Bitcoin News Today: The Changing Role of Bitcoin: Shifting from an Inflation Shield to a Gauge of the Dollar

- NYDIG analysis reveals Bitcoin's weak correlation with inflation, challenging its "digital gold" narrative as dollar fluctuations increasingly drive its price. - Technical indicators show bearish patterns and divergences, though institutional adoption and macroeconomic factors could still fuel a 2025 rebound. - Bitcoin and gold both respond to dollar strength/weakness rather than inflation, with combined market value nearing 133% of U.S. M2 money supply. - BlackRock's $100B Bitcoin ETF and retirement por

NYDIG's latest analysis suggests that Bitcoin, often promoted as a digital safeguard against inflation, may not fulfill that role as reliably as many investors believe. Instead, the cryptocurrency seems to react more strongly to changes in the U.S. dollar, a trend that could alter its attractiveness as broader economic conditions shift. These insights question a fundamental belief in the crypto community and reveal Bitcoin's increasing connection to mainstream financial markets, according to a

From a technical perspective, Bitcoin's price continues to show significant swings, with conflicting signals about its next move. Recently trading close to $113,000, Bitcoin has developed a "rising wedge" pattern on its weekly chart—a bearish indicator that could potentially drive the price below $60,000 soon, as noted in a

NYDIG's research further highlights the weak link between Bitcoin and inflation. Greg Cipolaro, the company's global research chief, pointed out that the relationship between Bitcoin and inflation metrics is "neither stable nor particularly strong," despite its reputation as "digital gold," as reported by Cointelegraph. Gold, the traditional inflation hedge, shows similarly inconsistent and sometimes opposite movements relative to inflation, according to Cipolaro. Both assets, instead, seem to be more influenced by real interest rates and the strength of the U.S. dollar. When the dollar declines, both Bitcoin and gold typically rise, though they do not move in tandem, according to a

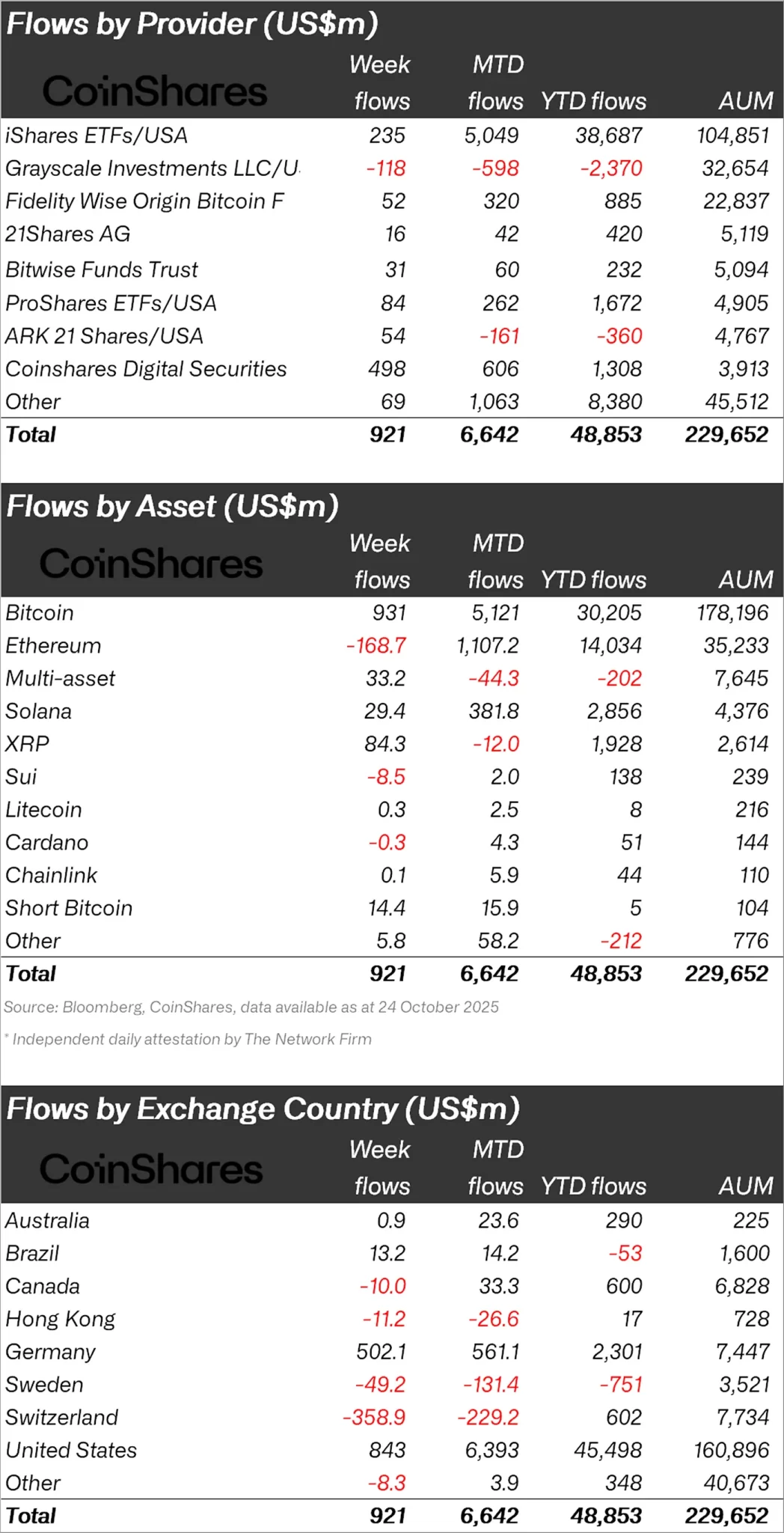

This dollar-driven trend is becoming more significant as global monetary policies change. Jurrien Timmer from Fidelity pointed out that the combined market capitalization of gold and Bitcoin now equals about 133% of the U.S. M2 money supply, approaching record highs from 1980, as mentioned in a

Bitcoin's shifting position within the financial landscape is also altering its risk characteristics. Unlike gold, which has a long-standing reputation as a store of value, Bitcoin's price is becoming more closely linked to liquidity trends and institutional involvement. The rapid growth of BlackRock's Bitcoin ETF, now nearing $100 billion in assets, and the inclusion of crypto in retirement investment options, as reported by FXStreet, underscore this shift. However, with negative funding rates for Bitcoin perpetual contracts and rising open interest, short-term price swings remain a challenge for traders as Bitcoin straddles the line between speculative asset and economic indicator.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pi Network Hits 2.69M Mainnet Users Before ISO 20022 Rollout

Bitcoin gold ratio signals rotation as gold retreats before Fed

Ethereum ETFs hit two-week outflow streak as $555m exitsEthereum breaks through $4,200 resistance barrier