The Rise of Robots: Balancing Economic Efficiency and Employment Concerns

- Humanoid robots are transforming industries with operational costs as low as $10/hour, driven by automation advances and investor confidence. - Tesla's Optimus robot and China's Leju Robotics ($200M funding) highlight global competition, with Amazon deploying 1M+ warehouse robots for $4B annual savings. - DoorDash's autonomous "Dot" robot and AI-powered data center maintenance demonstrate robotics' expanding roles in delivery and infrastructure. - Robotics-as-a-Service models and $37.4B projected 2032 ma

Once limited to the realm of science fiction, humanoid robots are swiftly establishing themselves as a vital part of the global industrial landscape. Futurist Dr. Pero Micic forecasts that their operational expenses could drop to just $10 per hour, as mentioned in a

Tesla Inc. remains at the forefront of this movement, advancing its Optimus humanoid robot project. CEO Elon Musk recently emphasized the progress made, describing the company's "robot army" as a major advantage during times of financial strain. Despite a 40% decrease in operating profit for the third quarter of 2025, Tesla's $41.6 billion in cash and lower inventory levels highlight its ability to fund ambitious robotics initiatives, according to the Bloomberg live blog. Musk's remarks about the risk of being removed from his position after the robot's launch underline the project's critical role in Tesla's future direction.

At the same time, Chinese companies are ramping up their efforts. Leju Robotics, based in Shenzhen, has recently raised over $200 million in new investment, with Citic Goldstone and Shenzhen Investment Holdings leading the round,

Amazon.com Inc. is utilizing automation to drive down expenses, with Morgan Stanley estimating that warehouse robots could save the company up to $4 billion annually,

Robotics are also transforming last-mile delivery. DoorDash Inc. has recently introduced its autonomous "Dot" robot in Riverside, California, which travels along sidewalks and bike lanes to deliver meals,

The financial rationale for robotics extends into data centers, where automation is expected to expand at a compound annual growth rate of 9.2%, reaching $37.41 billion by 2032,

As the expense of humanoid labor continues to fall, businesses must balance the drive for greater productivity with the societal implications of these technologies. With major players like

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ADA could slip below $0.30 as bearish momentum builds

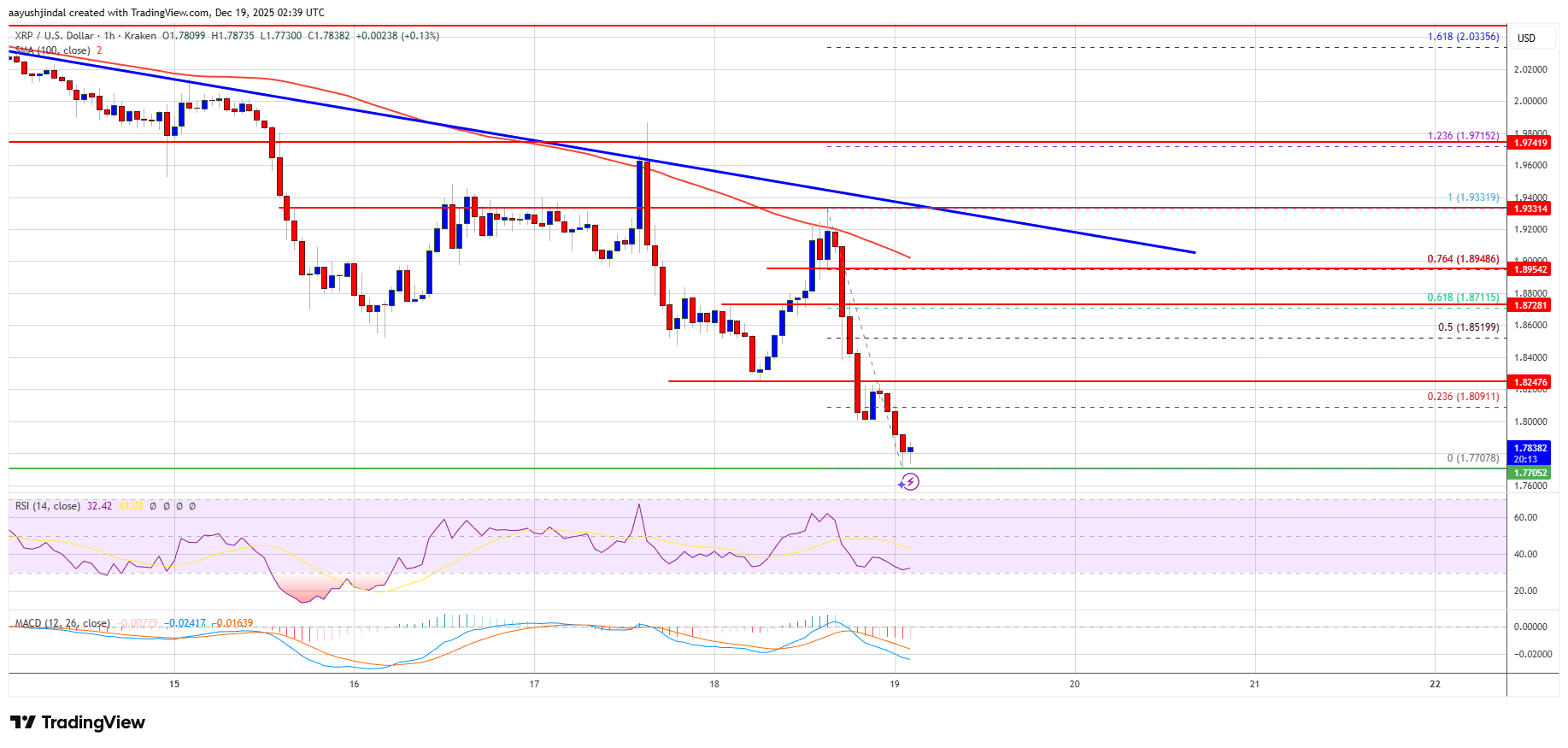

XRP Price Turns Lower as a Familiar Pattern Reappears Again

DAT Remains Uncollapsed as Altcoins Enter Stage 5; Traders Build Watchlists and Place Buy Orders