Full Overview of the Event

Recently, the yield on Japan's two-year government bonds rose to 1.155%, not only reaching a new high since 1996 but also being seen by the market as a signal of entering a "historical high range." At the same time, yields on medium- and long-term bonds such as the 10-year and 30-year also climbed in tandem, with the 10-year yield briefly surpassing 1.8% and the 30-year yield approaching 3.41% at its peak. This collective rise in yields is not an isolated technical fluctuation but is driven by a combination of significantly weakened demand in Japanese government bond auctions, investors demanding higher compensation, and expectations that Japan may end its decades-long ultra-loose monetary policy. In the short term, funds that had previously remained cautious about a policy shift in Japan have begun to interpret this change as confirmation of the "end of the zero interest rate era," causing global risk asset sentiment to shift from hesitation to a clear defensive mode. Especially after a repricing of interest rates in Japan, where the debt/GDP ratio exceeds 260% and is considered one of the world's largest "interest rate leverage points," the market is concerned that yen carry trade unwinding and global liquidity withdrawal will cause even more severe price and leverage liquidation shocks to highly volatile crypto assets such as bitcoin, with a tendency toward sharp adjustments that first slash valuations and then re-evaluate logic.

Yield Curve Anomalies

The two-year yield had just broken through 1% previously, marking the first time since 2008 that this level was reached. After the breakthrough, it quickly climbed further to 1.155% in a short time window, with such speed that many institutions have compared it to the rate hike cycle of the mid-1990s. Since 1996, Japan has been mired in an environment of near-zero or even negative interest rates, with short-term yields suppressed at extremely low levels for a long time. This round of climbing from near zero to above 1%, and then approaching 1.2%, is seen as one of the most "trend-significant" changes in nearly thirty years. Meanwhile, the 10-year yield is pushing toward 1.8%, and the 30-year yield once rose to around 3.4%, forming a yield curve that is rising almost across the board from the short to the long end, sending a signal that the market is systematically revising up expectations for future inflation, interest rates, and risk premiums. More crucially, recent Japanese two-year government bond auctions have shown weak subscription demand, forcing winning yields higher, with bid-to-cover ratios falling. Investors are only willing to take over at higher interest rates, causing short-term rates to jump even faster and further fueling aggressive repricing of the Bank of Japan's future policy path, amplifying the self-reinforcing mechanism of rising rates at the trading level.

Policy and Debt Pressure

On the policy expectation front, the market had gradually regarded the Bank of Japan's December meeting as a key node, with related pricing at one point showing an over 80% probability of a rate hike in December. After Governor Kazuo Ueda repeatedly sent signals of "early tightening," some institutions further raised the probability of a January rate hike to about 90%, believing that the policy shift has moved from "speculation" to "consensus." This means that the decades-long zero interest rate and yield curve control (YCC) framework is being gradually dismantled, and the "end of the zero interest rate era" has already been reflected in bond pricing and exchange rate performance. The problem is that the Japanese government's debt is extremely large, with a debt-to-GDP ratio exceeding 260%. At such a high leverage level, every 100 basis point increase in rates will significantly amplify long-term fiscal interest expenditure pressure, forcing the government to squeeze more resources from the budget to pay interest, weakening other spending capacity, and exposing debt sustainability issues to a higher rate environment. The rapid surge in yields is seen on the one hand as an inevitable cost of inflation and monetary normalization, and on the other hand, it puts the Bank of Japan in a dilemma: if it raises rates more aggressively to stabilize the yen, curb inflation, and prevent capital outflows, it may intensify selling pressure in the government bond market and fiscal unease; if it continues to suppress rates through bond purchases and verbal guidance, it may worsen yen depreciation and imported inflation risks, damaging policy credibility. This tug-of-war itself is seen by the market as a potential source of systemic risk.

