Bitget Daily Digest(September 25)|Plasma Mainnet Beta and XPL Launch; Continued Net Outflows from BTC and ETH ETFs; Tether Plans Private Placement at $500 Billion Valuation

Today's Preview

1. The Plasma (XPL) mainnet Beta will officially launch at 20:00 on September 25, 2025(UTC+8), along with the release of its native token XPL.

2. The ETHSofia Web3 conference will conclude on September 25, 2025(UTC+8), focusing on key Web3 sectors such as AI, DeFi, RWA, tokenization, scaling, trading technology, and security.

3. Bitget will host the third annual 2025 Smart Awards on September 25, 2025(UTC+8), recognizing the year’s top traders.

Macro & Hot Topics

1. Continued net outflows from BTC and ETH ETFs: On September 24, the US 10 spot Bitcoin ETFs saw a net outflow of 3,211 BTC (with Fidelity FBTC accounting for 2,463 BTC outflow). Nine spot Ethereum ETFs recorded a net outflow of 25,851 ETH (with Fidelity ETHA accounting for 7,986 ETH outflow). Grayscale’s Ethereum ETF has been approved for inclusion in the universal listing framework.

2. Frequent crypto security incidents: On September 23, Seedify suffered a hack linked to North Korean actors, resulting in a private key leak and abnormal SFUND token minting. UXLINK was attacked by the Inferno Drainer group, losing 542 million UXLINK tokens and over 10 trillion tokens minted on-chain; the team has initiated a new contract for 1:1 exchange.

3. US regulatory developments: The US SEC announced a joint regulatory roundtable with the CFTC, involving major market participants to strengthen oversight of the crypto asset market.

4. Ethereum has become the primary network for USDT issuance, with total USDT supply reaching $80 billion, and its share in circulation significantly increasing.

Market Updates

1. BTC and ETH saw slight increases, but market sentiment remains cautious. In the past 4 hours, liquidations totaled $57.73 million, mainly long positions.

2. The three major US stock indices fell for a second consecutive day—Dow, Nasdaq, and S&P 500 all closed lower—impacted by pressure on AI-related stocks and Powell’s comments on “overvaluation,” fueling risk-off sentiment.

