Investment Bank China Renaissance Plans $600M BNB Treasury With YZi Labs: Bloomberg

Hong Kong-listed investment bank China Renaissance is seeking to raise $600 million to introduce a public crypto treasury focused on BNB, the native token of the BNB Chain that’s widely used for discounts on Binance fees.

The project, if completed, would mark one of the largest single bets on BNB by a publicly listed entity. The largest BNB-focused treasuries among publicly traded companies currently belongs to CEA Industries, which earlier this month raised its total token holdings to 480,000.

The proposed investment vehicle would be formed in the United States and structured as a publicly traded company, designed specifically to buy and hold BNB, Bloomberg reports citing sources familiar with the deal.

YZi Labs, the $10 billion family office of Binance co-founder Changpeng Zhao, plans to invest alongside the investment bank.

BNB has more than doubled in price this year, and recovered quickly from the recent $500 billion crypto market crash. Zhao’s family office reportedly continues to actively organize investor interest, recently hosting a dinner in Singapore titled “BNB Visionary Circle: Igniting the Next Trillion,” signaling ongoing appetite for BNB-centric investments.

BNB’s price has outperformed the market since, being up 5.4% in the last seven days, while major tokens including bitcoin and ether are down significantly over the period. The broader market, as measured by the CoinDesk 20 (CD20) index, dropped 8.45% over the last 7 days.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report|In-Depth Analysis and Market Cap of aPriori (APR)

Stable deposit capped at 5 minutes—are retail investors becoming part of the project's "Play"?

A single address is suspected to have contributed over 60%. Will such "old-school" front-running still appear in 2025?

The peso crisis escalates, stablecoins become a "lifeline" for Argentinians

The role of cryptocurrencies in Argentina has fundamentally changed: from a novelty that once sparked curiosity and experimentation among the public, including Milei himself, to a financial tool used by citizens to protect their savings.

The crypto industry is not becoming more mature, but rather experiencing disorderly entropy increase.

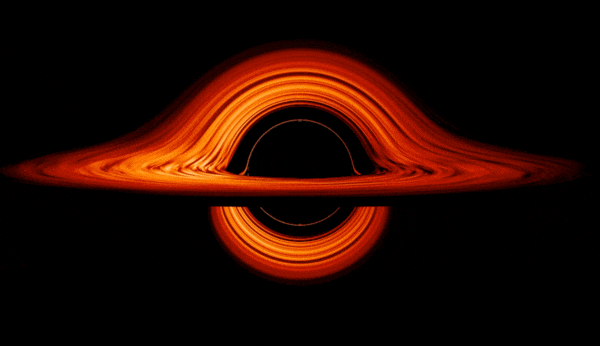

The harsh truth of the market may be that what we are creating is a liquidity black hole, not a flywheel.