CleanSpark Bitcoin production rose in September with 629 BTC mined and 445 BTC sold for about $48.7 million, leaving a treasury of 13,011 BTC; fleet efficiency improved 26% year‑over‑year and average operating hashrate reached 45.6 EH/s.

-

629 BTC mined; 445 BTC sold (~$48.7M)

-

Fleet efficiency +26% YoY; average operating hashrate 45.6 EH/s

-

15 major miners’ market cap hit $58.1B in September (The Miner Mag)

CleanSpark Bitcoin production hits 629 BTC in September; treasury at 13,011 BTC — read the full report and analysis from COINOTAG.

What is CleanSpark’s September Bitcoin production report?

CleanSpark Bitcoin production for September totaled 629 BTC, with 445 BTC sold for approximately $48.7 million and the company holding 13,011 BTC in its treasury. The update also highlighted a 26% year‑over‑year improvement in fleet efficiency and an average operating hashrate of 45.6 EH/s.

COINOTAG reviewed the company’s disclosed figures and comparable industry data to contextualize the results. Sales are consistent with CleanSpark’s stated strategy to monetize production for liquidity.

How did CleanSpark’s efficiency and sales affect its treasury and liquidity?

CleanSpark sold 445 BTC in September at an average realized price of about $109,568, generating roughly $48.7 million in proceeds. The company ended the month with 13,011 BTC after the sale, reflecting a balance between accumulation and cash-generation objectives.

Fleet-level efficiency improved 26% year over year, which supports lower unit costs per BTC mined. Average operating hashrate of 45.6 EH/s sustained production despite rising network difficulty.

