Since facing rejection at $0.146 nearly a month ago, Conflux has traded inside a descending channel, sliding to a local low near $0.06.

After weeks of sustained weakness, the token attempted a rebound, briefly rallying to $0.078 before pulling back.

At press time, Conflux [CFX] traded at $0.072, up 8.7% on the daily chart. Trading activity also picked up sharply, with volume rising 358% to $58 million, while market capitalization climbed toward $400 million.

The spike pointed to renewed short-term participation, though price structure remained fragile.

Conflux’s partnership with PlaysOut lifts sentiment

In a significant boost to a struggling CFX, PlaysOut and Conflux announced a partnership to explore AI-driven gaming and cross-chain interoperability.

According to the announcement, both teams plan to collaborate on scalable blockchain infrastructure, AI-supported engagement tools, and next-generation gaming use cases.

The partnership also outlined potential deployment of mini-game experiences within Conflux’s Layer 1 environment, alongside initiatives focused on Web2-to-Web3 onboarding and regional market expansion.

The announcement acted as a short-term sentiment catalyst, triggering a rush of speculative buying across spot markets.

Binance buyers dominate spot activity

After Conflux and Playsout announced their partnership, demand for CFX accelerated. On Binance, for example, buyers rushed into the market, fearing they would miss out on potential gains arising from the relationship.

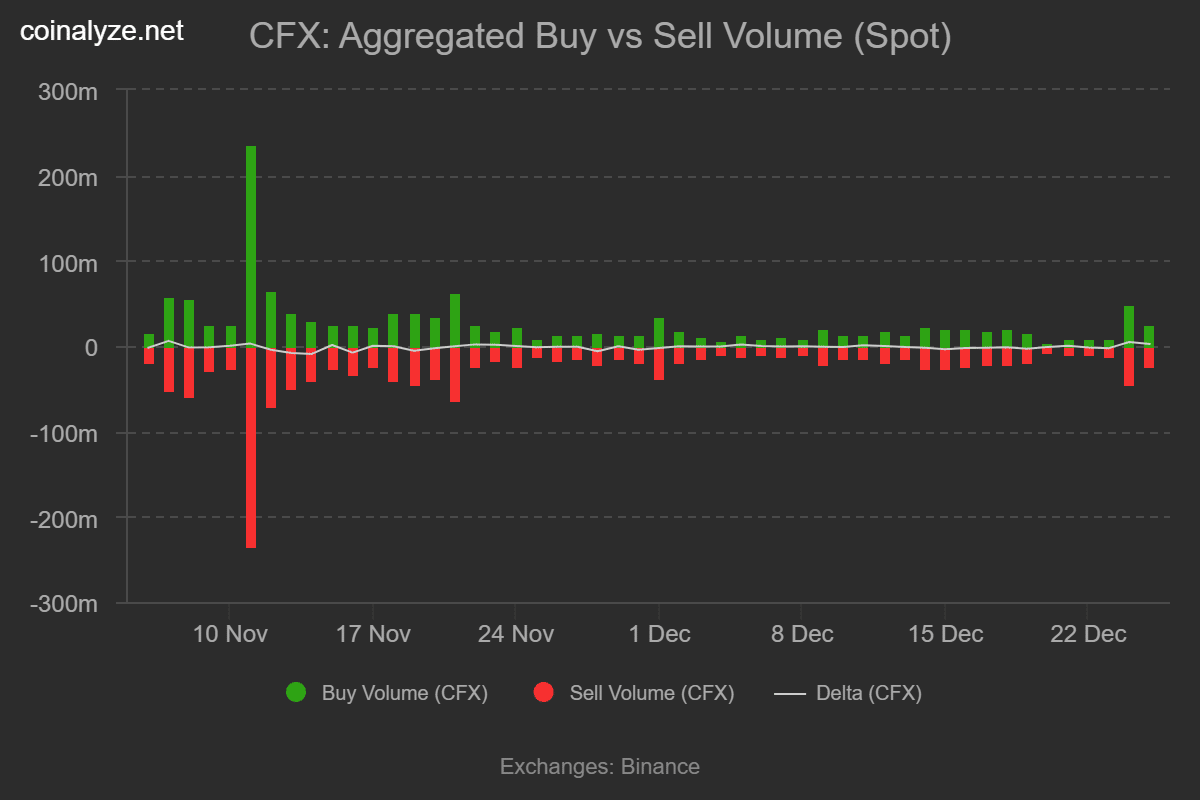

Coinalyze data showed that Buy Volume surged to 74.83 million, compared to 67 million in Sell Volume, between the 24th and the 25th of December.

