Bitcoin’s Path To $120,000 Could Be Delayed as Illiquid Supply Shrinks

Bitcoin’s price recovery faces resistance as illiquid supply declines and new demand weakens. A move above $115,000 is key for BTC to target $120,000.

Bitcoin’s price has been slowly recovering after recent declines, and it has been trading cautiously over the past few days. The rebound has been modest, but the underlying data suggest potential challenges ahead.

A decline in illiquid supply — long-term holdings that rarely move — may hinder Bitcoin’s ability to sustain its upward trajectory.

Bitcoin Holders Are Offloading

Illiquid Bitcoin supply has started to decline again, with approximately 62,000 BTC moving out of inactive wallets since mid-October. This shift indicates that more coins are re-entering circulation, increasing potential selling pressure.

When illiquid supply falls, available liquidity rises, often making sustained price rallies more difficult.

Historically, shrinking illiquid supply signals reduced conviction among long-term holders. Unless new inflows balance this movement, Bitcoin could face headwinds in maintaining its recovery.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bitcoin Illiquid Supply. Source:

Glassnode

Bitcoin Illiquid Supply. Source:

Glassnode

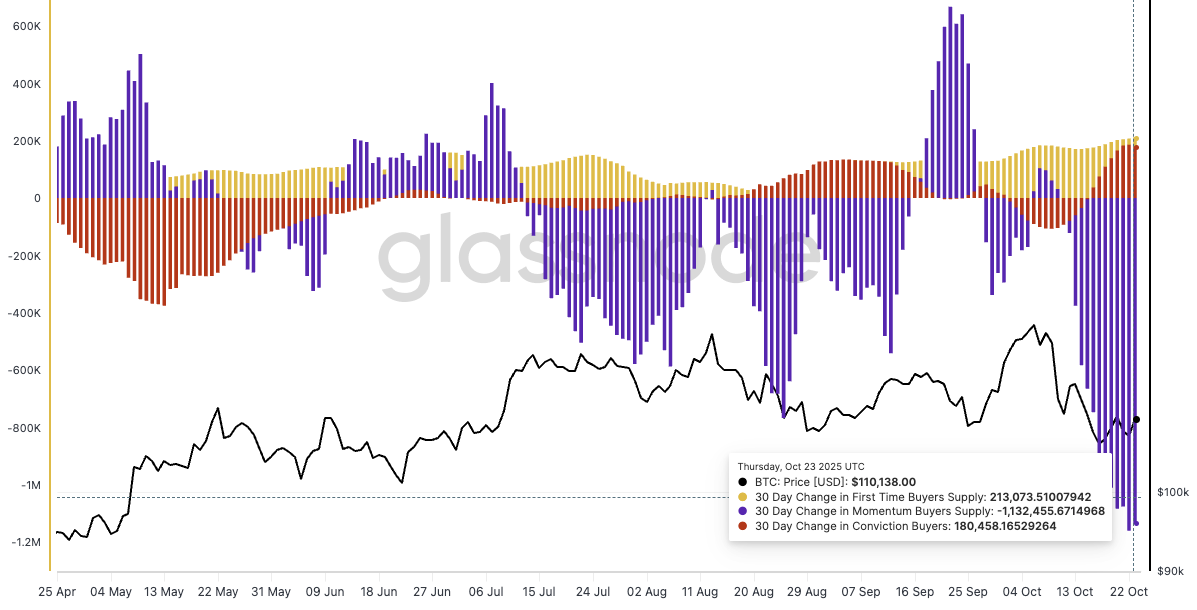

Buyer and seller dynamics show that momentum traders have mostly exited the market. Meanwhile, dip-buyers have not stepped in aggressively enough to counter the growing sell-side pressure. This imbalance has weakened Bitcoin’s upward momentum, keeping it vulnerable to price stagnation or short-term retracement.

Additionally, first-time buyers have remained largely inactive, highlighting limited spot demand. The lack of fresh capital inflows continues to weigh on market strength. Until a stronger wave of buyers re-emerges, the existing equilibrium between sellers and holders is likely to restrain Bitcoin’s breakout potential.

Bitcoin Buyer/Seller Dynamics. Source:

Glassnode

Bitcoin Buyer/Seller Dynamics. Source:

Glassnode

BTC Price Could Face Consolidation

Bitcoin’s price currently stands at $112,513, just above the $112,500 mark. Establishing this level as solid support is critical for sustaining recovery. However, weak inflows and cautious sentiment could make holding this position difficult as traders await stronger signals of renewed demand.

The present market structure suggests Bitcoin may struggle to push past $115,000. Unless liquidity conditions improve, price action may remain rangebound or consolidate above $108,000. Without strong buying momentum, attempts to rally could lose traction quickly.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

For Bitcoin to target $120,000, renewed interest from both retail and institutional investors is essential. A decisive move above $115,000 would likely invalidate the bearish scenario, triggering fresh momentum and attracting new capital into the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DEXs Compete with CEXs as DeFi Trading Volume Reaches $613 Billion in October 2025

- DEXs hit $613.3B in October 2025 volume, up 22.7% from September, driven by liquidity mining and airdrops. - Uniswap led with $170.9B (60.4% rise), while CEXs hit $2.17T, led by Binance's $810.4B. - DeFi growth coincided with crypto volatility; Bitcoin's drop spurred trading as investors repositioned. - Risks include regulatory scrutiny and competition, but DEXs' 19.84% market share highlights growing preference. - Market resilience suggests continued interest in decentralized finance as projects refine

AIOZ Transforms Residences into Decentralized Web3 Internet Centers

- AIOZ Network, a blockchain-agnostic DePIN platform, aims to democratize AI compute, storage, and streaming via peer-to-peer networks, positioning itself as a Web3 infrastructure cornerstone. - The platform integrates AI compute, S3-compatible storage, and low-latency streaming, rewarding users with tokens for contributing idle hardware while enabling creators to monetize content without intermediaries. - AIOZ's tokenomics prioritize real-world usage (e.g., AI tasks, storage) over speculation, fostering a

Ethereum Updates Today: Ethereum ETFs Surpass Bitcoin in Q3 Inflows Amid Rising Interest in Altcoins

- Ethereum ETFs saw $15.97M net inflows in late October 2025, led by Grayscale’s ETH ETF with $56.05M, now holding $1.54B total inflows. - Solana and Litecoin ETFs debuted, with Bitwise’s BSOL attracting $129M in two days, while Grayscale’s GSOL added $4M, signaling altcoin ETF momentum. - Institutional demand shifted toward Ethereum and altcoins, driven by regulatory clarity and Ethereum’s smart contract ecosystem, outpacing Bitcoin’s $8.7B Q3 inflows. - Challenges persist, including limited regulation an

Bitcoin News Update: Crypto Market Liquidity Wipeout Wipes $370 Billion as Trader with Perfect Record Suffers $38 Million Loss

- October 2025 crypto crash erased $370B in 24 hours, triggered by Trump's 100% China tariff and liquidity purge. - A 100% win rate trader lost $38M as BTC/ETH fell 18-20%, with altcoins losing 60-80% amid $19.37B liquidations. - Fed's rate cut exacerbated panic, causing $890M in 24-hour liquidations and pushing Bitcoin dominance above 60%. - Analysts warn of systemic fragility from leverage, geopolitical risks, and U.S.-China tensions, calling it "the worst bull market ever."