Canton Network token rebounded sharply, climbing to $0.109 after dipping to $0.079 three days earlier.

At press time, Canton [CC] traded at $0.1063, up 18.24% on the daily chart, signaling renewed upside momentum. The rally also lifted CC’s market capitalization by over $1 billion, rising from $2.8 billion to $3.9 billion.

That surge raised a key question: what drove the rebound?

Canton buyers defend the dip

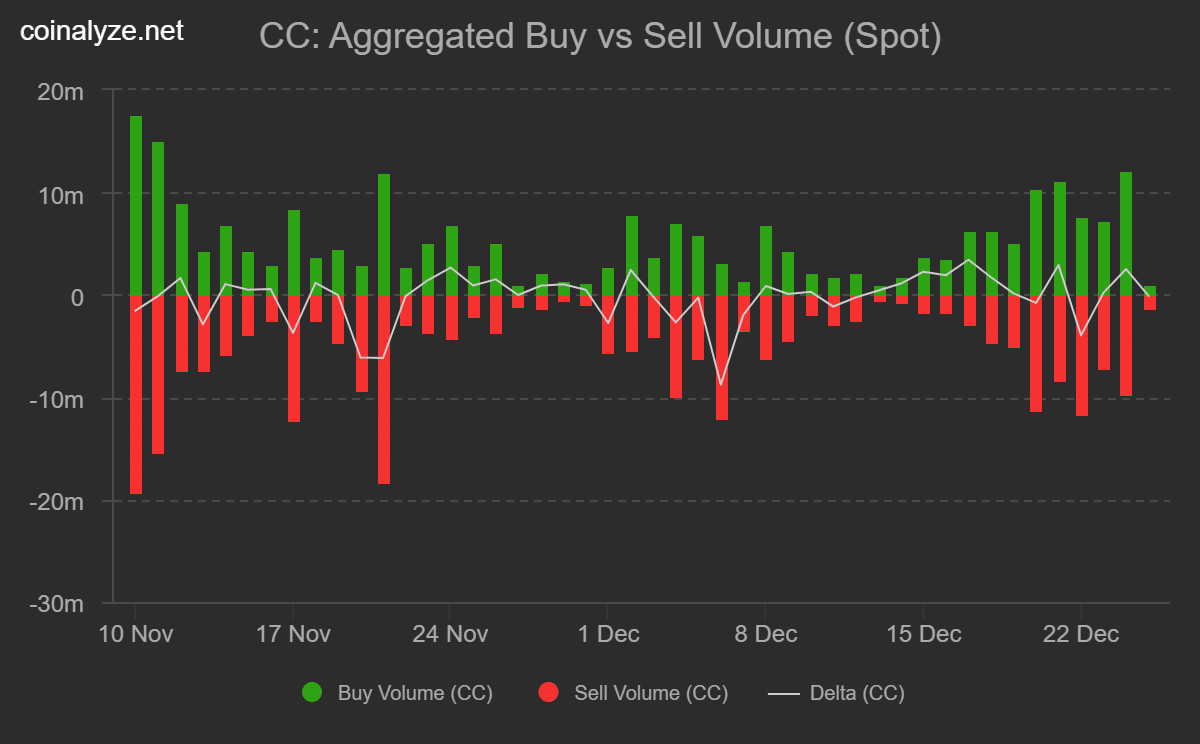

Spot market data showed buyers stepped in aggressively after CC’s recent pullback.

According to Coinalyze, CC recorded 20.3 million in Buy Volume versus 17.9 million in Sell Volume during the rebound phase. That imbalance produced a positive Buy/Sell Delta of 2.4 million, highlighting strong spot accumulation.

Source: Coinalyze

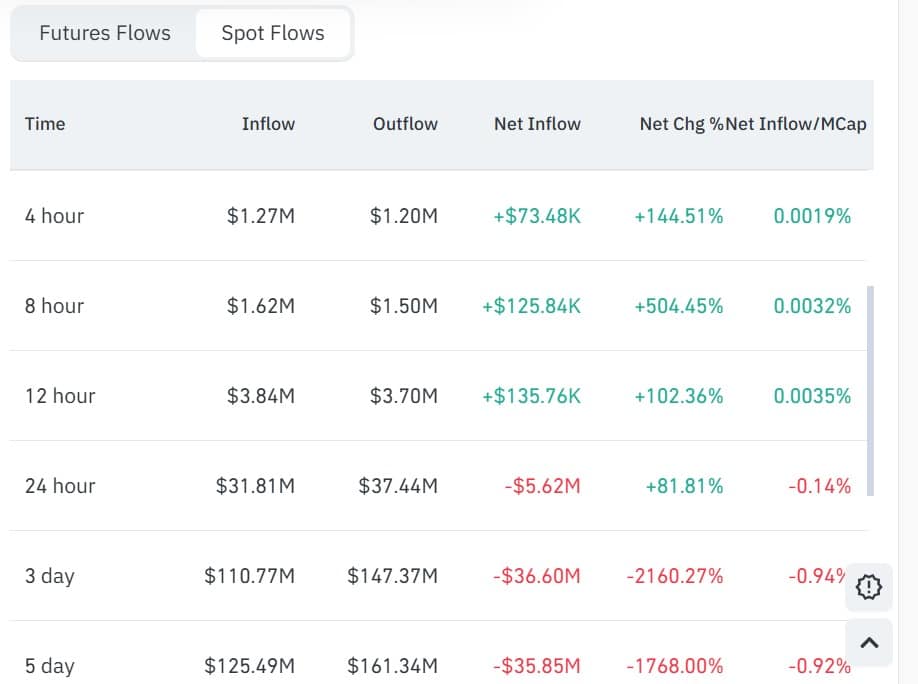

On top of that, exchange flow data reinforced the demand picture.