Source: Coinalyze

For that reason, the market recorded a positive Buy Sell Delta of 7.8 million, a clear sign of aggressive spot accumulation.

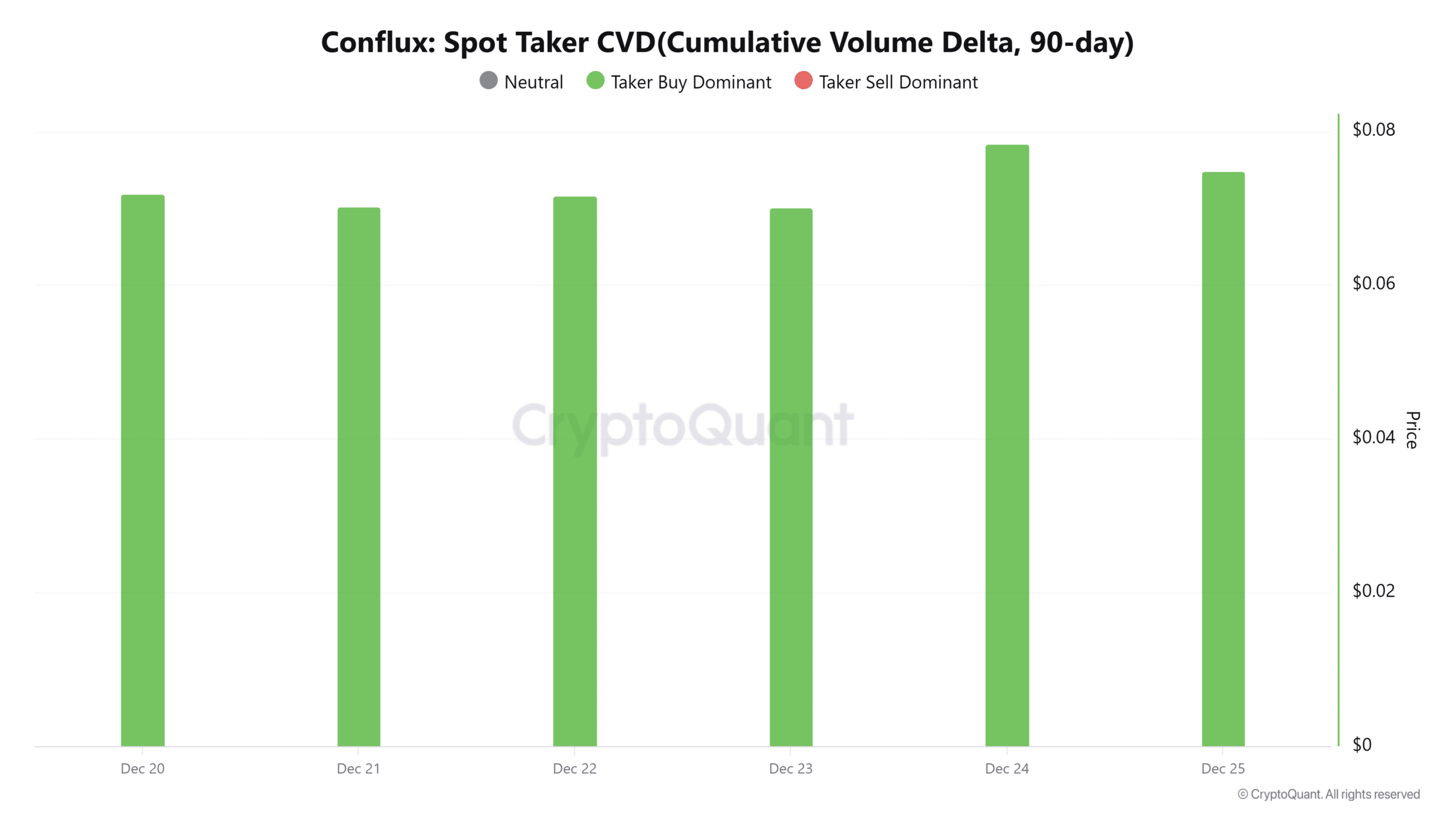

Even more importantly, Spot demand was not limited to Binance, as more buy orders were executed across the spot market.

