B2 Airdrop’s Hourly Limit Reductions Discourage Bots and Promote Fair Participation

- Binance Alpha launched Phase 2 of its B2 token airdrop, requiring 225+ Alpha Points with hourly threshold reductions if unmet. - Users must spend 15 Points to claim 16 B2 tokens, but claims expire after 24 hours without confirmation. - The dynamic system aims to prevent bot activity while promoting B2, a decentralized data infrastructure under Binance's ecosystem. - This aligns with Binance's strategy to expand DeFi offerings and maintain control over token distribution fairness.

Binance Alpha has initiated the second round of its B2 token airdrop campaign, providing incentives to users who possess at least 225 Binance Alpha Points. Announced through official channels on October 25, this program enables qualified users to receive 16 B2 tokens on a first-come, first-served basis, as detailed in a

Participants are required to use 15 Binance Alpha Points to claim their tokens, a measure intended to minimize bot participation and promote equitable access. This deduction must be confirmed on the Alpha event page within 24 hours; otherwise, the claim will be automatically canceled. This approach reflects Binance's commitment to boosting user participation and advancing the B2 network, a decentralized data infrastructure initiative within the Binance ecosystem, as highlighted by Lookonchain.

The structure of the airdrop demonstrates Binance's strategy to distribute B2 tokens in a secure and measured way, balancing ease of access with protective measures. By modifying the threshold in real time, Binance seeks to deter mass front-running and ensure a wide range of users can participate, according to Lookonchain. Experts observe that these efforts are consistent with Binance's larger goal of expanding its decentralized finance (DeFi) footprint and strengthening its role in the rapidly changing crypto sector.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ADA could slip below $0.30 as bearish momentum builds

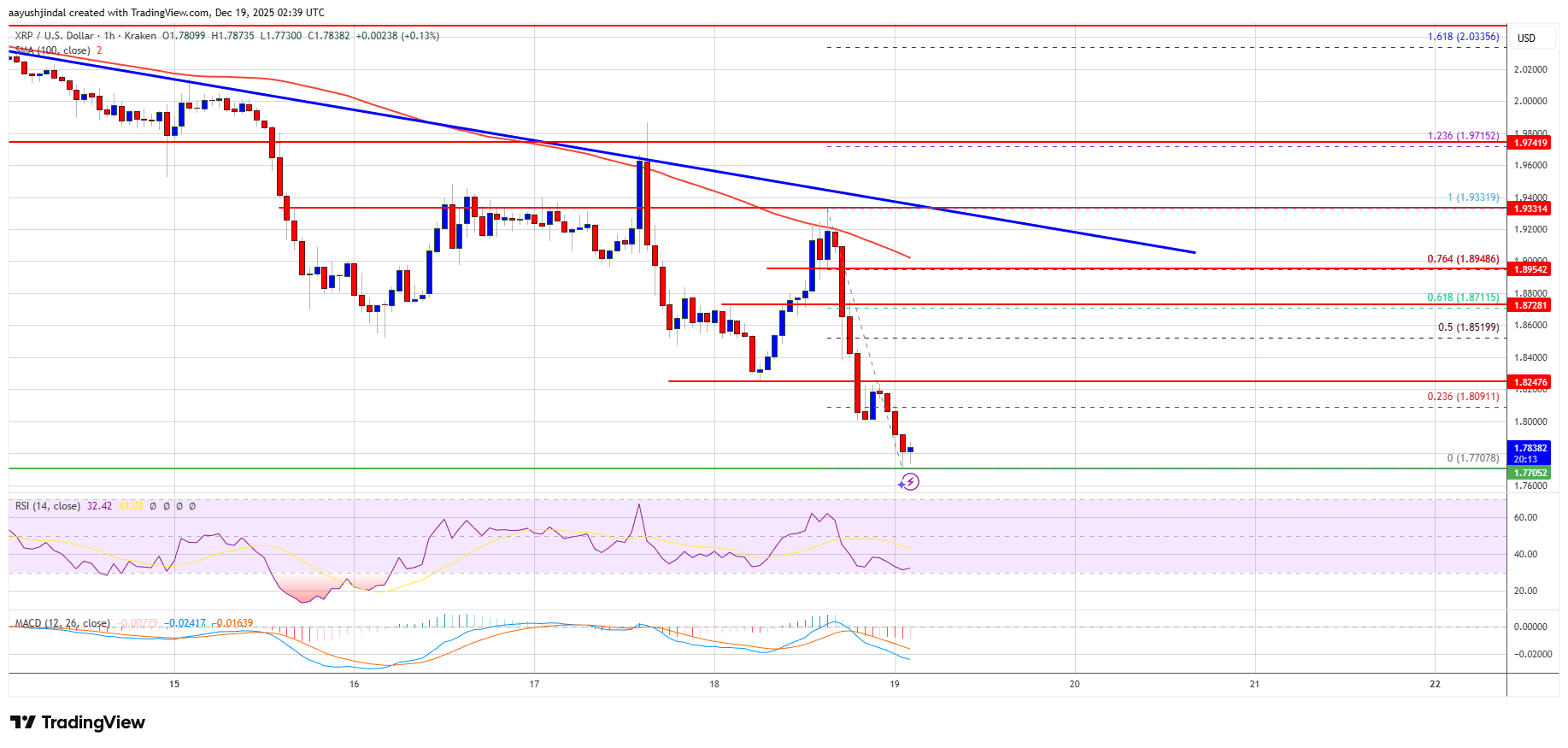

XRP Price Turns Lower as a Familiar Pattern Reappears Again

DAT Remains Uncollapsed as Altcoins Enter Stage 5; Traders Build Watchlists and Place Buy Orders