When Saturn Retrograde Meets Bitcoin: The Collective Healing Behind the Crypto Metaphysics Craze

Original author: San, Deep Tide TechFlow

AI fortune-telling is no longer a novelty; it can analyze facial features, choose seats for mahjong, and predict just about anything.

But the crypto world plays by different rules, taking fate and mapping it directly onto K-line charts.

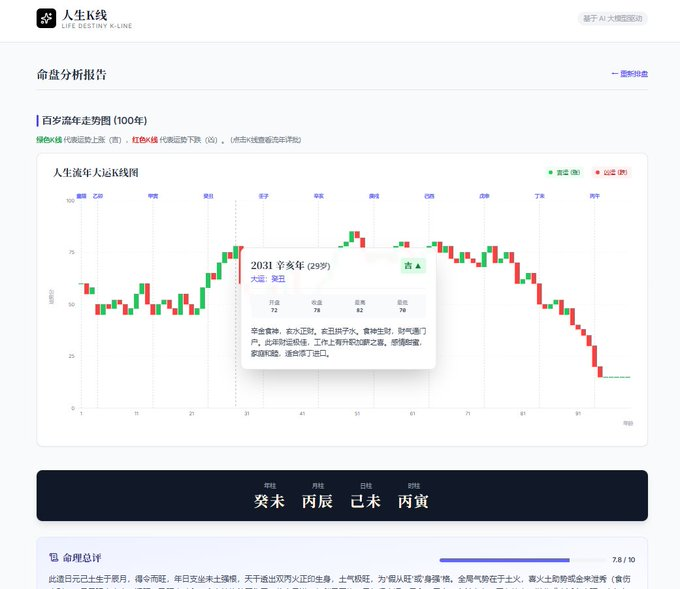

On December 13, crypto metaphysics content creator @0xSakura Sakura released something new: an app called "Life K-Line."

By entering your birth information, AI generates a K-line chart from age 1 to 100, with red and green candles depicting your life fortune.

This thing went viral on Twitter. The initial tweet garnered over 3.3 million views, and within three days, the website and API had been accessed over 300,000 times. People started frantically sharing screenshots, with many claiming that the generated K-line closely matched the ups and downs of their real lives.

Even more surreal, within 24 hours of launch, a copycat token with the same name appeared, despite the tool being clearly labeled "for entertainment only."

Why can an entertainment-based fortune-telling tool resonate so strongly in the crypto world?

Behind this is the long-standing undercurrent of metaphysics in trading, as well as a collective release of anxiety within the crypto community.

The Metaphysics Faction in the Trading Industry

It's not surprising that crypto traders believe in metaphysics. Wall Street is no different.

W.D. Gann was one of the most famous market analysts of the 20th century and the person who most deeply combined mysticism and technical analysis on Wall Street, using astrology to predict market trends and trade.

Soros admitted in "The Alchemy of Finance" that he would judge market risk based on the severity of his back pain. When the market was about to reverse, his back would hurt intensely.

But these stories have long remained at the level of "legend," with few people openly admitting to using metaphysics to guide their trading.

Privately, one might arrange feng shui, wear lucky beads, or consult a master for market readings, but letting peers know would be seen as unprofessional.

The crypto world has broken this taboo.

In this inherently mysterious industry, metaphysics seems naturally compatible. Some people predict BTC's fortunes for the coming year based on their birth chart, while others decide whether to open a position based on today's fortune.

Moreover, discussions about metaphysics in the crypto industry seem to have increased in recent years. More and more people, whether out of belief or curiosity, are joining the ranks of metaphysical trading, and Twitter has seen the rise of many crypto influencers who use metaphysical analysis as their personal brand.

The viral success of "Life K-Line" is a manifestation of this trend.

A large number of users in the community discuss their "life trends" with varying degrees of seriousness or humor. They don't see themselves as "superstitious"; they're just using a more interesting way to share their feelings about uncertainty with peers.

The status of metaphysics among traders has changed—from a Wall Street secret to a public topic on crypto social media.

Why Metaphysics Is More Popular in the Crypto Industry

Why do crypto traders need metaphysics?

The answer to this question can be roughly divided into three reasons.

Psychological Compensation for Anxiety About Uncertainty

The crypto market is a perfect environment for generating anxiety.

Trading is 24/7, year-round, with no circuit breakers; wild price swings can happen in an instant.

