Fed and ETF Boost Cryptocurrency Market! Institutional Investors Sell Ethereum (ETH), Rush to Bitcoin and These Two Altcoins!

This week, Bitcoin and altcoins are focused on the Fed's October interest rate decision and the meeting between US President Donald Trump and Chinese President Xi Jinping.

At this point, while it is almost certain that the FED will cut interest rates by 25 basis points, BTC and the market started the critical week with an increase.

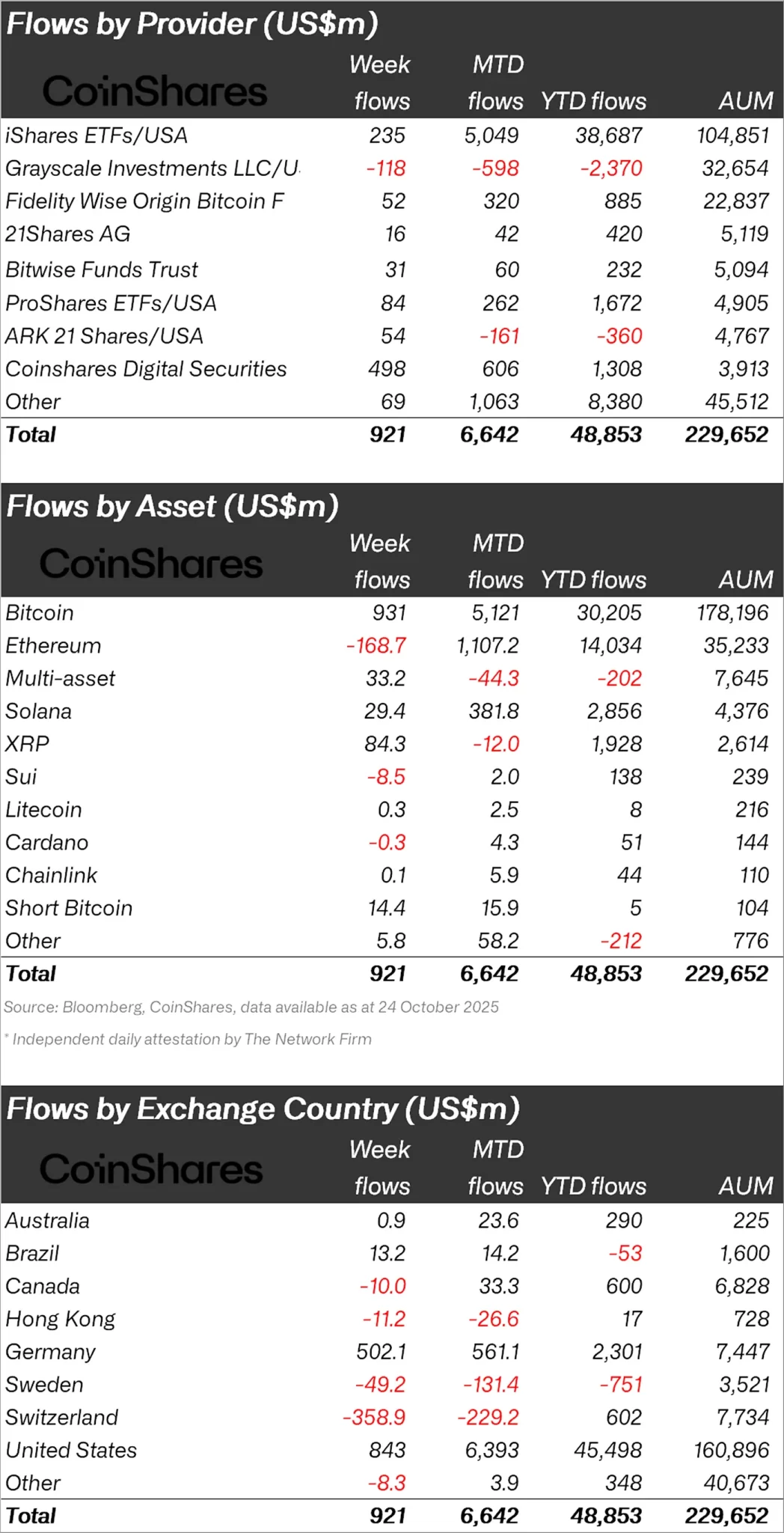

As investors continue to closely monitor market developments with the recovery, CoinShares released its weekly cryptocurrency report and stated that $921 million in inflows occurred last week.

“Following lower-than-expected US Consumer Price Index (CPI) data, investor confidence increased, resulting in an inflow of $921 million into cryptocurrency investment products.”

Bitcoin Enters, Ethereum Exits!

When looking at individual crypto funds, it was seen that the majority of inflows were in Bitcoin.

While Bitcoin experienced an inflow of $931 million, Ethereum (ETH) experienced an outflow of $168.7 million.

When we look at other altcoins, Solana (SOL) experienced an inflow of $29.4 million and XRP $84.3 million, while Sui (SUI) experienced an outflow of $8.5 million.

“A total of $931 million inflows have been made into Bitcoin, bringing cumulative inflows since the US Federal Reserve (Fed) began cutting interest rates to $9.4 billion.

Ethereum saw total outflows of $169 million for the first time in 5 weeks, and daily outflows remained stable throughout the week.

Solana and XRP saw outflows of $29.4 million and $84.3 million, respectively, ahead of their US ETF launches.

When looking at regional fund inflows and outflows, the USA ranked first with an inflow of $843 million.

Following the USA, Germany had an inflow of $502 million and Brazil $13.2 million.

In the face of these inflows, Switzerland experienced an outflow of $358.9 million and Sweden $49.2 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

India's judiciary declares cryptocurrency as lawful property in a historic decision

- India's Madras High Court ruled cryptocurrency as legal property, blocking WazirX from redistributing a user's frozen XRP during its post-hack restructuring. - The court emphasized crypto's "intangible property" status, requiring a ₹9.56 lakh bank guarantee to protect the investor's holdings until arbitration concludes. - The decision challenges offshore restructuring plans, affirming Indian jurisdiction for domestic investments and aligning with global precedents like New Zealand's Cryptopia ruling. - I

Ethereum Update: Despite $169M Loss, Staking Boom and Dencun Enhancements Fuel Optimism for $8K

- Ethereum lost $169M in exchange outflows but leveraged ETPs show strong demand, signaling bullish sentiment. - Bitcoin attracted $921M inflows amid Fed rate cut optimism, highlighting crypto market rotation toward safe-haven assets. - Institutional staking demand and Dencun upgrades reinforce Ethereum's long-term appeal, with $8K 2025 price forecasts. - Macroeconomic uncertainty and Fed policy focus drive risk-on rallies, while ETF approvals could unlock new capital inflows.

Whale deposits $3.72M USDC into Hyperliquid, opens $27.7M BTC long

Spot XRP, Solana, and Litecoin ETFs may launch in next two weeks, expert speculates