In fact, Spot Taker CVD data from CryptoQuant showed Buyer Dominance jumped to a weekly high on the 24th, reflecting fresh demand.

Source: CryptoQuant

Profit-taking resurfaces as price stalls

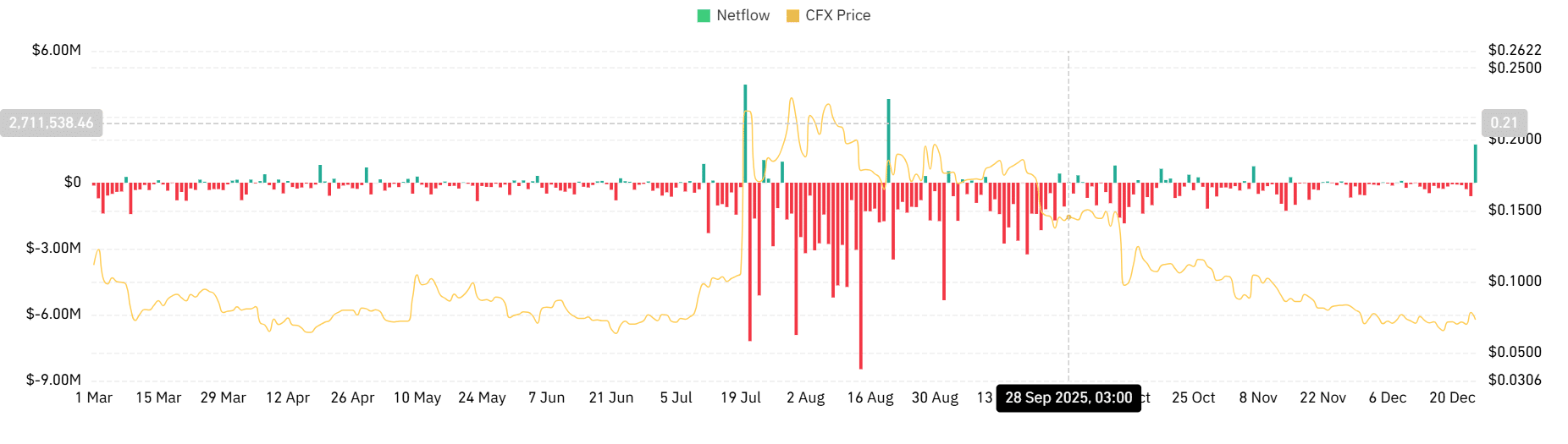

Despite the rebound, signs of distribution quickly followed. Data from CoinGlass showed Spot Netflow turning positive for the first time in nearly three weeks.

At press time, net inflows stood at $1.73 million, levels last seen in August.

Positive netflows typically reflect increased exchange deposits, often associated with profit realization after sharp rallies.

Source: CoinGlass

Historically, such spikes in profit-taking have coincided with renewed downside pressure for CFX, especially when broader trend momentum remains weak.

Just a short-term bubble?

Technical indicators echoed the mixed setup.

Conflux’s Relative Strength Index briefly pushed into bullish territory, touching 54, before sliding back to 47 at press time. The pullback suggested that sellers absorbed recent buying interest.

Source: TradingView

In fact, the Trend Strength Index (TSI) remained negative, at -11 at press time, indicating intense bearish pressure.

These market conditions pointed towards a fierce battle between sellers and buyers seeking market control. Thus, the next move depends on who overwhelms the other.

If buyers hold onto the momentum they recently showed, Conflux could target $0.093. Conversely, if sellers manage to overpower them, CFX could drop to $0.068.

Final Thoughts

- Conflux and PlaysOut announced a partnership to explore AI-driven gaming and cross-chain interoperability.

- CFX bounced back from a month-long downtrend and briefly touched a high of $0.078, then retraced to $0.072.