Liquidity and Sentiment

A sharp rise in yields often resonates with a strengthening of the local currency, and Japan is no exception. As yields on two-, ten-, and thirty-year government bonds rise, the market's pricing of a narrowing interest rate differential between Japan and overseas increases the yen's attractiveness, forcing a reassessment of previous large-scale short yen carry trades that profited from the spread with the US dollar or other high-yield currencies. Against the backdrop of expected yen appreciation and rising financing costs, the average global funding cost moves higher, directly suppressing leveraged trading and risk appetite. Over the past year, whenever expectations of a Japanese rate hike heated up and yields surged, global high-risk assets often came under pressure simultaneously. Bitcoin and other crypto assets experienced nearly 30% drawdowns during such periods, reflecting the linkage between tightening liquidity expectations and declining risk appetite. Meanwhile, the narrative of "Japanese government bonds = global financial time bomb" has rapidly spread among social media and KOLs. Some opinions emphasize that a 30-year yield rising above 3% will trigger a global bond price repricing and a chain reaction of deleveraging. Panic language and extreme analogies will, in the short term, amplify hedging sentiment and protective selling, reinforcing already fragile market sentiment and causing price volatility to significantly exceed changes in fundamental variables themselves.

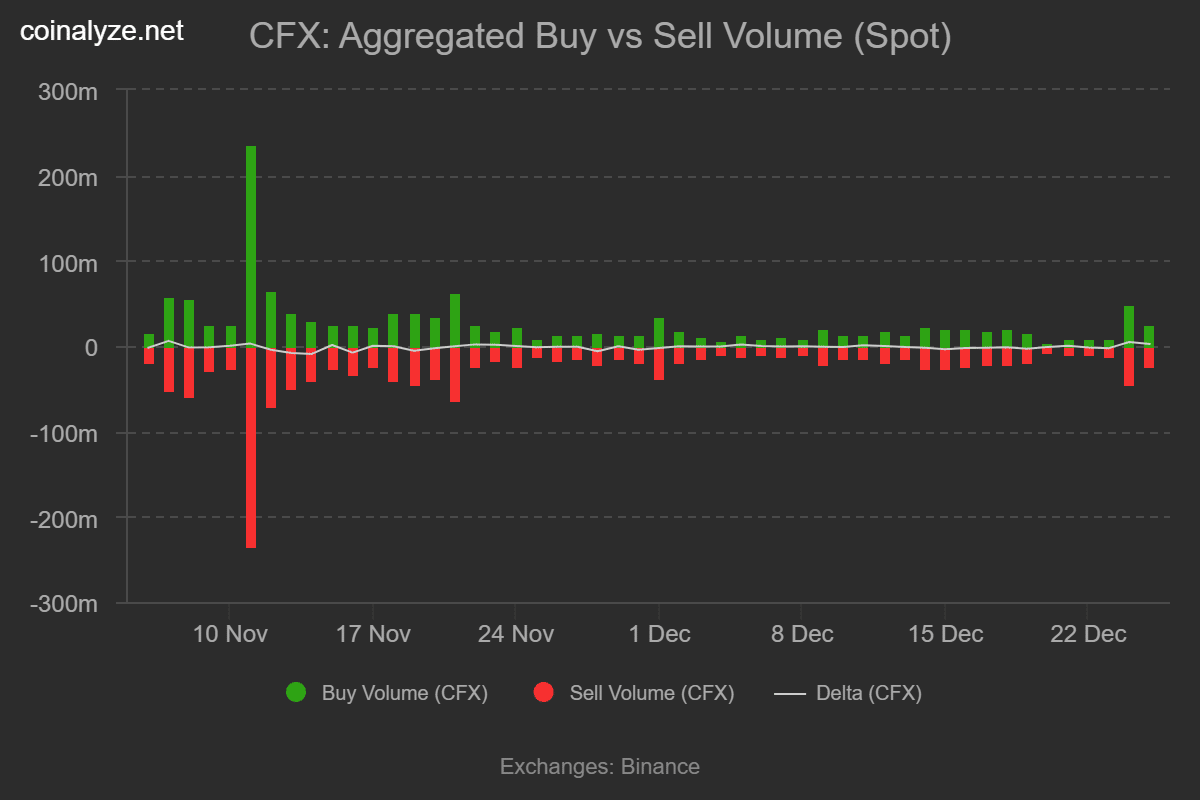

Crypto Market Linkage

Historically, rising expectations of Japanese rate hikes and surging yields have often coincided with deep corrections in the crypto market. Research shows that during the early December period when rate hike expectations intensified and the two-year yield hit a new high since 2008, leading crypto assets such as bitcoin recorded a maximum drawdown of nearly 30%, with some highly leveraged altcoins falling even more dramatically. The reason is not a single bearish factor, but rather a chain reaction caused by a synchronized adjustment in global liquidity pricing. In an environment where global capital regards Japan as a key funding source, once yen funding costs rise and carry trades contract, the "cheap leverage" available for speculating on highly volatile assets naturally tightens, amplifying crypto assets' sensitivity to interest rate and exchange rate changes. A stronger yen and a narrowing spread with the US dollar or other major currencies will prompt institutions to reassess the risk-reward ratio of crypto assets and yen-related arbitrage strategies in multi-asset portfolios: on the one hand, some funds may passively reduce crypto positions to cope with margin pressure or to cover yen liabilities; on the other hand, some funds may proactively lower their exposure to high-beta assets, withdrawing leverage from crypto and emerging markets to buffer against the risk of further rate hikes. This cross-asset, cross-market rebalancing logic allows changes in Japanese government bond yields to be transmitted to the crypto market through three channels: funding costs, leverage constraints, and risk budgets.

Bull and Bear Logic Game

