Bitcoin News Update: Bitcoin's Surge: Immediate Optimism Versus Long-Term Downtrend Concerns

- Bitcoin's 20% November 2025 rally to $80,000 sparks cautious optimism but analysts warn of unresolved structural downtrends and technical resistance. - Binance's delisting of GMT/BTC and ME/BTC pairs reflects risk management efforts amid evolving regulatory demands for liquidity and asset coverage compliance. - Price forecasts range from $167,598 by 2025 to $250,000 by 2027, driven by post-halving scarcity and ETF inflows despite $4.3B monthly crypto losses. - Technical analysis highlights a broadening a

Bitcoin's November 2025 Rally: Optimism Meets Uncertainty

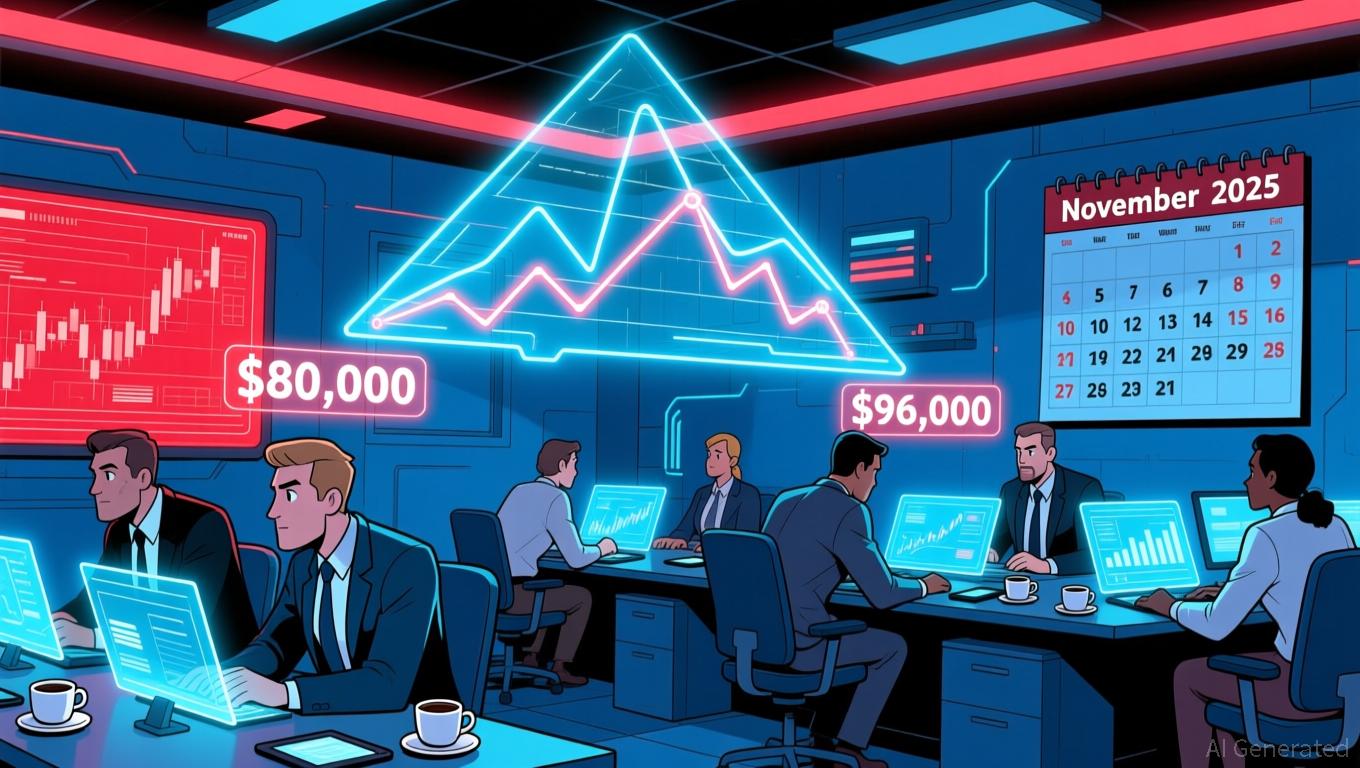

In November 2025, Bitcoin staged a notable recovery, climbing 20% and reigniting hope among investors. Despite this surge, which saw the cryptocurrency approach the $80,000 threshold by month’s end, experts warn that the overall market trend remains downward. After plunging from its record high of $126,296 in the third quarter, Bitcoin now faces significant technical resistance as it seeks to establish a new price baseline.

Short-term traders are eyeing a potential move above $96,000, but many analysts remain wary, emphasizing that the current upswing is fragile and vulnerable to deeper structural issues.

Binance Delistings Highlight Industry Shifts

On November 28, 2025, Binance removed several trading pairs, including GMT/BTC and ME/BTC, as part of its ongoing commitment to risk management and regulatory compliance. These actions, taken in response to recent audits, are designed to maintain liquidity and uphold market stability. Traders are encouraged to adjust their holdings ahead of such changes, as delistings often prompt significant price adjustments. This move reflects a broader trend within the industry to meet evolving regulatory standards, especially concerning asset backing and liquidity management.