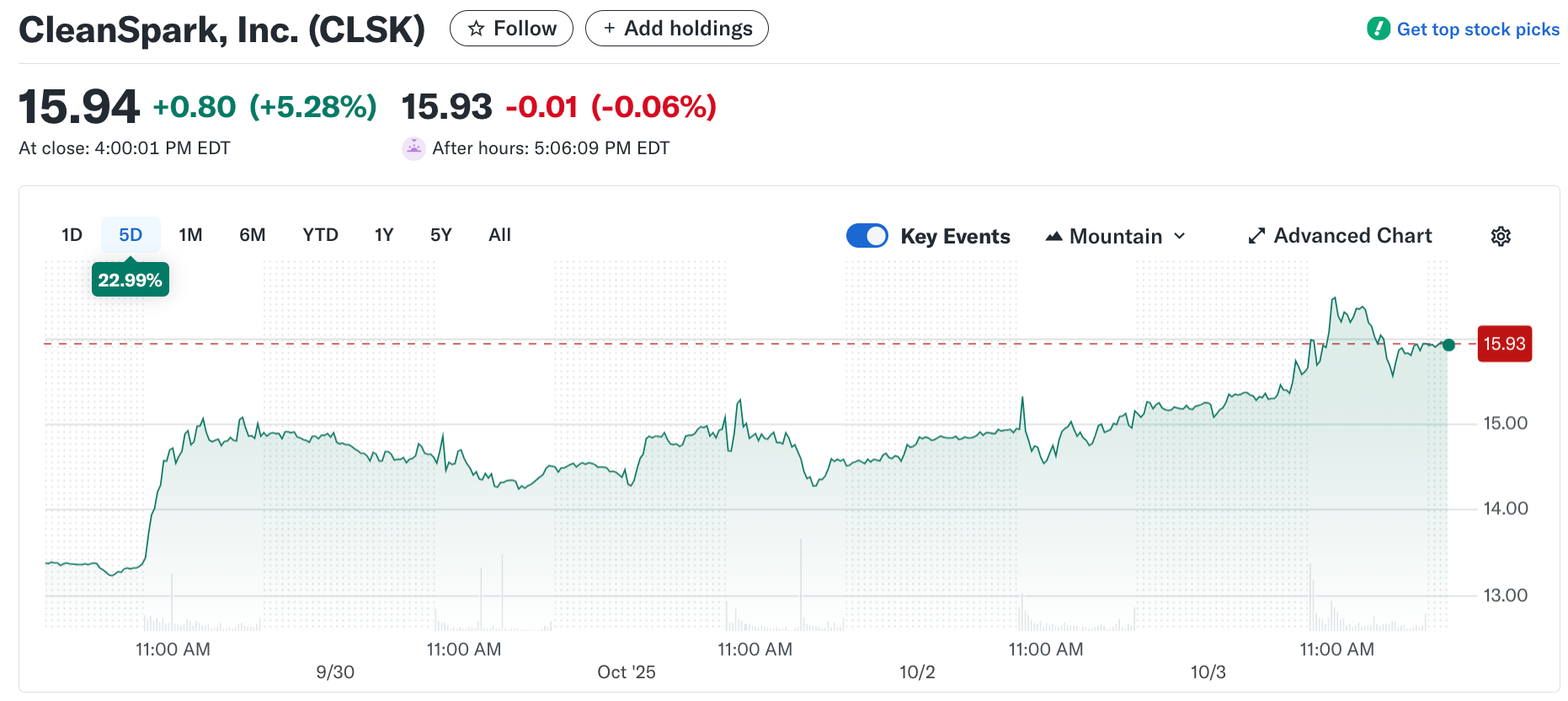

CleanSpark shares performance. Source: Yahoo Finance

CleanSpark shares performance. Source: Yahoo Finance

Why are miners facing new pressures?

Bitcoin miners face higher energy costs and potential tariffs on imported mining rigs, which can materially affect margins and capital expense forecasts. Tariff exposure has been reported as a significant risk for several publicly traded miners.

Customs allegations that some rigs were manufactured in China have created potential tariff liabilities for firms, with reported exposures reaching into the hundreds of millions for certain companies. Tariff rates reported in industry commentary vary by origin and may reach an effective duty of over 50% for China‑origin machines.