From the bearish perspective, rising Japanese rates are seen as the starting point for global deleveraging: falling bond prices, rising funding costs, and yen carry trade unwinding will force a rewrite of asset valuations that were predicated on a low-rate environment, with risk assets overall facing valuation compression and increased volatility. Given that Japan's debt/GDP exceeds 260% and the 30-year yield breaking 3% has been described as "shaking the foundation of global finance," the bearish chain of reasoning is usually: Japanese government bond selling pressure → global interest rate center moves up → asset discount rates rise → bubbles in high-valuation assets such as stocks and crypto are squeezed. From the bullish perspective, another long-term logic is emphasized: in an era of high debt, high deficits, and continuously rising nominal interest rates to combat inflation and currency credit erosion, crypto assets such as bitcoin, which do not rely on sovereign credit, have the opportunity to gain relative allocation value as fiat currency credit is diluted over the long term. Especially when real yields on traditional bonds remain low or even negative for a long time, some long-term funds view crypto assets as an option to hedge structural risks in the monetary system. The key differences between the two sides focus on two questions: first, whether Japan will experience a debt crisis due to uncontrolled yields, triggering a passive global asset reallocation; and second, whether this process will be a sharp short-term deleveraging or a long-term smooth clearing, which will determine whether the crypto market experiences a one-off sharp sell-off or is gradually absorbed by longer-term capital amid volatility.

Future Scenarios

In a relatively moderate scenario, if the Bank of Japan chooses a gradual rate hike and manages to control two- to ten-year yields near current levels through disciplined government bond purchases and communication management, with only a slow upward move, the impact on crypto assets will most likely remain in the "neutral to slightly bearish" range: on the one hand, higher liquidity pricing and a stronger yen will suppress some leverage demand, limiting the crypto market's upside elasticity; on the other hand, as long as the yield curve does not steepen uncontrollably, risk assets will still have time to digest valuations and positions. If a more extreme scenario unfolds, with yields continuing to rise out of control and the short end approaching or even breaking higher thresholds, triggering concentrated concerns about Japan's debt sustainability, then not only might yen carry trades be unwound on a large scale, but global risk assets could also experience simultaneous forced deleveraging. Extreme volatility in the crypto market (including single-month drops of over 30% and concentrated on-chain liquidations) will need to be considered as a high-probability event. From a trading and risk management perspective, investors should focus on several indicators: the slope and volatility of Japanese government bond yields across different maturities, the direction and magnitude of the yen against the US dollar, changes in global funding rates and capital costs, as well as bitcoin futures leverage ratios and forced liquidation data. In terms of position management, a more conservative approach is to moderately reduce leverage multiples, control concentration in single assets, and reserve risk budgets ahead of key Japanese policy meetings, using options or hedging tools to cope with tail volatility, rather than stubbornly resisting trend reversals with high leverage at liquidity inflection points.