Looking Ahead: Bitcoin Price Forecasts Through 2030

Predictions for Bitcoin’s value over the next several years vary considerably. Some analysts foresee a conservative peak of $167,598 by the end of 2025, while more optimistic projections suggest the price could soar to $250,000 by 2027. Much of this speculation centers on the impact of the most recent halving event, which has historically tightened supply and attracted institutional interest. Well-known Bitcoin proponent Max Keiser recently suggested that the current downturn marks the conclusion of a distribution phase, with accumulation underway and the potential for new record highs in 2025. This positive outlook is further supported by renewed ETF inflows, indicating that institutional investors remain confident despite recent losses totaling $4.3 billion in crypto assets.

Technical Analysis: Risks Remain

Despite the recent rally, technical indicators suggest caution. Since 2023, Bitcoin’s price has been confined within a broadening ascending wedge pattern. The breakdown observed in the fourth quarter of 2025 has intensified bearish sentiment. Analysts caution that if Bitcoin falls below the $80,000 mark, it could trigger a wave of liquidations, potentially driving the price down to $53,489 in early 2026. This scenario underscores the ongoing struggle between short-term bullish activity and deeper, unresolved risks, particularly as global economic conditions and regulatory clarity remain uncertain.

Altcoin Market: Volatility and Shifting Trends

Elsewhere, the altcoin sector has experienced heightened volatility. Tokens such as Kaspa (KAS) and Sui (SUI) have seen significant gains, fueled by speculation and technical developments. However, the Altcoin Season Index, which tracks the performance of the top 100 cryptocurrencies relative to Bitcoin, dropped to 22 in late November, signaling a possible end to the extended bull run. Despite this, select tokens like Bonk (BONK) and Ripple (XRP) have recently outperformed Bitcoin, highlighting a rapidly changing market landscape where liquidity is constantly on the move.

Outlook for 2025 and Beyond

As the year concludes, Bitcoin’s future will depend on its ability to overcome key resistance levels and maintain upward momentum. While recent gains offer some encouragement, the market remains exposed to economic shocks and regulatory developments. Investors are urged to approach the market with both optimism and caution, as the cryptocurrency sector continues to navigate a complex transition between accumulation and distribution phases.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fed's Leadership Ambiguity and Divergent Policy Views Fuel Market Fluctuations Ahead of December Meeting

- U.S. Federal Reserve faces speculation over Chair Powell's future amid mixed signals and internal divisions on rate cuts. - Market expectations for a December rate cut surged to 84.7% as officials like John Williams shifted toward easing, while dissenters like Stephen Miran face criticism. - Trump's reported plan to nominate Kevin Hassett as next Fed chair risks politicizing monetary policy, with Treasury yields dipping below 4% on speculation. - OPEC+ supply pauses and political pressures complicate the

XRP News Today: Clearer Regulations Propel XRP ETFs to $628M as the Asset Earns Greater Legitimacy

- Canary Capital's XRPC ETF dominates XRP ETF market with $250M inflows, outpacing all competitors combined. - Grayscale's GXRP and Franklin Templeton's XRPZ drove $164M debut inflows, boosting total XRP ETF AUM to $628M. - 2025 SEC ruling cleared XRP's secondary sales as non-securities, enabling institutional adoption and $2.19 price rebound. - XRPC's 0.2% fee waiver and institutional focus fueled $6B+ ETF trading volumes, reversing prior outflows. - Analysts project $6.7B XRP ETF growth within 12 months

Bitcoin Updates: Anxiety Sweeps Crypto Market, Yet ETFs Ignite Optimism for Recovery

- Crypto Fear & Greed Index hits 20, signaling extreme fear as BTC/altcoins face renewed volatility amid Tether's "weak" stablecoin downgrade. - Tether CEO defends USDt stability with $215B Q3 assets, while Bitcoin-focused firms adopt defensive stances against mNAV risks. - Altcoin Season Index at 25/100 shows modest rebound, with Zcash surging 1,000% and Grayscale filing first U.S. Zcash ETF. - Upcoming spot altcoin ETF launches and potential Fed rate cuts (80% priced) spark optimism despite fragile on-ch

The Impact of Artificial Intelligence on Transforming Business Efficiency and Entrepreneurial Expansion

- AI-driven tools are becoming essential for SMEs and startups to enhance productivity and operational efficiency amid competitive pressures. - McKinsey reports 71% of organizations now use generative AI in 2025, but SMEs lag behind large enterprises in scaling AI adoption. - AI adoption delivers measurable ROI, with case studies showing 15-140% productivity gains in sectors like legal, sales, and customer service. - Investors are prioritizing AI-enhanced SaaS platforms that address SME pain points, enabli