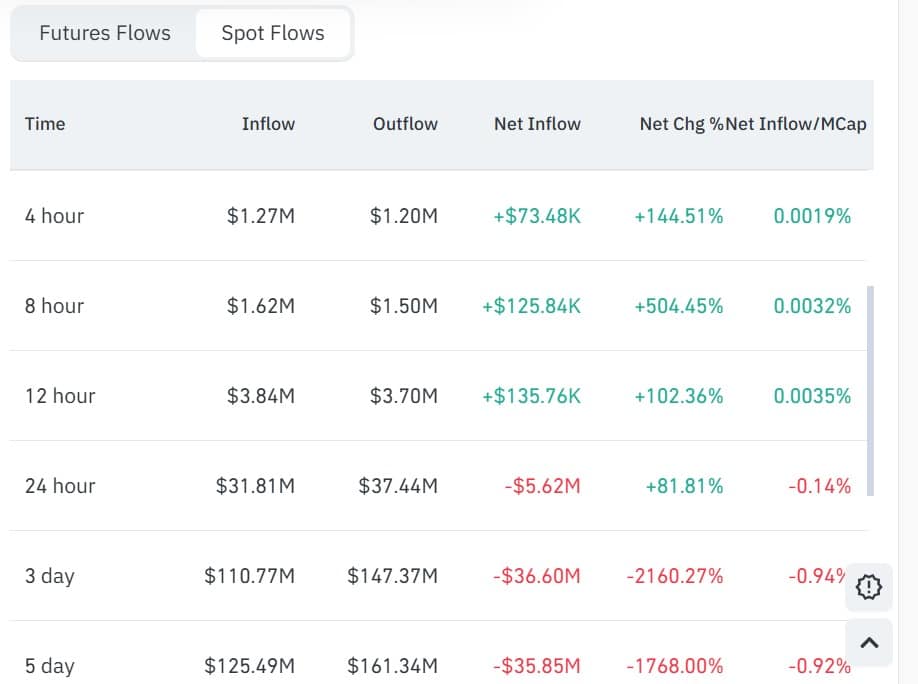

Here, a single tweet from a major influencer can instantly wipe out hundreds of millions or even billions of dollars from a coin's market cap, and the founders of well-packaged projects can disappear overnight.

Traders constantly face "unknown risks," and the most terrifying part is not the "risk" itself, but the "unknown."

Economist Frank Knight pointed out in 1921: risk is a quantifiable probability (like rolling dice), while uncertainty is an unquantifiable unknown (like whether war will break out tomorrow).

Humans are naturally afraid of "uncertainty." When we can't quantify risk, we instinctively create "false certainty" to ease our anxiety.

Metaphysics is the best vehicle for this false certainty.

When you can't find direction, opening today's trading almanac at least gives you a clear instruction.

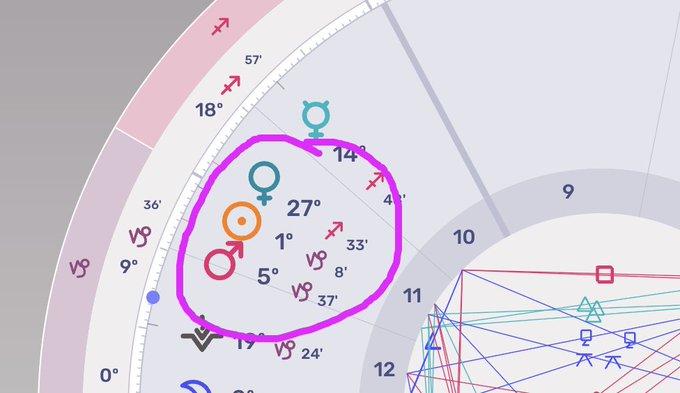

Within the crypto world, the crypto astrologer @AstroCryptoGuru, who has 51,000 followers, uses Bitcoin's "birth chart" (the genesis block time on January 3, 2009) combined with planetary cycles for predictions:

Saturn signals correspond to bear markets, Jupiter signals to bull market tops. He claims to have successfully predicted the bull market peak in December 2017, the bear market in 2022, and the BTC stage high in 2024.

This method of tying specific dates to celestial events gives traders a clear "waiting signal" during times of market confusion—even if that signal comes from outer space.

"Don't open positions during Mercury retrograde, there will be a crash at the full moon, the birth chart shows a BTC bull market next year"—these directions require no complex technical analysis or reading of obscure whitepapers, just belief in "destiny."

A 2006 study by the University of Michigan found that stock market returns in 48 countries were 6.6% lower during full moons than new moons.

This isn't because the moon really affects the market, but because collective superstition influences trader behavior. When enough people believe "the full moon will cause a crash," they sell early, and the crash actually happens.

In the crypto world, this collective anxiety is even more intense, especially during bear markets, when all "fundamental analysis" and "value investing" become jokes, making metaphysical analysis seem more reliable.

