Bitcoin Down 30% from ATH Triggers Tax-Loss Harvesting Rush as Investors Offset Stock Gains Before Year-End

Bitcoin has retraced roughly 30% from its all-time high, according to Bloomberg, creating a potential year-end tax-optimization window. Market advisers say this year’s tax-loss harvesting activity in digital assets could be more widespread than in prior cycles as investors reassess risk in crypto markets.

Year-to-date metrics show Bitcoin down about 5%, while the S&P 500 has advanced around 18%, underscoring a notable performance gap that may influence asset allocation for mixed portfolios, especially for those who entered Bitcoin near the October peak.

Tax-loss harvesting is the practice of selling assets at a loss to offset gains, potentially reducing tax liabilities. With equities rising and crypto pulling back, this approach is drawing renewed attention as part of disciplined year-end tax planning for crypto holders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

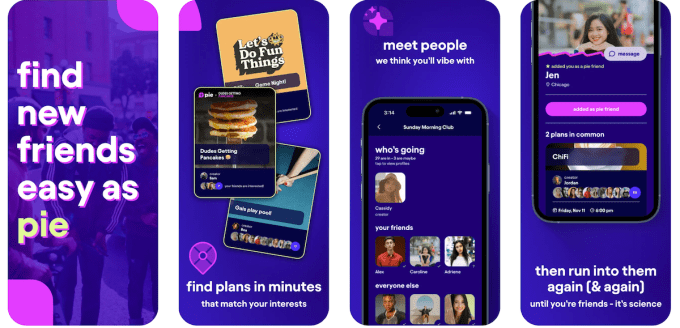

As people look for ways to make new friends, here are the apps promising to help

XRP’s Long-Term Breakout Narrative Builds Even As Short-Term Bears Linger

Next Crypto To Explode: Upexi Shares Slide 7.5% As DeepSnitch AI Attracts Investors With 100% ROI

XRP Holds $1.88 Support as Price Consolidates Below $1.94 Resistance