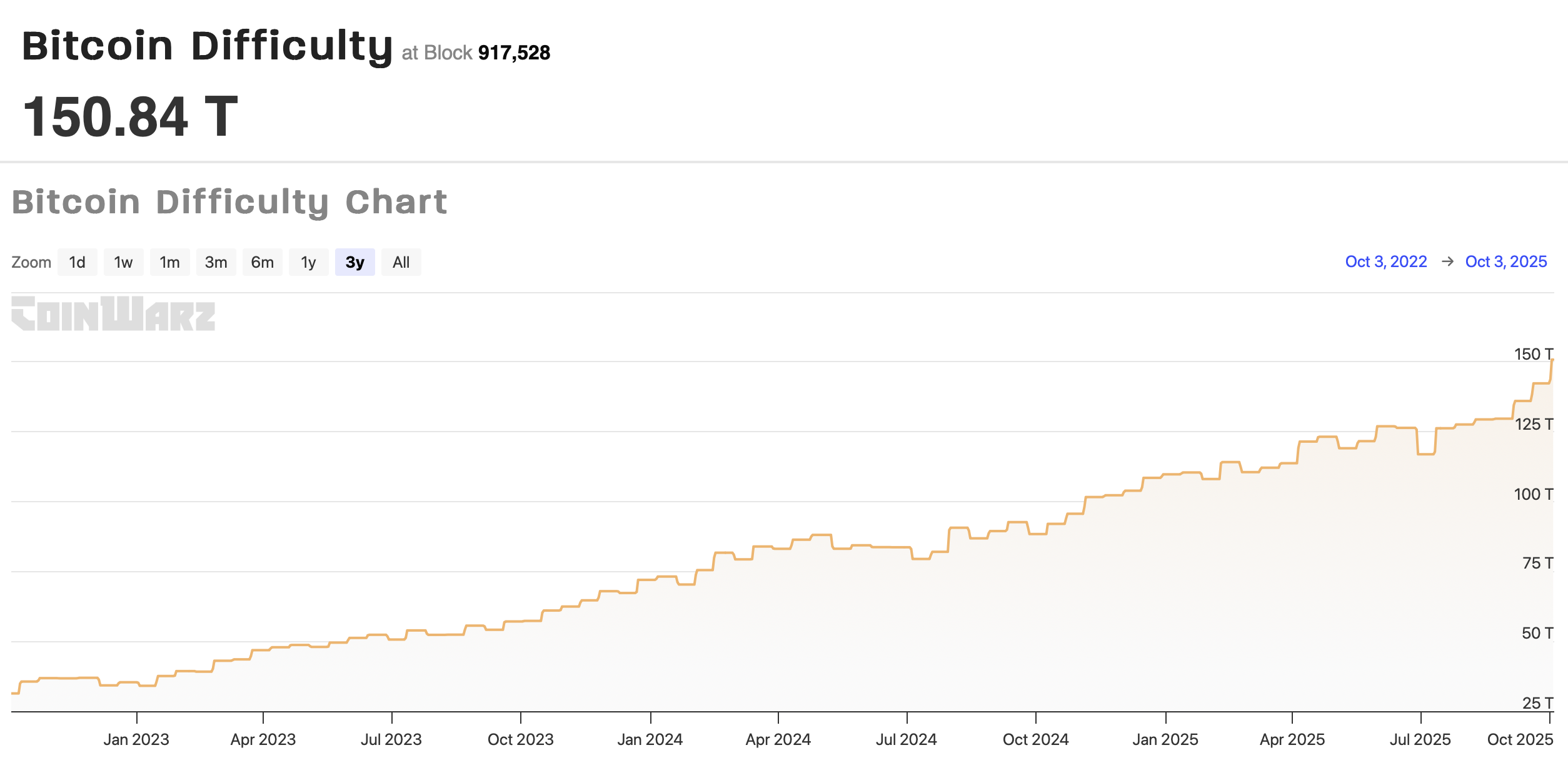

Network mining difficulty also reached record highs in September and October, increasing the computational work required per BTC and pressuring energy consumption and cost per coin.

Bitcoin mining difficulty over 3 years. Source: Coinwarz.com

Bitcoin mining difficulty over 3 years. Source: Coinwarz.com

When did CleanSpark change its sales strategy and why?

CleanSpark began selling a portion of monthly production in April to pursue greater financial self-sufficiency. The firm also opened an institutional Bitcoin trading desk to facilitate scheduled sales and improve execution.

In August, CleanSpark sold 533.5 BTC for about $60.7 million, illustrating the company’s recurring liquidity approach. Management framed sales as a tool to support operations and capital needs rather than a change in long‑term accumulation policy.

Frequently Asked Questions

How many BTC does CleanSpark hold now?

CleanSpark reported 13,011 BTC in its treasury at the end of September after mining 629 BTC and selling 445 BTC during the month.

Does selling monthly production mean miners are abandoning accumulation?

Selling part of monthly output is a cash-management tactic. Many miners balance accumulation with sales to fund operating expenses and capital expenditures while still retaining strategic BTC reserves.

How do tariffs affect miner economics?

Tariffs on imported mining rigs increase upfront capital costs and extend payback periods. Reported potential liabilities and duties can materially change project IRRs and equipment replacement cycles.

Key Takeaways

- Production and sales: 629 BTC mined in September; 445 BTC sold for ~ $48.7M.

- Operational improvement: Fleet efficiency +26% YoY; 45.6 EH/s average operating hashrate.

- Industry pressures: Rising energy costs, tariffs on rigs, and record mining difficulty are key headwinds.

Conclusion

CleanSpark Bitcoin production strengthened in September, combining improved fleet efficiency with an active sales program to support liquidity. COINOTAG analysis shows the company balancing accumulation (treasury 13,011 BTC) with operational funding amid rising difficulty and tariff risks. Monitor earnings updates and regulatory developments for the next directional signals.

Published by COINOTAG on 2025-10-03 · Updated 2025-10-03