Circle denies plans to issue HKD-backed stablecoins

Stablecoin issuer Circle declares that it has no current plans to issue its own stablecoin pegged to the Hong Kong dollar. However, it is open to collaborating with other firms.

- Circle has no plans to launch a Hong Kong dollar-backed stablecoin, instead focusing on expanding the adoption of its U.S. dollar and euro-pegged stablecoins, USDC and EURC, across Asia.

- At the moment, Circle is the world’s second-largest stablecoin issuer, with USDC holding a market cap of $75.28 billion and EURC leading among euro-backed stablecoins.

According to an interview with the Hong Kong Economic Times, the stablecoin firm’s Vice President for the Asia-Pacific region, Chen Qinqi, stated that the company has no plans to issue their own stablecoin backed by the Hong Kong dollar. Instead, it is currently focusing its efforts on expanding the utilization of its U.S dollar-stablecoin USDC and its euro-backed stablecoin EURC.

Hong Kong has seen a major increase in companies expressing interest in obtaining a license to issue HKD-pegged stablecoins, especially since the region released its Stablecoin Ordinance bill, which came into effect on Aug. 1.

The Stablecoin Ordinance provides a legal framework for stablecoin operations in the administrative region and includes requirements that firms need to adhere to if they wish to obtain a stablecoin issuer license from the Hong Kong Monetary Authority.

At the moment, Chen Qinqi clarified that institutional investors in Hong Kong can use USDC in Hong Kong under the existing framework without additional regulation related to the Stablecoin Ordinance. Moreover, the company does currently hold a license from Singapore.

Institutional investors can obtain USDC ( USDC ) either directly from Circle or through their established partners, while retail investors must access it through partners.

Although Circle is not directly regulated in Japan, USDC became the first stablecoin that Japanese regulators have allowed licensed institutions to offer to the public. Both retail and professional investors in Japan can obtain USDC through partners.

Earlier in November, Circle CEO Jeremy Allaire hinted at a possible expansion into Hong Kong, as the company looks to hire more employees and open up a branch in the region. Allaire has also stated that the firm is considering applying for a license under the new framework in Hong Kong.

Chen stated that the company has yet to move forward with plans to open an office in Hong Kong and the team is still in the process of evaluating potential office locations. He refused to comment on any specific steps taken to obtain a license under the bill.

