecoins, European banks risk falling behind the United States, which could weaken the sovereignty of the European continent. He pointed out that Europe is leading in regulation and the development of public digital currencies, but is lagging behind in the private currency sector; the stablecoin market size may grow from about $250 billion to several trillions of dollars in the coming years, forcing European banks to address the demand for private tokenized currencies. He emphasized that Europe may face risks from the existence of private dollar stablecoins issued by non-European participants, which are almost currency-like; although related discussions have just begun, they are crucial for the future sovereignty of Europe. Previous news reported that nine European banks plan to jointly launch a MiCA-compliant euro stablecoin.

- 09:14Circle is exploring reversible transactions to help recover funds in cases of fraud and hacking.ChainCatcher news, according to Cointelegraph, stablecoin issuer Circle is exploring reversible transactions to help recover funds in cases of fraud and hacking. This move appears to contradict the core principles of irreversibility and decentralization in cryptocurrency transactions. Circle President Heath Tarbert revealed to the Financial Times that the company is researching relevant mechanisms to reverse transactions in cases of fraud or hacking, while still maintaining settlement finality. He admitted that when considering transaction reversibility, they also hope to preserve finality, and there is an inherent contradiction between the two. Tarbert also pointed out that although blockchain is often seen as the future of finance, it can be beneficial to draw on features from traditional finance; the current financial system has advantages that blockchain does not yet possess. Some developers believe that, provided all parties agree, introducing a certain degree of transaction reversibility to combat fraud is both necessary and feasible.