So traders need metaphysics not because it's accurate, but because it provides an explanation. Even if that explanation is false, it's easier to accept than endless uncertainty.

Cognitive Bias Leads to Self-Reinforcement

Why does metaphysics always "seem effective"?

The reason metaphysics continues to be popular in the crypto world is not just because it relieves anxiety, but because it "really seems to work."

It's not that metaphysics is accurate, but that cognitive biases in our brains reinforce themselves.

The most typical is confirmation bias: when you believe "the full moon will cause a crash," you remember every crash after a full moon and ignore the days when the market rose or stayed flat. When your "Life K-Line" shows a bull market this year, you attribute every small rise to "the chart coming true," and explain away crashes as "short-term corrections that don't affect the big trend."

Image source @Drazzzzz

And the crypto social media environment amplifies this bias many times over.

"I went long on ETH contracts based on tarot card advice and made 20% in three days!" Tweets like this are likely to be widely retweeted, liked, and shared.

But traders who lost money following tarot advice won't post, and won't be seen.

As a result, the entire community's information flow is filled with cases where metaphysics "came true," while failures are filtered out.

Similar examples are everywhere on Twitter. For instance, when @ChartingGuy's blood moon prediction window arrived in March this year, no matter whether the market went up or down, there was always an explanation: "peaked early," "delayed fulfillment," or "needs to be combined with other planetary angles."

And if BTC happened to pull back during that period, the tweet would be repeatedly cited as a "divine prediction."

When BTC crashes, traders desperately need a reason. We look through social media: technical analysis says "broke support," macro analysis says "Japan raised interest rates," but these explanations are too complex and uncertain.

Metaphysics, on the other hand, provides a simple and clear answer: "Saturn is retrograde, the crypto market is entering a bear cycle."

This explanation requires no understanding of market trends, policies, or data—just belief that celestial movements affect the market. So it spreads quickly and becomes consensus.

More importantly, the ambiguity of metaphysics means it can never be disproven.

The master says not to trade during Mercury retrograde; if you lose money, it's because you didn't heed the advice; if you make money, it's because your chart is special and suited for retrograde trends. If tarot cards show huge volatility ahead, any rise or fall counts as fulfillment.

This characteristic—that any outcome can be explained—makes metaphysics invincible in the crypto world.

So traders aren't superstitious; their brains are just processing information in the most energy-efficient way: remembering what's useful, ignoring what's not, and using simple explanations instead of complex analysis.

Metaphysics is popular not because it's accurate, but because it always appears to be accurate.

The Social Attribute of Metaphysics

Another reason metaphysics is popular in the crypto world is that it has become a kind of social currency.

Talking about technical analysis leads to disagreements, but talking about metaphysics has no right or wrong, only resonance. "Is your Life K-Line accurate?" is widely discussed not because everyone truly believes, but because it's a topic anyone can join—no professional threshold required.

There's an example that perfectly proves the demand for metaphysics.

Previously, our readers kept asking if we could add a fortune-checking feature. After enough requests, we actually added a "Today's Fortune" section to the website.

People don't necessarily use it for decision-making, but they want a common topic—a daily ritual for psychological comfort.

When you say in a group, "Mercury is retrograde today, I'm not opening any positions," no one will question you with "that's unscientific." Instead, someone will reply, "Me too, let's avoid this wave together."

The essence of this interaction is actually to confirm that each other's anxiety is reasonable.

A Pew Research survey in 2025 showed that 28% of American adults consult astrology, tarot cards, or fortune-telling at least once a year.

Metaphysics is no longer a fringe culture, but a universal psychological need. The crypto world has simply turned this need from "private use" into "public display."

In this market with no authoritative answers, metaphysics doesn't provide answers, but companionship.

So, is your Life K-Line accurate?

The viral success of "Life K-Line" lies in expressing, in a crypto-native way, what every trader feels but dares not admit: our sense of control over the market may be as fragile as our sense of control over fate.

When you see your "Life K-Line" showing a bear market this year, you won't really liquidate and exit. But when you lose money, you'll blame yourself less, and when you miss out, you'll feel a bit more comforted:

"It's not my fault, it's just my chart's cycle is off."

In this 24/7, year-round, uncertainty-filled market, what we really want to predict is not our life's trajectory, but a psychological support that keeps us at the table.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analyzing Canton’s 18% surge: Is $0.135 target in sight for CC?

USDT’s Dynamic Impact Sparks a Stablecoin Freeze Focus

10 stories that rewired digital finance in 2025 – the year crypto became infrastructure

XRP Holds Strong As Institutional Demand Surges