Circle’s stablecoin empire

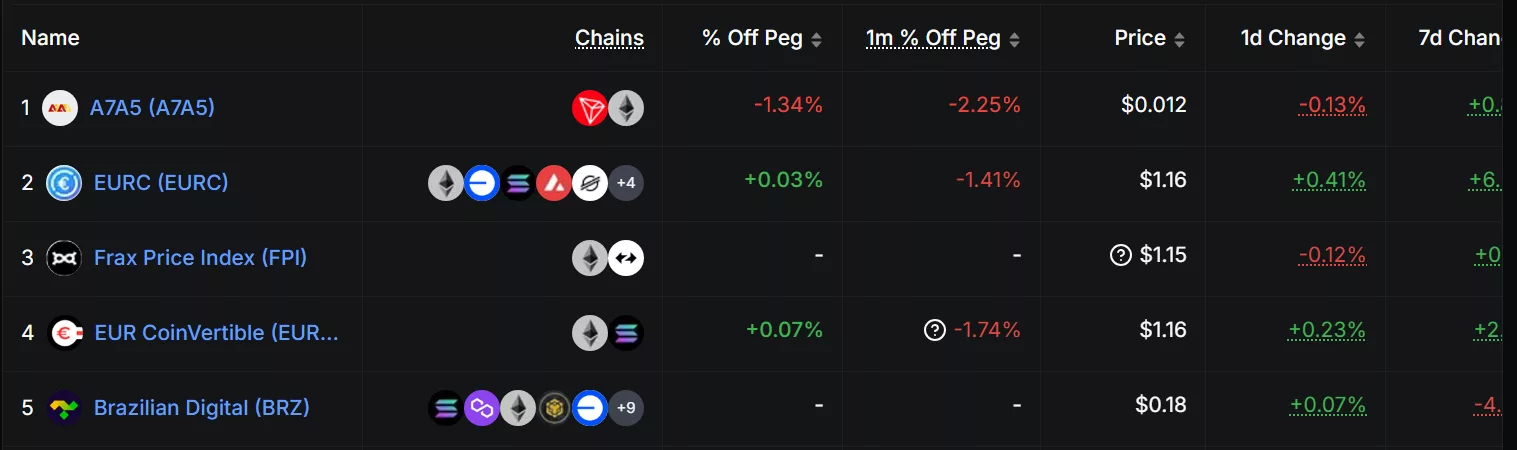

According to data from DeFi Llama, Circle’s USD-backed token, USDC is currently the second largest stablecoin by market cap. Falling behind only to Tether’s USDT ( USDT ), USDC has a market cap of $75.28 billion. However, it does have a faster daily growth rate than Tether, with a rise in market value by 0.41% compared to USDT’s 0.06%.

On the other hand, Circle is still the largest stablecoin issuer by market cap amongst the euro-backed stablecoins. The firm’s EURC ( EURC ) has a market cap of $266.5 million, contributing to more than 45% of the total $570 million market cap generated by euro-backed stablecoins.

Circle is one of the top five non-USD pegged stablecoins by market cap | Source: DeFi Llama

Circle is one of the top five non-USD pegged stablecoins by market cap | Source: DeFi Llama

With regards to non-USD backed stablecoins , EURC is still behind the ruble-backed A7A5. The ruble-backed stablecoin dominates the non-USD backed stablecoin market by more than 40%. Meanwhile, EURC still requires an additional $213 million if it wishes to surpass A7A5 as the largest non-USD pegged stablecoin issuer.

The stablecoin industry has been growing at an unprecedented pace, as it recently surpassed $300 billion in total market cap. JPMorgan’s latest report predicted that the stablecoin market is due for a massive increase, reaching $2 trillion within the next two years.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ChainOpera AI Token Plummets 70%: A Stark Warning for AI-Based Cryptocurrencies

- ChainOpera AI (COAI) collapsed 99% in late 2025 due to hyper-centralization, governance failures, and technical vulnerabilities. - 88% token control by ten wallets, $116.8M losses at C3.ai, and minimal code updates exposed systemic risks in AI-driven crypto projects. - Regulatory uncertainty from U.S. CLARITY/GENIUS Acts and algorithmic stablecoin collapses accelerated panic, highlighting market fragility. - The crash underscores urgent need for frameworks like NIST AI RMF and EU AI Act to balance innova

The Increasing Expenses of Law School and the Expansion of Public Interest Scholarship Initiatives

- US law school tuition rose to $49,297/year by 2025, with debt averaging $140,870, driven by declining state funding and inflation. - The 2025 OBBB Act capped student loans at $50,000/year and $200,000 total, prompting schools like Santa Clara to adopt tuition moderation and scholarships. - Public interest scholarships (e.g., Berkeley, Stanford) and LRAPs now enable 85%+ retention in public service roles, reducing debt's influence on career choices. - PSLF has forgiven $4.2B for 6,100 lawyers since 2025,

The PENGU USDT Sell Alert and Its Impact on Stablecoin Market Trends

- PENGU/USDT's 2025 sell-off triggered a 30% price crash and $128M liquidity shortfall, exposing flaws in algorithmic stablecoin models. - High concentration (70.72% held by large wallets) and USDT dependency amplified volatility, eroding trust in decentralized governance. - Retail optimism clashed with institutional caution, accelerating migration to regulated stablecoins like USDC under U.S. and EU frameworks. - Regulators and institutions now prioritize hybrid models combining AI governance with CBDCs t

The Influence of Emerging Academic Research Directions on Investments in the STEM Industry

- Farmingdale State College (FSC) drives STEM investments through industry partnerships and infrastructure, aligning academic research with AI, engineering, and sustainability demands. - Collaborations with National Grid , Tesla , and Estée Lauder create skilled talent pipelines and applied research, boosting regional economic growth and green innovation. - FSC’s 2025 STEM Diversity Summit and inclusive education model attract socially conscious investors, enhancing workforce diversity in high-growth secto