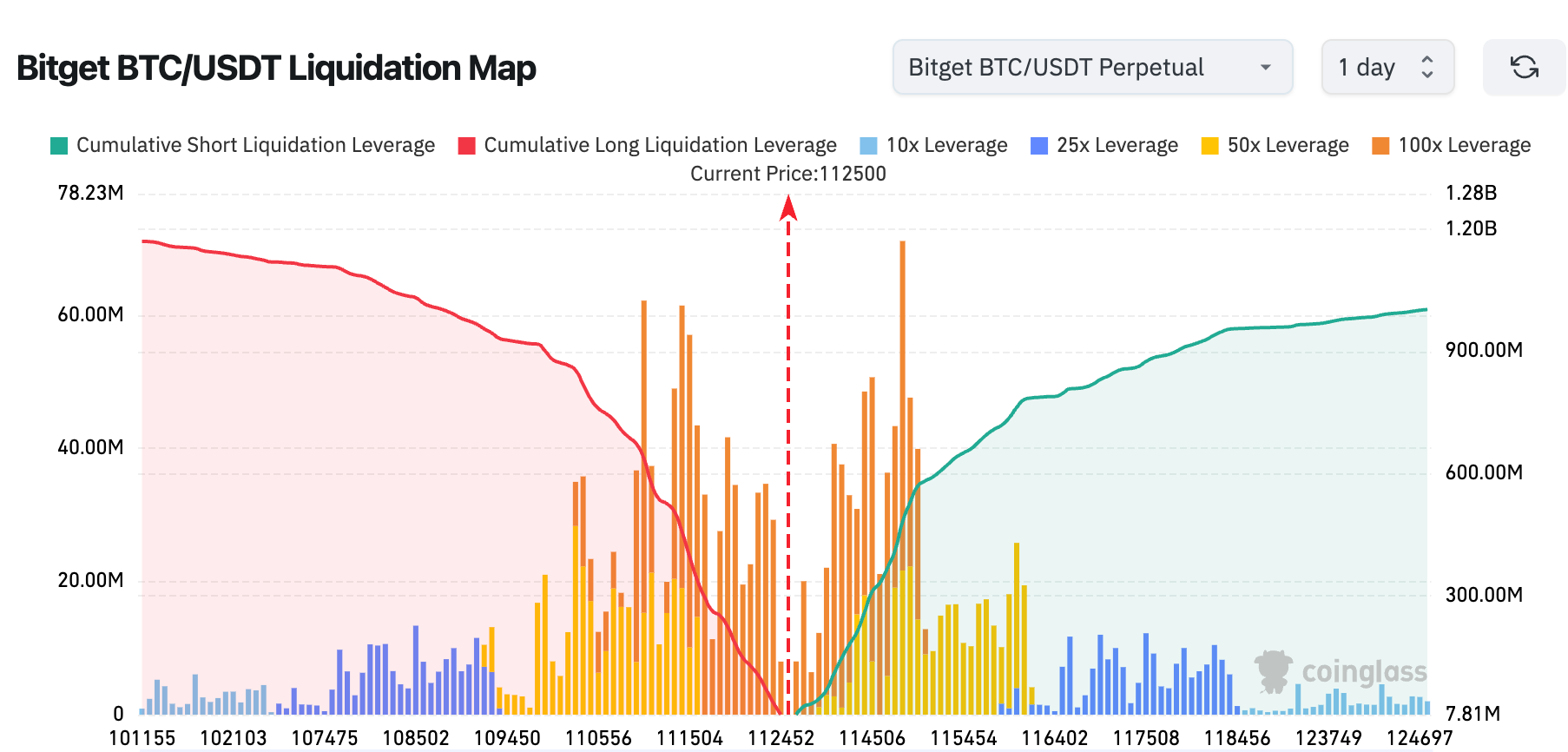

3. Bitget’s BTC/USDT liquidation map shows the current price at 112,500 USDT, with dense long positions above 113,000 USDT. A breakout could trigger a long squeeze; beware of short-term volatility and extreme moves.

