Ethereum (ETH) Premium-Selling Emerges in Bearish Crypto Market as ETH Strangle Signals Strategy Shift

COINOTAG News, citing Greek.Live analyst Adam, notes that the crypto market remains cautious with a tilt toward bearish sentiment as year‑end liquidity thins. Traders favor option premium collection over directional bets, with the December 26 expiry around $88,770 in focus; a max pain point near $98,134 and a six‑month model implying a roughly -$17,000 move.

Market participants are shifting toward premium selling in uncertain conditions, outlining plans for bullish call spreads and naked put selling. The strategy aims to harvest premiums while maintaining a cautious ratio of short‑term calls and puts to reduce exposure in a low conviction environment.

One notable ETH position was reported: a sold strangle at 2750/3150 expiring January 2, but analysts urge patience amid thin holiday liquidity. The consensus leans toward pausing trading until next Monday, with some weighing a simple iron condor as liquidity returns.

Overall, the posture favors short‑term call spreads and naked puts, with risk controls at the forefront. Market watchers are advised to stay disciplined and ready to recalibrate as macro drivers shape volatility through year‑end and into Q1.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

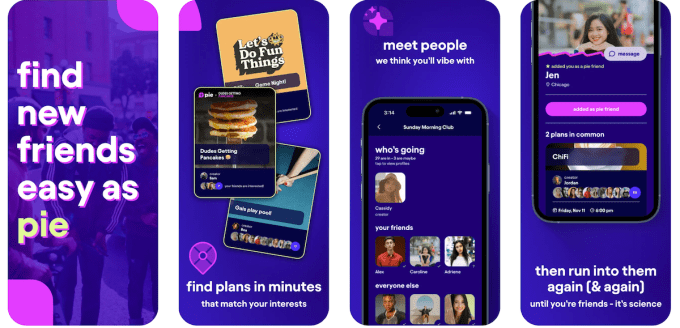

As people look for ways to make new friends, here are the apps promising to help

XRP’s Long-Term Breakout Narrative Builds Even As Short-Term Bears Linger

Next Crypto To Explode: Upexi Shares Slide 7.5% As DeepSnitch AI Attracts Investors With 100% ROI

XRP Holds $1.88 Support as Price Consolidates Below $1.94 Resistance