On the 23rd of December, CC saw $147 million in exchange outflows compared to $110 million in inflows. That pattern persisted.

At press time, CC posted $37.44 million in exchange outflows.

Source: CoinGlass

Over the same period, inflows dropped to $31.81 million, resulting in a -$5.62 million Spot Netflow. Such a drop suggested increased demand, as buyers stepped up to aggressively accumulate the altcoin.

Historically, such exchange behavior has resulted in stronger upward pressure, as experienced over the past day.

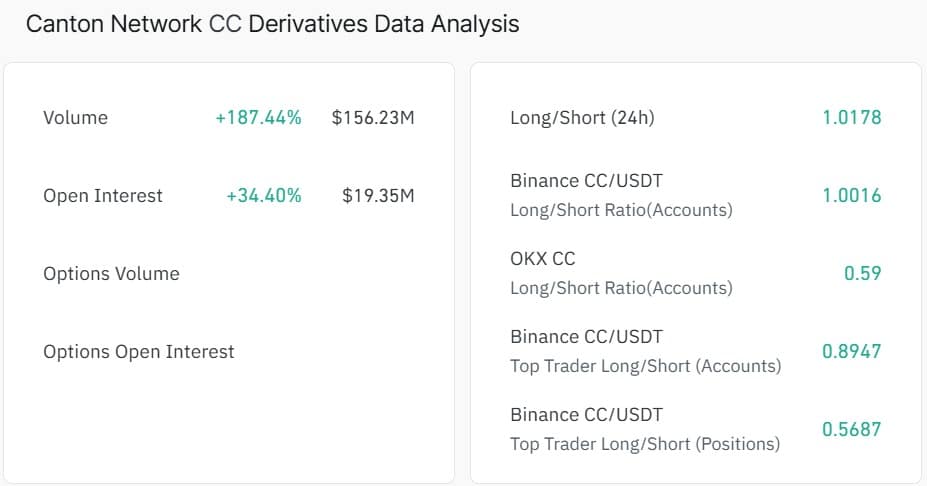

Futures traders follow

Interestingly, after Canton signaled a potential rebound, traders rushed into the Futures market, fearing they might miss out. As such, Derivatives Volume surged 187.44% to $156.25 million while Open Interest hiked 34.4% to $19.3 million.

Source: CoinGlass

Typically, when Volume and OI rise in tandem, it signals increased participation with traders either taking long or short positions.

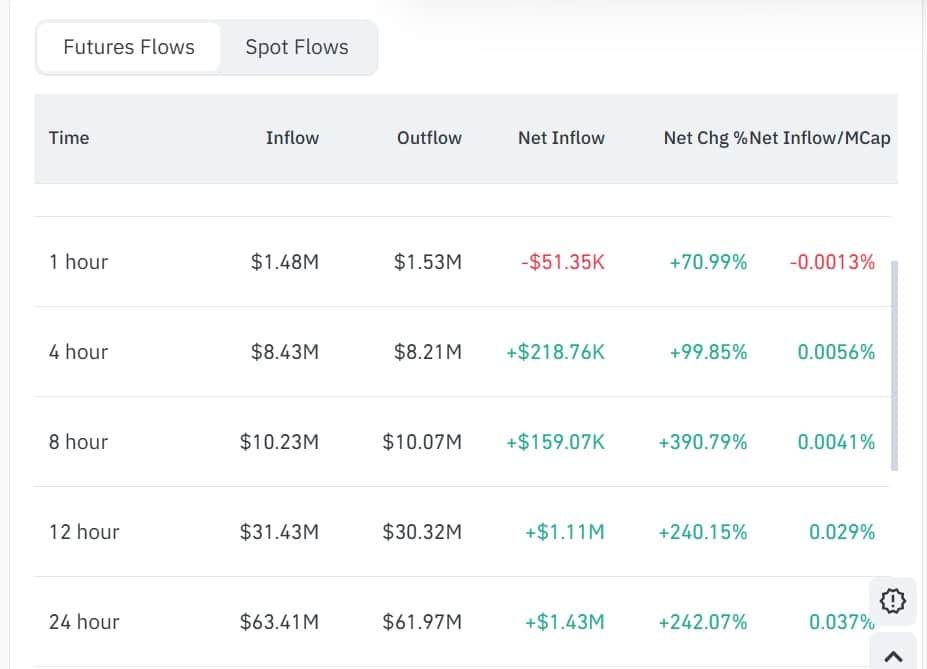

In fact, significant capital was deployed into Futures, where inflows surged to $63.6 million compared to $61.97 million in outflows.

Source: CoinGlass

As a result, Futures Netflow jumped 242% to $1.43 million, indicating increased demand for Futures positions. Often, a higher OI, combined with volume and inflow, has suggested higher demand for long positions.

Can CC hold the momentum?

Technical indicators aligned with the improving flow data.

CC’s Stochastic RSI formed a bullish crossover and entered overbought territory near 83.

Source: TradingView

Meanwhile, the Directional Movement Index showed a bullish crossover, with the trend strength reading climbing above 31.

These signals suggested buyers maintained control, at least in the near term.

Canton’s rebound reflected synchronized demand across Spot and Futures markets. If buying pressure holds, bulls may attempt a push toward the $0.11 level.

A successful break could open the door toward $0.135. By contrast, failure to sustain momentum could trigger a retracement back toward the $0.08 zone.

Final Thoughts

- Canton [CC] rebounded from $0.07 slip and rallied 18% to a local high of $0.109.

- Buyers stepped in and bought the dip across the spot and futures markets, strengthening upward momentum.