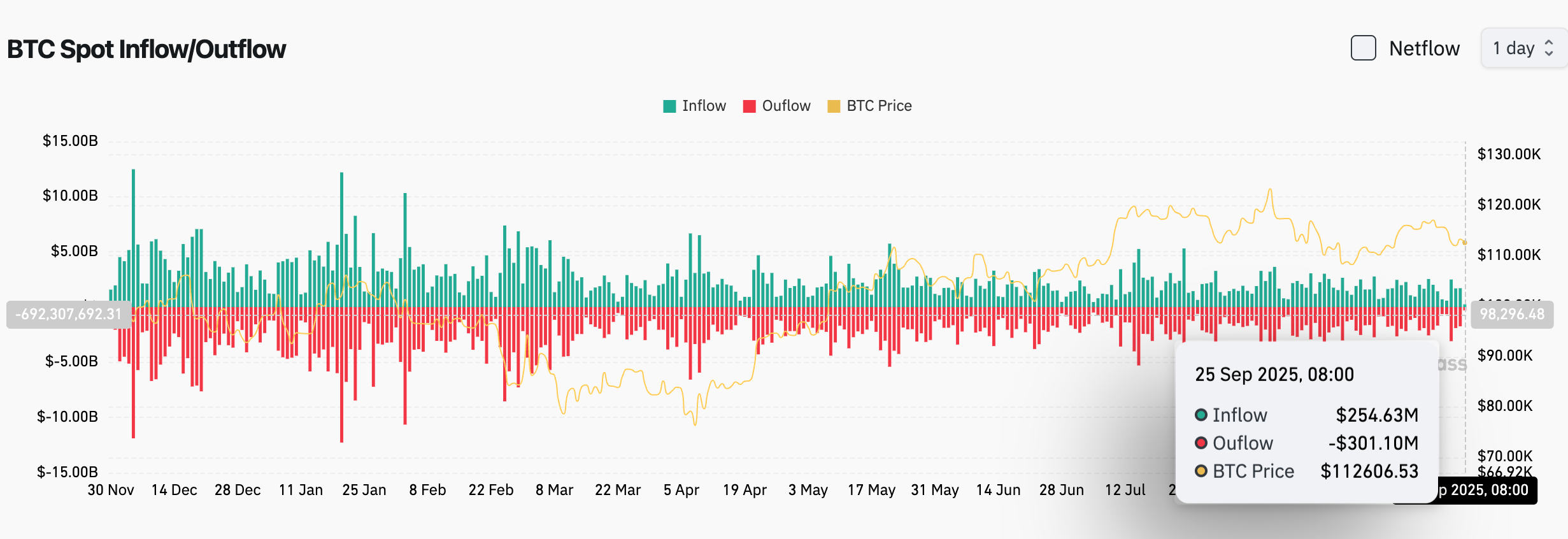

4. In the past 24 hours, BTC spot inflows totaled $253 million, outflows $300 million, for a net outflow of $47 million.

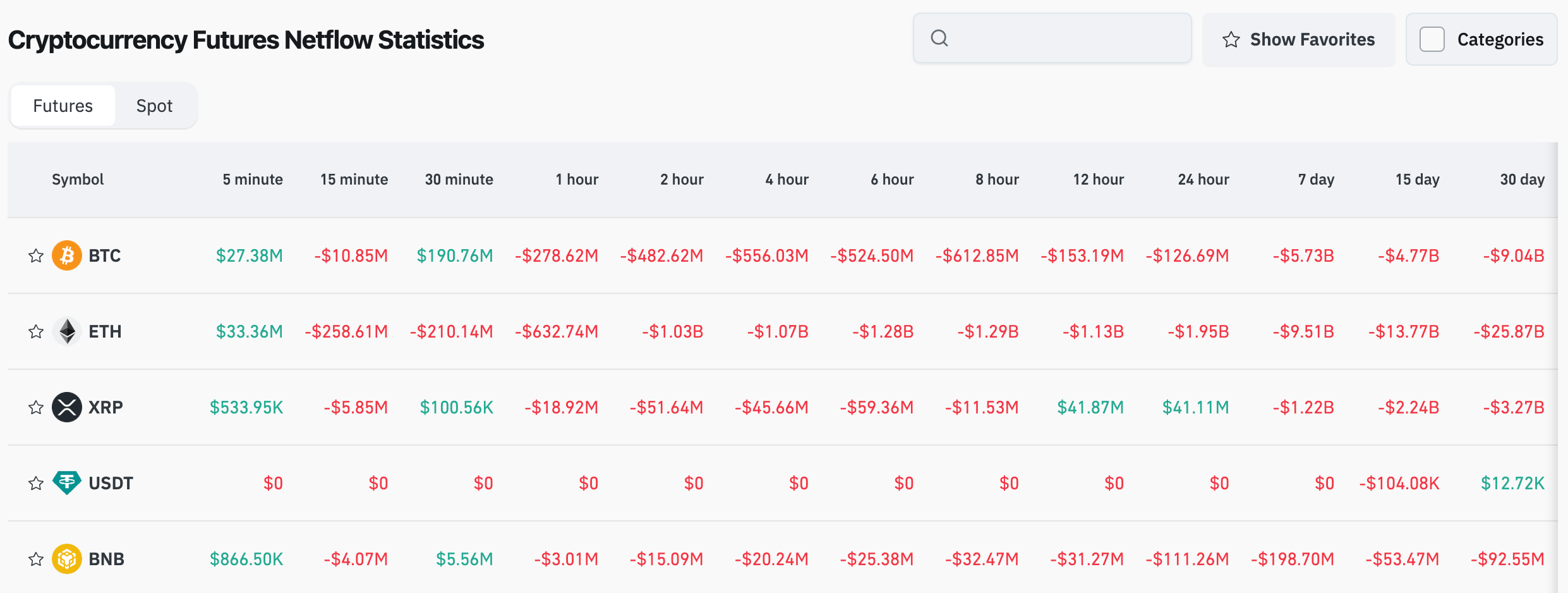

5. In the past 24 hours, BTC, ETH, XRP, USDT, and BNB led contract trading net outflows, potentially presenting trading opportunities.

News Updates

1. Tether is reportedly seeking a $500 billion valuation through private placement. If achieved, its chairman would become the fifth richest person globally.

2. The US SEC and CFTC released the agenda for their regulatory coordination roundtable, advancing regulatory standardization of the crypto industry.

3. US Democratic Senator Elizabeth Warren called for an investigation into overseas crypto transactions involving the Trump family.

4. Jiuzi Holdings approved a $1 billion Bitcoin investment plan, further increasing its commitment to the crypto sector.

Project Developments

1. CFTC launches a tokenized collateral program, allowing stablecoins to be used as margin for derivatives trading.

2. Bitget Onchain upgrade: four major networks, including Ethereum and Solana, are now integrated, and AI-powered on-chain signals have been released.

3. SuperImage completed a $5 million strategic funding round to support product upgrades and global expansion.

4. Bubblemaps launched the BMT token incentive program to empower its community intelligence ecosystem.

5. Canton Network entered a strategic partnership with Chainlink to accelerate institutional blockchain adoption.

6. Franklin Templeton expanded its Benji tokenization platform to BNB Chain, enhancing multi-chain asset management capabilities.

7. Polygon announced a zkEVM upgrade to optimize transaction throughput and security.

Disclaimer: This report was generated by AI and human-verified for accuracy. It is not intended as investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Faces Mounting Pressure as Analysts Eye $70,000 Support Level

The Graph Price Prediction 2026-2030: Will GRT Skyrocket or Stumble?

Buy Spot Crypto Now: LD Capital Founder Reveals Why This is the Perfect Moment

Expert Connects the Dots Between Ripple, XRP, and BlackRock